Rivian (RIVN) Price Prediction and Forecast 2025-2030 for March 18

Shares of Rivian Automotive (NASDAQ:RIVN) surged an eye-catching 6.22% through midday trading on Tuesday, bringing the stock’s five-day gain to 5.92%. However, Rivian is still struggling in 2025, with a year-to-date loss of -11.70%. The electric vehicle maker IPO’ed in November 2021 and immediately made a splash with its stock price skyrocketing to $180 in just […] The post Rivian (RIVN) Price Prediction and Forecast 2025-2030 for March 18 appeared first on 24/7 Wall St..

Shares of Rivian Automotive (NASDAQ:RIVN) surged an eye-catching 6.22% through midday trading on Tuesday, bringing the stock’s five-day gain to 5.92%. However, Rivian is still struggling in 2025, with a year-to-date loss of -11.70%.

The electric vehicle maker IPO’ed in November 2021 and immediately made a splash with its stock price skyrocketing to $180 in just its first week of trading. The cash infusion was a much-needed lifeline for Rivian, with $3.7 billion in operating expenses in 2021 and only delivering 920 vehicles. The company also had backers in Amazon (NASDAQ:AMZN) and Ford (NYSE:F), who held 260 million shares of Rivian collectively at IPO.

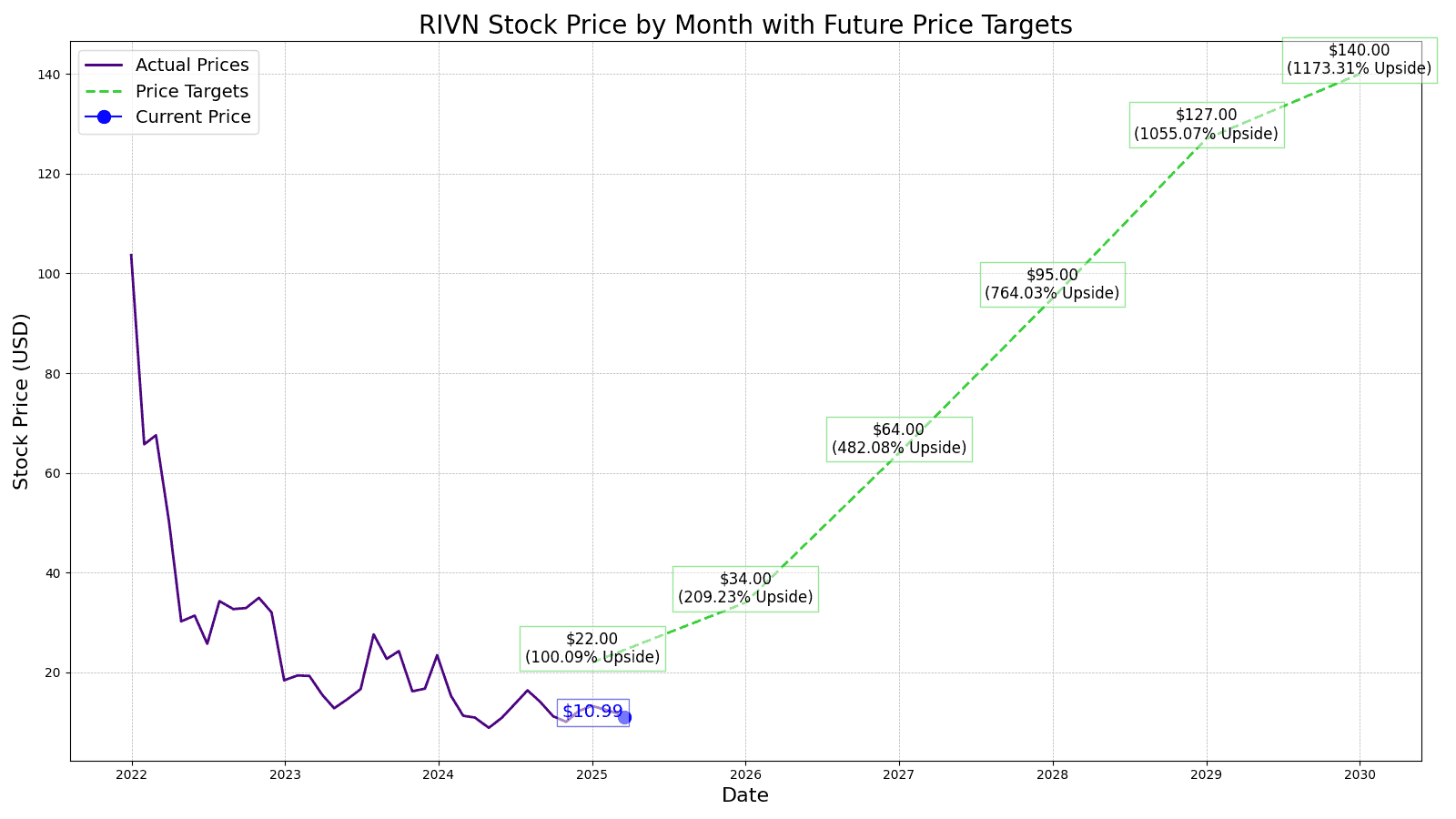

But as the COVID-19 lockdown investing frenzy died out, it left an SUV-sized hole in Rivian’s stock price, currently trading for $10.99 per share, down -91.00% since its post-IPO high.

24/7 Wall Street aims to provide readers with our assumptions about the stock prospects going forward, what growth we see in Rivian for the next several years, and what our best estimates are for Rivian’s stock price each year through 2030.

Key Points in this Article:

- Key growth drivers include cost reduction in EV components and increased production capacity, targeting profitability by 2027.

- Rivian aims to cut material costs by 45% with the introduction of its Gen 2 platform by 2026.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. The report includes a complete industry map of AI investments that includes many small caps.

Rivian vs. Tesla: The Early Years

