Sanctioned crypto exchange Garantex shifts millions as it reboots platform

Shuttered crypto exchange Garantex is reportedly back under a new name after laundering millions in ruble-backed stablecoins and sending them to a freshly created exchange, according to a Swiss blockchain analytics company. Global Ledger claims the operators of the Russian exchange have shifted liquidity and customer deposits to Grinex, which they say is “Garantex’s full-fledged successor,” in a report released to X on March 19.“We can confidently state that Grinex and Garantex are directly connected both onchain and offchain.”“The movement of funds, including the systematic transfer of A7A5 liquidity, the use of one-time-use wallets, and the involvement of addresses previously associated with Garantex, provides clear onchain proof of their link,” the Global Ledger team said in the report.After completing its investigation on March 13, Global Ledger says it had found onchain data showing Garantex laundered over $60 million worth of ruble-backed stablecoins called A7A5 and sent them to addresses associated with Grinex.Global Ledger claims Garantex has moved all its funds over to a newly launched exchange and is back in business. Source: Global Ledger“In this case, the burning and subsequent minting process was used to launder funds from Garantex, allowing new coins to be minted from a system address with a clean history,” the team said.A Garantex manager also reportedly told Global Ledger that customers have been visiting the exchange office in person and moving funds from Garantex to Grinex.“Additionally, offchain indicators, such as transactional patterns, commentaries and exchange behaviors, further reinforce this connection,” it said.The report also points to a description of Grinex on the Russian crypto tracking site CoinMarketRating, claiming that the owners of Garantex created it. The reports said this shows “Grinex is not an independent entity but rather a full-fledged successor to Garantex, continuing its financial operations despite the exchange’s official shutdown.”Source: Global LedgerBy March 14, the volume of incoming transactions on Grinex was nearly $30 million, according to Global Ledger. CoinMarketRating shows that the trade volume for the month is now over $68 million, with spot trading topping $2 million.The US Department of the Treasury’s Office of Foreign Assets Control first hit Garantex with sanctions in April 2022 for allegedly money laundering violations.Related: US, UK, Australia sanction Zservers for hosting crypto ransomware LockBitOn March 6, the US Department of Justice collaborated with authorities in Germany and Finland to freeze domains associated with Garantex, which they claim processed over $96 billion worth of criminal proceeds since launching in 2019.Stablecoin operator Tether also froze $27 million in Tether (USDT), on March 6 which forced Garantex to halt all operations, including withdrawals.Only a few days later, on March 12, officials with India’s Central Bureau of Investigation arrested Aleksej Bešciokov, who allegedly operated Garantex, on US charges that included conspiracy to commit money laundering. Magazine: How crypto laws are changing across the world in 2025

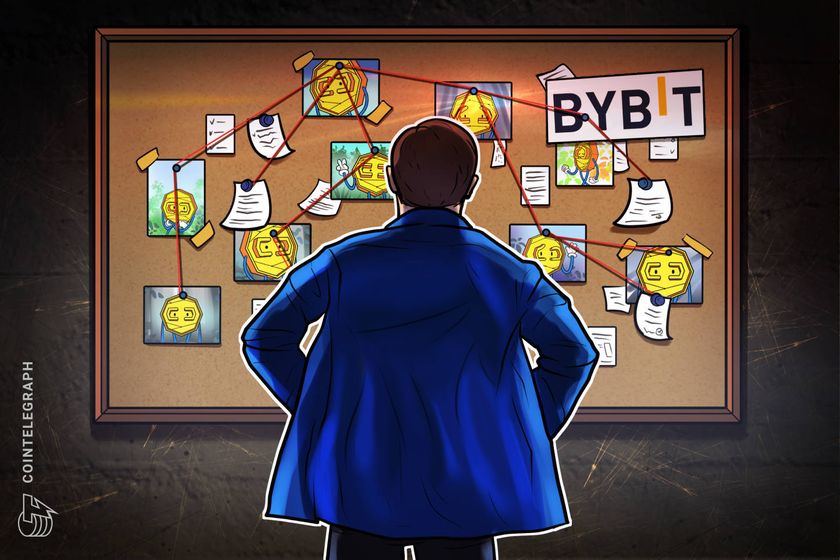

Shuttered crypto exchange Garantex is reportedly back under a new name after laundering millions in ruble-backed stablecoins and sending them to a freshly created exchange, according to a Swiss blockchain analytics company.

Global Ledger claims the operators of the Russian exchange have shifted liquidity and customer deposits to Grinex, which they say is “Garantex’s full-fledged successor,” in a report released to X on March 19.

“We can confidently state that Grinex and Garantex are directly connected both onchain and offchain.”

“The movement of funds, including the systematic transfer of A7A5 liquidity, the use of one-time-use wallets, and the involvement of addresses previously associated with Garantex, provides clear onchain proof of their link,” the Global Ledger team said in the report.

After completing its investigation on March 13, Global Ledger says it had found onchain data showing Garantex laundered over $60 million worth of ruble-backed stablecoins called A7A5 and sent them to addresses associated with Grinex. Global Ledger claims Garantex has moved all its funds over to a newly launched exchange and is back in business. Source: Global Ledger

“In this case, the burning and subsequent minting process was used to launder funds from Garantex, allowing new coins to be minted from a system address with a clean history,” the team said.

A Garantex manager also reportedly told Global Ledger that customers have been visiting the exchange office in person and moving funds from Garantex to Grinex.

“Additionally, offchain indicators, such as transactional patterns, commentaries and exchange behaviors, further reinforce this connection,” it said.

The report also points to a description of Grinex on the Russian crypto tracking site CoinMarketRating, claiming that the owners of Garantex created it. The reports said this shows “Grinex is not an independent entity but rather a full-fledged successor to Garantex, continuing its financial operations despite the exchange’s official shutdown.” Source: Global Ledger

By March 14, the volume of incoming transactions on Grinex was nearly $30 million, according to Global Ledger. CoinMarketRating shows that the trade volume for the month is now over $68 million, with spot trading topping $2 million.

The US Department of the Treasury’s Office of Foreign Assets Control first hit Garantex with sanctions in April 2022 for allegedly money laundering violations.

Related: US, UK, Australia sanction Zservers for hosting crypto ransomware LockBit

On March 6, the US Department of Justice collaborated with authorities in Germany and Finland to freeze domains associated with Garantex, which they claim processed over $96 billion worth of criminal proceeds since launching in 2019.

Stablecoin operator Tether also froze $27 million in Tether (USDT), on March 6 which forced Garantex to halt all operations, including withdrawals.

Only a few days later, on March 12, officials with India’s Central Bureau of Investigation arrested Aleksej Bešciokov, who allegedly operated Garantex, on US charges that included conspiracy to commit money laundering.

Magazine: How crypto laws are changing across the world in 2025