Novo Nordisk (NVO) Price Prediction and Forecast 2025-2030 (March 2025)

Novo Nordisk sees the obesity drug market expanding to $100 billion by 2030. With promising new obesity treatments in the pipeline, 24/7 Wall St. projects huge upside on the stock through the end of the decade. The post Novo Nordisk (NVO) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..

Among weight loss drugs, Ozempic has become a phenomenon. With as much as $17 billion in sales in 2024, it shows no signs of slowing down, much to the delight of its Danish manufacturer, Novo Nordisk A/S (NYSE: NVO). This Scandinavian economic behemoth is the highest-valued company in Europe at over $500 billion, which exceeds Denmark’s entire gross domestic product. Ironically, Ozempic and Wegovy, as with many of Novo Nordisk’s other products, were created primarily for treating diabetes. The weight-loss factor has become a very profitable and unintended side effect.

Founded a century ago, Copenhagen-based Nordisk originally made insulin. After coming to the United States in 1982, it underwent several corporate changes until becoming Novo Nordisk in 1989. In addition to diabetes drugs, the company also makes drug treatments for wound healing, menopausal hormone replacement, and human growth hormone.

Besides Ozempic and Wegovy, the company has made progress recently on other obesity drugs in its pipeline, including amycretin and CagriSema. It also aims to increase production capacity to meet the high demand for its obesity and diabetes medications.

24/7 Wall St. Key Points

-

Ozempic has become a phenomenon, much to the delight of its Danish manufacturer, Novo Nordisk A/S (NYSE: NVO).

-

Novo Nordisk sees the obesity drug market expanding to $100 billion by 2030.

-

With promising new obesity treatments in the pipeline, 24/7 Wall St. projects huge upside on the stock through the end of the decade.

-

Be sure to grab a complimentary copy of our “The Next NVIDIA” report, which includes a complete industry map of AI investments, including many small caps.

Investors are concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it is clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall St. aims to present some farther-looking insights based on Novo Nordisk’s own numbers, along with business and market development information that may be of help with your own research.

Challenges and Opportunities

Novo Nordisk sees the obesity drug market expanding to $100 billion by 2030. To that end, it has amycretin in FDA phase 1 and CagriSema in phase-2 trials, which both show greater efficacy potential than Wegovy and Ozempic.

While Novo Nordisk has built itself into a pharmaceutical giant, it has seriously run afoul of regulatory laws on several occasions. Novo Nordisk’s practices have raised red flags in Denmark, as well as in the United States and United Kingdom, for years. More recent ones include:

- A 2017 $59 million fine from the DOJ due to lack of FDA disclosures concerning cancer risks from diabetes drug Victoza

- Membership suspension from the UK’s Association of British Pharmacy Industry over ethics violations tantamount to bribing of health professionals

- 235 active Ozempic-related product liability lawsuits as of August 2024

- A 2024 investigation led by the U.S. Senate confirmed predatory pricing of Ozempic by almost 1,500% vs. its price in Europe, and 1000% for Wegovy.

Although the number of Ozempic-related lawsuits are piling up, Novo Nordisk’s stance is that the complaints are unwarranted, and will either be dismissed or settled.

Novo Nordisk has spared no expense in expanding its pharmaceutical reach and scope. In addition to adding new factories to ramp up production to meet demand for Ozempic and Wegovy, the company’s expansion toward treating other afflictions saw billions spent in acquisitions. The past decade has seen the following events:

- In 2015, Novo Nordisk announced a $400 million collaboration with Sanofi subsidiary Ablynx, to use its nanobody technology to develop a new drug.

- After an unsuccessful bid to acquire Ablynx in 2018, Novo Nordisk bought diabetes drug company Ziylo.

- 2020 saw Novo Nordisk buying Corvidia Therapeutics from AstraZeneca for its heart disease treatments.

- Novo Nordisk announced it would acquire Emisphere Technologies for $1.35 billion in December 2020, adding another diabetes pill to its catalog.

- In November 2021, Novo Nordisk acquired Dicerna Pharmaceuticals and its RNAi therapeutics, for $3.3 billion.

- Intending to expand its sickle cell disease and rare blood disorders portfolio, 2022 saw Novo Nordisk buying Forma Therapeutics for $1.1 billion.

