I’m retiring in 3 years when I turn 70 – how the bulk of my IRA be in bonds to reduce my RMDs?

There is a Wall Street financial generalization that still rings true a majority of the time: portfolios should focus on growth and take greater risk while young, and shift to safer, income based holdings when one grows older. However, portfolios have grown more complex over the years, often to take advantage of tax loopholes or […] The post I’m retiring in 3 years when I turn 70 – how the bulk of my IRA be in bonds to reduce my RMDs? appeared first on 24/7 Wall St..

There is a Wall Street financial generalization that still rings true a majority of the time: portfolios should focus on growth and take greater risk while young, and shift to safer, income based holdings when one grows older. However, portfolios have grown more complex over the years, often to take advantage of tax loopholes or other opportunities. While the validity of the principle remains intact, navigating the landscape has become more circuitous, especially when it comes to retirement accounts and RMD.

Key Points

-

Retirement fund asset allocation shifts from growth towards income as one approaches age 70 are still a prudent idea.

-

Required Minimum Distribution (RMD) percentages are based on total value, not on asset class, so it should not be a prevalent factor when choosing assets for a retirement portfolio.

-

Should a portfolio become so large to the point where RMD can potentially cause a negative tax impact that outstrips growth, that would be a justification for further fine tuning of the growth to income ratio asset mix.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

RMD Concerns, “Death and Taxes”

