Our net worth tops $5 million, but I still book the cheapest hotel room – how can I finally let go of my frugal habits?

It’s natural to be worried about money from time to time, or to prefer to spend your money cautiously. And this holds true even if you’re wealthy. A lot of people become wealthy by virtue of spending less than they earn and saving and investing the difference. So it’s not a bad thing to […] The post Our net worth tops $5 million, but I still book the cheapest hotel room – how can I finally let go of my frugal habits? appeared first on 24/7 Wall St..

Key Points

-

Having money is supposed to make it easier to spend.

-

If you’re too frugal for your own good, an intervention may be needed.

-

It pays to talk to a financial advisor if you’re more worried about money than you need to be.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

It’s natural to be worried about money from time to time, or to prefer to spend your money cautiously. And this holds true even if you’re wealthy.

A lot of people become wealthy by virtue of spending less than they earn and saving and investing the difference. So it’s not a bad thing to be naturally frugal to some degree.

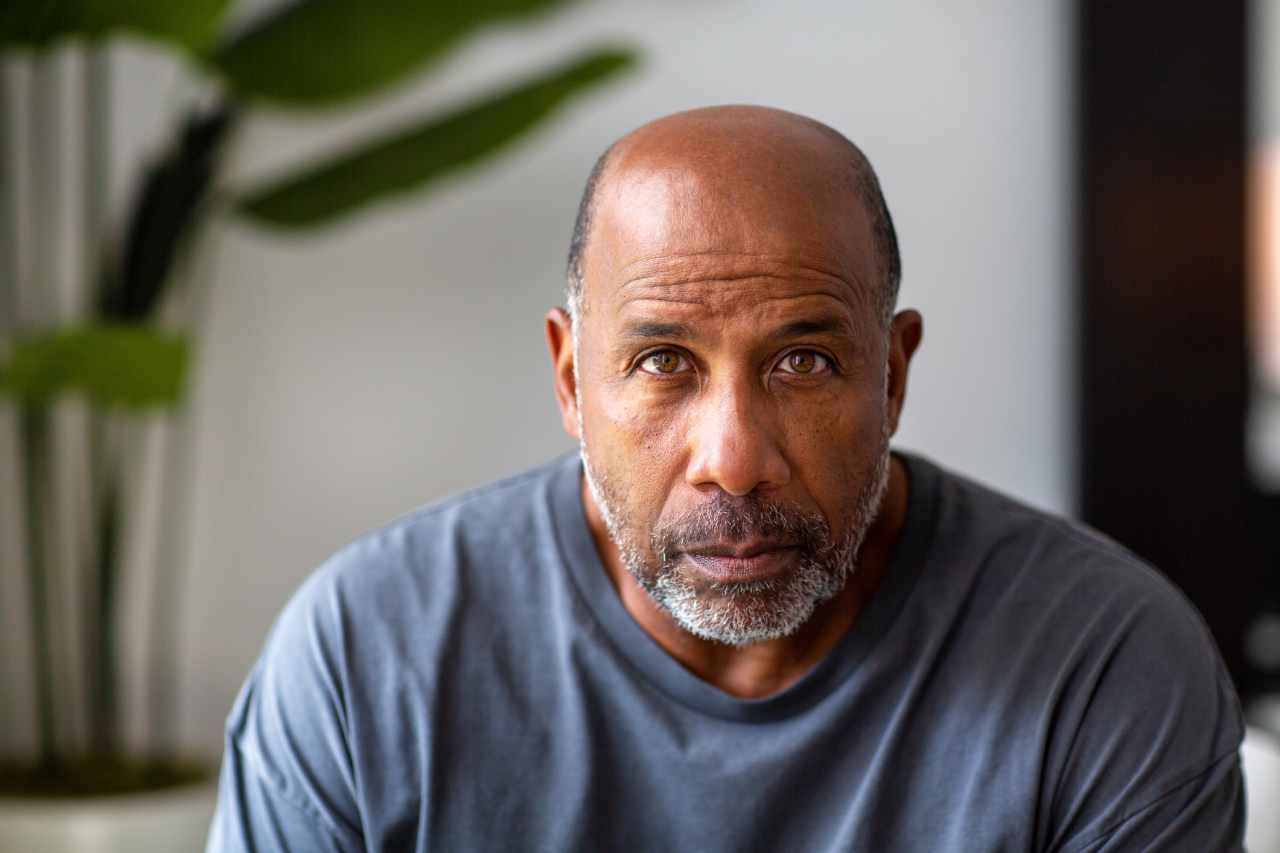

What’s more problematic is when money stresses you out even when you have plenty of it, and when you err on the side of being ultra-frugal when you don’t have to be. That seems to be the situation this Reddit poster is in.

They’re in their mid-30s with a $5 million net worth, which means money clearly is not tight. Yet they stress about spending any of their money. If they have a $100 expense, they get anxious.

They say they also make a point to choose the least expensive hotel rooms when they travel even though they can clearly afford better. And it seems like they genuinely want to change their ways but feel stuck in their current mindset.

It’s a good thing that the poster recognizes that this line of thinking isn’t the most healthy. And with the right help, they can hopefully get to a place where they’re able to enjoy their money much more.

Why some people struggle to part with their money

It’s one thing to worry about a $100 expense when you’re down to your last $1,500 in your savings account. It’s another thing to stress over $100 when you’re worth $5 million.

My guess is that the poster may have experienced some financial stress or trauma earlier in life, even if it wasn’t extreme. They claim they were never poor, but it may be that they spent a good number of years having to live frugally so that now, it’s hard to break old habits.

And to be clear, it’s not a bad thing to be frugal. It’s only bad if it’s taken to an extreme. And it sounds like that’s where the poster is headed if they’re not already there yet.

It’s a good thing to get help

The fact that the poster is reaching out to the Reddit community means they’re clearly serious about wanting advice. And some commenters had helpful suggestions, like specific books they thought the poster might benefit from reading.

But I happen to think the poster can benefit from working with two specific types of professional. And the first is a therapist.

This isn’t to say that they need to spend hours each week pouring their heart out to a counselor. But it would be good to have a few sessions to discuss their financial anxiety. A therapist or counselor may be able to offer up some tips that allow the poster to take a more relaxed approach to modest spending.

I’d also love to see the poster sit down with a financial advisor. But it’s important to find someone who’s open-minded and non-judgmental.

A financial advisor can help run the numbers to highlight the impact of spending more money. And chances are, the poster will come to the realization that increasing their spending modestly won’t have much of an impact on their long-term goals one way or another.

The poster doesn’t mention how much money they save annually. But to have gotten to $5 million in their 30s, they clearly save a lot.

So let’s say they commonly save $200,000 a year. If they were to spend a little more so they’re only saving $190,000 a year, or $180,000, it probably wouldn’t make a material difference in the long run.

A financial advisor can show them this so they’re able to loosen up a bit — and enjoy the money they’ve no doubt worked very hard to earn.

The post Our net worth tops $5 million, but I still book the cheapest hotel room – how can I finally let go of my frugal habits? appeared first on 24/7 Wall St..