The following is a table of Rivian’s revenues, operating income and share price for the first few years as a public company. Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Year | Share Price |

Revenues | Net Income |

| 2021 | $50.24 | $55.0 million | ($4.22 billion) |

| 2022 | $19.30 | $1.658.0 billion | ($6.856 billion) |

| 2023 | $10.70 | $4.434.0 billion | ($5.739 billion) |

| 2024 | $13.25 | $4.997.0 billion | ($4.689 billion) |

Now let’s take a look at Tesla (NASDAQ:TSLA) in the first few years it manufactured and sold the Model S (the official launch of the Model S was June 22, 2012).

| Year | Share Price |

Revenues | Net Income |

| 2011 | $2.24 | $204.2 million | ($2.45 million) |

| 2012 | $2.25 | $413.3 million | ($3.96 million) |

| 2013 | $16.87 | $2.013 billion | ($74 million) |

| 2014 | $13.81 | $3.198 billion | ($294 million) |

While revenue growth for both firms after launching their first mass-market vehicles is similar, Tesla’s net income was much more favorable. Tesla CEO Elon Musk has always been a proponent of word-of-mouth marketing and a hawkish approach to minimizing product costs, allowing his company to stay afloat while moving to new lines of automobiles.

The biggest question facing Rivian investors today is, can they lower costs, and when will positive net income be realized?

Key Drivers of Rivian’s Stock Performance

- EV Technology and Cost Curves: Rivian’s next generation (G2) R1 vehicles are designed for performance upgrades while at the same time reducing component costs. For example, the number of electronic components will be reduced by 60%, over 60 parts will be eliminated, the compact motor will be redesigned, and close to 2000 connections or welds will be removed. These changes alone are expected to drop materials costs by 20% and speed up the assembly line by 30%. Looking into the back half of 2026, Rivian sees a material cost reduction of 45% for the R2 line of vehicles. Rivian is also investing in enhanced advanced driver assistance systems with improved cameras, radar, and NVIDIA-powered computing power, creating highway assist and 360-degree visibility.