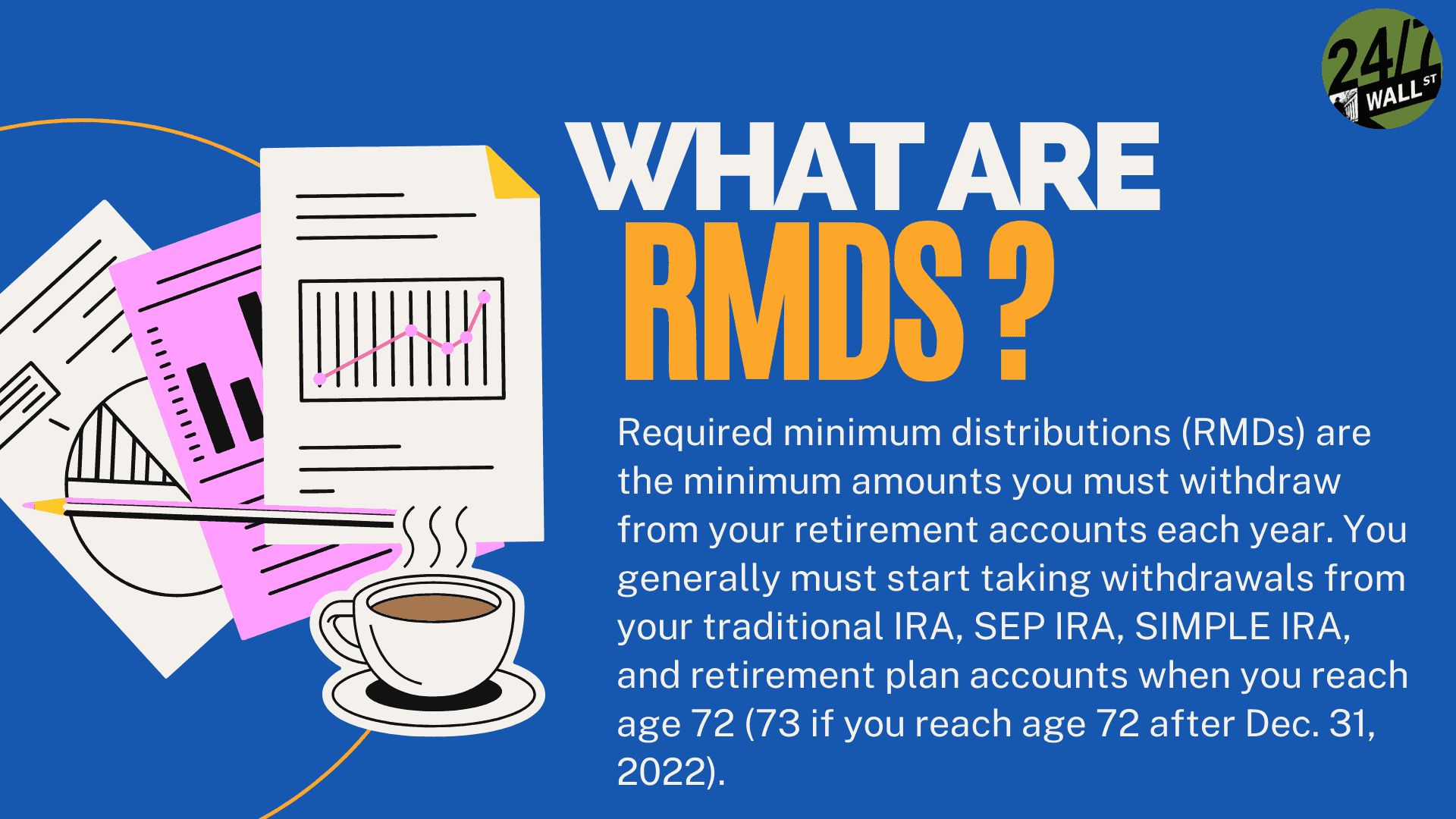

Required Minimum Distributions (RMD) are Internal Revenue Service-mandated retirement account annual withdrawals that are triggered once an account holder reaches age 73. RMD contains a number of parameters that have created some confusion for retirees, which has spawned misinformation that can result in tax liabilities. For clarification’s sake:

- RMDs exist so that the IRS can finally collect taxes on retirement account holdings that have been tax-deferred for years. Once RMDs commence, they continue until death. As Benjamin Franklin was quoted, “Nothing is certain except death and taxes.”

- The year one turns age 73 is when RMD kicks in. The account holder must take the distribution before April 1st of the following year to avoid an IRS penalty. Subsequent RMDs are due before December 31st going forward.

- The penalty is currently an additional 25% on top of the RMD amount for the specified year.

- RMD is calculated based upon life expectancy, number of dependents, and the value of the account as of the end of the previous year.

- Inherited IRAs or other tax-deferred accounts are subject to the RMD 10-year rule. In other words, the beneficiary has up to 10 years to withdraw the entirety of whatever is left in an inherited tax-deferred account before closing it out.

- RMD amounts under the 10-year rule are taxed by the IRS at the beneficiary’s current tax bracket, as a part of their income.

- Roth accounts are exempt from RMD during the lifetime of the account owner, but the RMD 10-year rule applies to inherited accounts.

Better Safe Than Sorry

Retiree accounts that hold equities or equity-based ETFs are primarily geared for growth. While the stock market has its inherent volatility, its general long-term trend has been bullish, and millions have benefited from the bull run. However, retirees seeking consistent income for their golden years are more sensitive to market volatility risk, as they may not be able to weather any bear market downturns.

Many retirees will opt to rebalance their retirement portfolios to weigh more towards stabler, income-producing assets, such as bonds, REITs, midstream energy companies, or dividend stocks, including preferred stocks. For those who lack the resources to research and monitor individual securities, ETF versions of the aforementioned asset classes will often be the alternative of choice.

However, some people erroneously believe that RMD is somehow connected to asset class and that holding bonds, rather than stocks, will reduce the RMD amount. Such a presumption is completely wrong. People who believe this may be in for a penalty shock if they base RMD calculations on asset class, rather than on cumulative value. A Reddit post inquiring about this topic received numerous responses echoing this same answer.

From a reduced volatility and income reliability perspective, switching portfolio allocations makes perfect sense, but attempting to play with RMD as a determinant factor should be dismissed, under most circumstances.

Exceptions and Strategies

One of the only instances where the degree of asset swap should be a primary consideration is if an equity asset is extremely volatile to the point where its price uptrend can bump the total value to a higher tax bracket, while the timing of the downturn can then cause a shortfall on total income, due to additional taxes that will levied on total value, inclusive of any dividend income.

In circumstances such as the above, the argument for switching to fixed income is made stronger, given the difficulty in trying to time the market for waves and crests in trading trends. The owners of some portfolios that have relied on a rocket-fueled growth stock like Nvidia (NASDAQ: NVDA) for the bulk of its value are often understandably reluctant to sell it.

Some alternatives to selling outright can be to deploy strategies, such as:

- A covered call writing strategy combined with a Good Til Cancelled Stop Loss sell order for the stock at a price that will protect the portfolio from any significant losses. This will add income to help pay for the taxes or offset any paper loss valuations before Dec. 31.

- Do a partial ROTH conversion, pay the tax early, and let the growth continue without having to worry about its impact on income – provided the account holder has the liquidity to pay those taxes).

In general, the RMD and corresponding taxes only may become a factor when the portfolio value exceeds $1.5 million. The normal RMD would equate to $60,000 in that case. If one’s other assets cumulatively equate to an amount where that $60,000 would create a tax consequence change, then one should possibly consider an additional portfolio asset tweak. Otherwise, as one respondent put it succinctly: “That’s like telling your boss you don’t want a raise because your income tax will go up.”

The post I’m retiring in 3 years when I turn 70 – how the bulk of my IRA be in bonds to reduce my RMDs? appeared first on 24/7 Wall St..