- Flush with Ozempic and Wegovy cash, Novo Nordisk bought Inversago Pharma for $1 billion, Embark Biotech for up to $500 million, ocedurenone—an experimental drug for uncontrolled hypertension and potentially beneficial in treating cardiovascular and kidney diseases—from KBP Biosciences for $1.3 billion during 2023.

- To address expanding Ozempic and Wegovy demand, Novo Nordisk’s parent, Novo Holdings, bought NJ-based Catalent, a global provider of drug delivery systems, gene therapies, manufacturing, biologics, and other operations, in 2024.

- 2024 also saw the acquisitions of Cardior Pharmaceuticals for its cardiovascular treatment portfolio, and Austria’s Single-use Support, a fluid management company.

Novo Nordisk’s past acquisitions for both greater production capacity and logistical flexibility will reap benefits through geopolitical risk mitigation and broader product menu options. Entering untapped markets, such as China, will be key to Novo Nordisk’s future growth.

In recent news, FDA has approved Ozempic to reduce risk of kidney disease and cardiovascular death in adults with type 2 diabetes and chronic kidney disease. Novo Nordisk also has introduced NovoCare Pharmacy, which lowers the cost of Wegovy and offers easy home delivery. And the U.S. government reportedly is considering using Wegovy in a program that negotiates lower prices for Medicare in 2027. This could make Wegovy and similar drugs more affordable for people over 65 on Medicare Part D plans.

Novo Nordisk’s Performance

Here is a table summarizing performance in share price, revenues, and profits (net income) from 2015 to 2024.

| Fiscal Year (DEC) | Price | Revenues | Net Income |

| DKK (=US$0.15) | DKK (=US$0.15) | ||

| 2015 | $29.04 | 107.927B/$16.19B | 34.860B/$5.23B |

| 2016 | $17.93 | 111.780B/$16.76B | 37.925B/$5.69B |

| 2017 | $26.83 | 111.696B/$16.75B | 38.130B/$5.72B |

| 2018 | $23.03 | 111.831B/$16.77B | 38.628B/$5.79B |

| 2019 | $28.94 | 122.021B/$18.30B | 38.951B/$5.84B |

| 2020 | $34.92 | 126.946B/$19.04B | 42.138B/$6.32B |

| 2021 | $56.00 | 140.800B/$21.12B | 47.757B/$7.16B |

| 2022 | $67.67 | 176.954B/$26.54B | 55.525B/$8.33B |

| 2023 | $103.45 | 232.261B/$34.84B | 83.683B/$12.55B |

| 2024 | $86.02 | 290.400B/$40.10B | 100.99B/$14.65B |

Key Drivers for Novo Nordisk’s Stock

- A more potent obesity treatment called CagriSema combines semaglutide, the active ingredient in Ozempic, with amylin and calcitonin receptor agonists. Amylin helps regulate blood sugar levels, similar to GLP-1, while calcitonin controls calcium levels in the blood. Results for two late-stage FDA trials of the drug are expected by the end of 2024.

- Wegovy’s June 2024 approval for sales in China opens the door to a new market, which has hundreds of million prospective new customers from China’s burgeoning middle and upper class.

- New experimental obesity drug amycretin, a single molecule that operates as a GLP-1 receptor agonist that reduces one’s appetite, is in phase-1 FDA trials. The new pill achieved a 13.1% average weight loss after 12 weeks, more than doubling the efficacy of Wegovy for the same time span.

- With the obesity drug market expected to reach $100 billion by 2030, genetic-based treatments currently in the R&D stage could become the next pharma golden ring.

- While some legal experts believe that the number of Ozempic lawsuits over gastroparesis and other afflictions, such as pancreatitis, kidney, and gallbladder issues, can reach as high as 20,000, Novo Nordisk is apparently confident it can reach a settlement that will allow it to continue its growth trajectory without impediment.