- Electric Vehicle Demand and Incentives: Rivian is currently delivering around 13 thousand vehicles per quarter, which is above analyst estimates, and producing 9 thousand new G2 vehicles per quarter, which keeps it on pace to produce 57,000 units in 2024. The total plant capacity is 215,000 vehicles with expansion plans of 400,000 additional vehicles in Georgia.

- Management’s Path to Profits: Rivian also expects profitability from the R1 platform through premium configurations and scale benefits. The company targets positive adjusted EBITDA by 2027, with long-term goals of 25% gross margin, high teens adjusted EBITDA margin, and 10% FCF margin

- Material Cost Reduction: The introduction of the Gen 2 platform and commercial cost downs are expected to reduce material costs by ~20%.

- Fixed Cost Reduction: Improved labor and overhead costs, reduced depreciation, and lower LCNRV charges due to a 30% increase in production line rate and design changes.

- Increased Revenue From Credits: Strong demand for regulatory credits, with over $200 million contracted for FY24.

Rivian (RIVN) Stock vs. Tesla Stock: Why Rivian Receives Different Treatment

Taking a historic look at pricing Rivian stock would start by comparing the sales multiples Tesla received in 2012 to 2015 when the Model S scaled. Tesla was feeling the weight of expansion and keeping its debt load manageable and the market-priced Tesla stock was close to 10x sales.

While Rivian is in a similar situation, albeit with more debt and higher expanses, the market is only valuing the stock at under 3 times sales. Let’s take a look at why that is the case.

- Market Position and Brand Recognition:

- Tesla: By 2011-2015, Tesla had already established itself as a leading innovator in the electric vehicle (EV) market, with significant brand recognition and a first-mover advantage.

- Rivian: Rivian is relatively new to the market and still building its brand and market position.

- Production and Sales Volumes:

- Tesla: From 2011 to 2015, Tesla ramped up production and sales, particularly with the Model S, which gained popularity and market traction.

- Rivian: Rivian is still in the early stages of production, with limited sales volumes compared to Tesla’s growth phase.

- Investor Expectations and Sentiment:

- Tesla: Investors had high expectations for Tesla’s future growth and disruptive potential in the auto industry, leading to higher valuation multiples.

- Rivian: While Rivian has potential, it has not yet demonstrated the same level of market disruption or growth trajectory that Tesla did during its comparable early years.

- Competitive Landscape:

- Tesla: Had fewer direct competitors in the EV space during its early years, allowing for a larger market share and higher investor confidence.

- Rivian: Faces more competition from established automakers entering the EV market and other new entrants, impacting its relative valuation.

Rivian(RIVN) Stock Forecast Through 2030

| Year | Revenue | Shares Outstanding | P/S Est. |

| 2025 | $6.680 | 978 mm | 2x |

| 2026 | $10.675 | 978 mm | 2x |

| 2027 | $16.491 | 978 mm | 2.5x |

| 2028 | $25.124 | 978 mm | 2.5x |

| 2029 | $37.538 | 978 mm | 2.5x |

| 2030 | $49.394 | 978 mm | 2.75x |

*Revenue in $billions

Rivian (RIVN) Stock Prediction in 2025

The current consensus average one-year price target for Rivian’s stock is $14.24, which represents upside potential of 29.57% from today’s share price. Of all the analysts covering RIVN, the stock is a consensus “Hold,” with 12 of 21 analysts providing a hold rating, six providing a buy rating and three providing a sell rating.

24/7 Wall Street’s 12-month forecast projects Rivian’s stock price to be $22.00, which represents upside potential of 100.09% from today’s share price.

Rivian Stock Forecast Through 2030

We estimate Rivian’s stock price to be $140.00 per share. Our estimated stock price will be 1,173.31% higher than the current stock price.

| Year | Price Target | % Change From Current Price |

| 2025 | $22.00 | 100.09% |

| 2026 | $34.00 | 209.23% |

| 2027 | $64.00 | 482.08% |

| 2028 | $95.00 | 764.03% |

| 2029 | $127.00 | 1,055.70% |

| 2030 | $140.00 | 1,173.31% |

The post Rivian (RIVN) Price Prediction and Forecast 2025-2030 for March 18 appeared first on 24/7 Wall St..