Why Pagaya Technologies Stock Plummeted by 13% on Tuesday

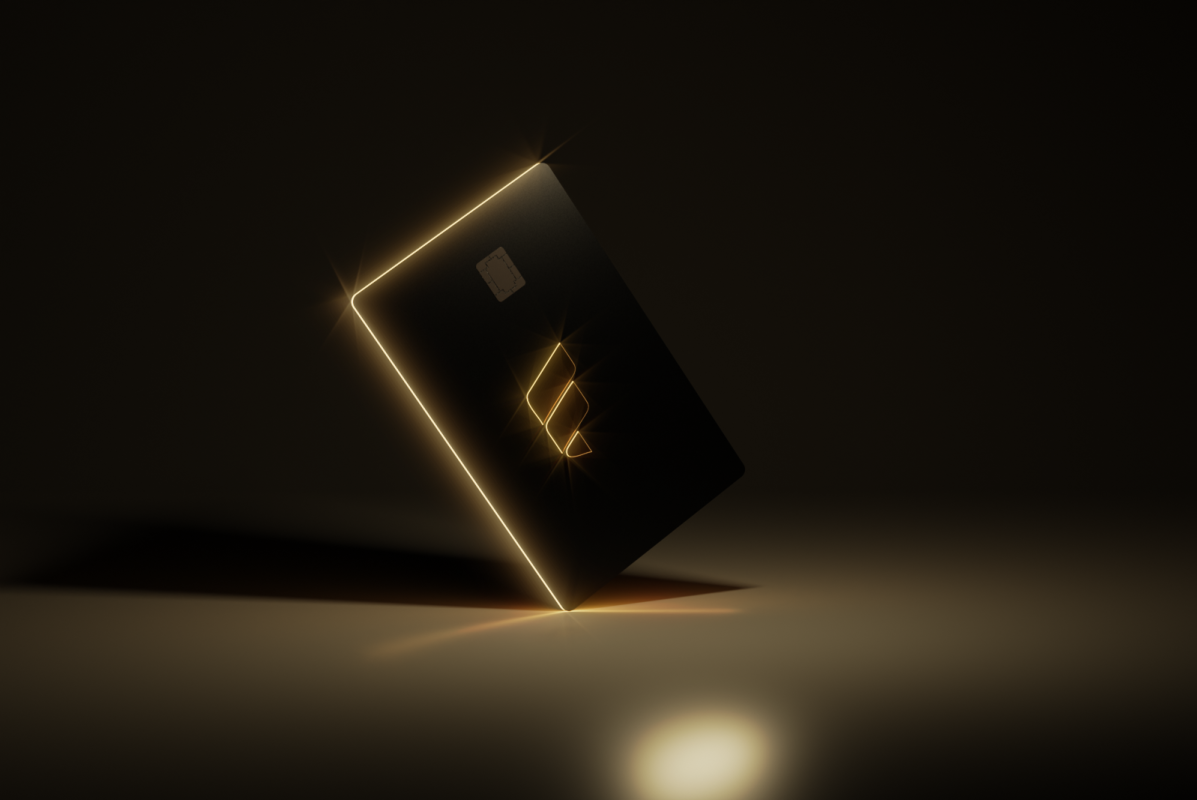

A short-seller ripped into Pagaya Technologies (NASDAQ: PGY) in a report published on Tuesday, and the market reacted accordingly. The document raised enough concern to generate an investor sell-off, with the stock closing 13% lower as a result. Meanwhile, the S&P 500 (SNPINDEX: ^GSPC) essentially flatlined on the day.The firm behind the report is Iceberg Research, a business with a history of disseminating highly critical analyses of stocks it has shorted. In its latest report, bearing the incendiary title "Pagaya: Using Other People's Money to Hide Massive Losses," Iceberg leveled a clutch of accusations against the fintech. Among other transgressions, the short-seller effectively said Pagaya is engaging in self-dealing in some of its loan transactions.Continue reading

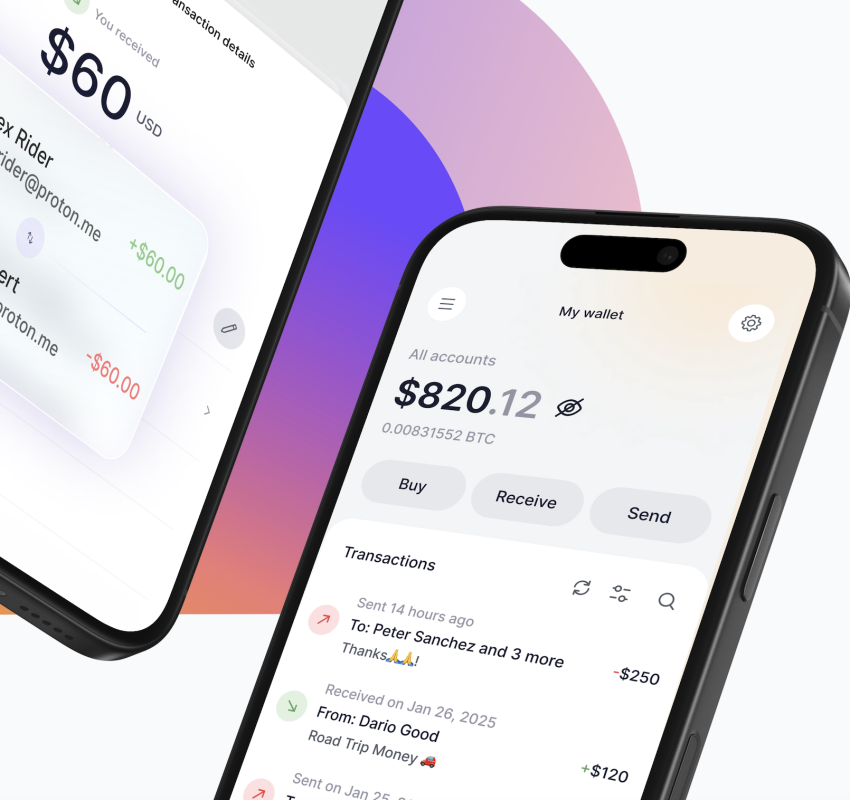

A short-seller ripped into Pagaya Technologies (NASDAQ: PGY) in a report published on Tuesday, and the market reacted accordingly. The document raised enough concern to generate an investor sell-off, with the stock closing 13% lower as a result. Meanwhile, the S&P 500 (SNPINDEX: ^GSPC) essentially flatlined on the day.

The firm behind the report is Iceberg Research, a business with a history of disseminating highly critical analyses of stocks it has shorted.

In its latest report, bearing the incendiary title "Pagaya: Using Other People's Money to Hide Massive Losses," Iceberg leveled a clutch of accusations against the fintech. Among other transgressions, the short-seller effectively said Pagaya is engaging in self-dealing in some of its loan transactions.