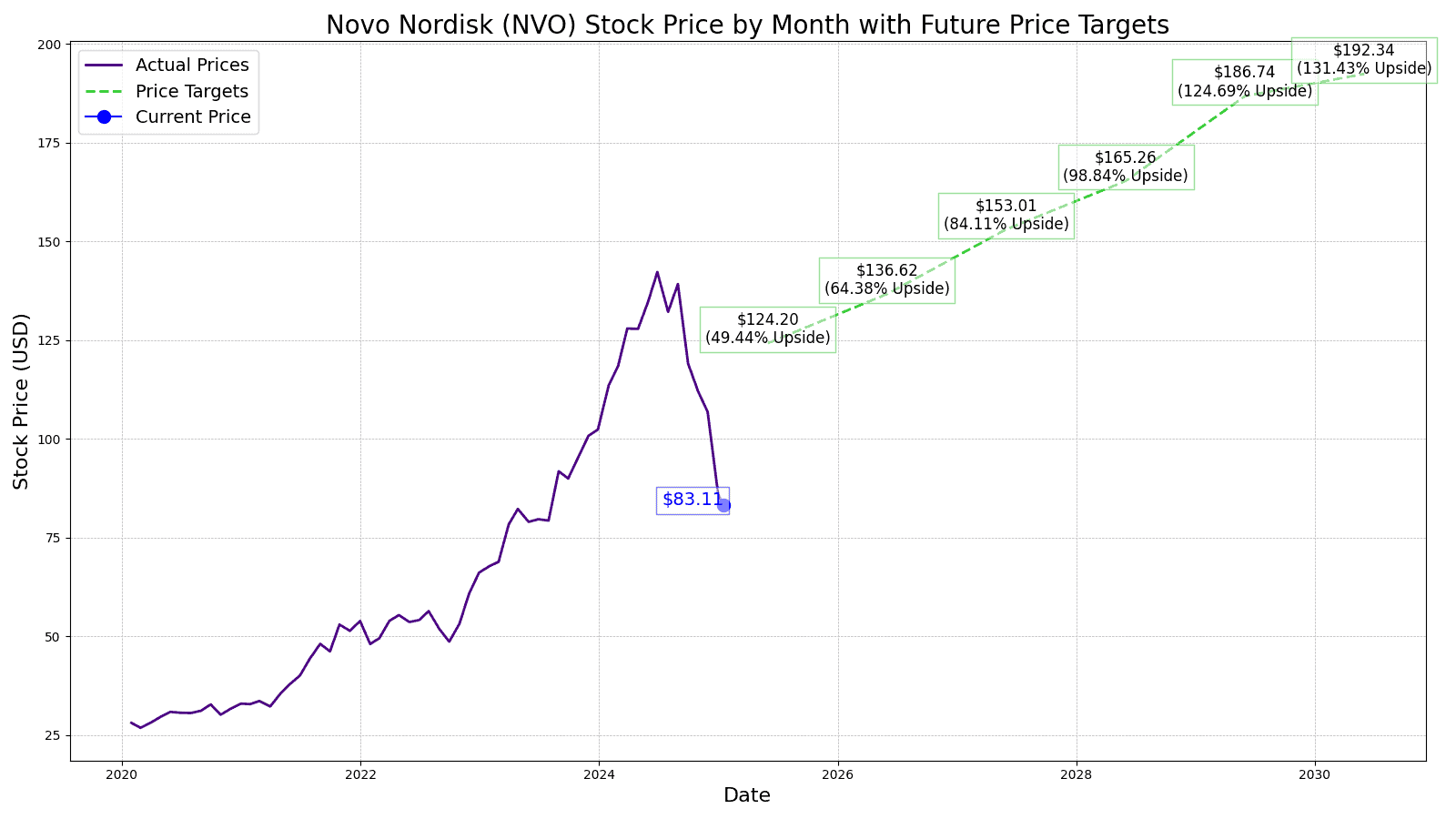

Stock Price Prediction for 2025

Out of 11 Wall Street analysts covering the stock, six of them recommend buying shares, two of them with Strong Buy ratings. Just one of those analysts rates the shares at Underperform. Their consensus 12-month target price for the stock is $113.43, which would be a 41.5% gain over the current share price. The 24/7 Wall St. 12-month projected target is higher at $124.20. This would be 54.8% above today’s price.

Novo Nordisk’s Outlook for the Next Five Years

Novo Nordisk’s median P/E ratio has been 26.40 from 2010 to the present. The following price predictions are based on a 25 P/E. In the subsequent five years to follow, Novo Nordisk’s newest products, presently in FDA trials, are targeting the obesity market.

It is anticipated to reach $100 billion by 2030. Obesity drugs competing against offerings from Eli Lilly and other rivals require drugs that meet the following criteria: Sufficient efficacy to fulfill the medical needs of a large population of patients;

- Tolerable enough for prolonged patient treatment to obtain a significant and consistent therapeutic effect;

- Flexible enough to be prescribed to patients without an abundance of diagnostic testing or monitoring;

- Formulaically efficient enough to manufacture and distribute at scale.

With Wegovy gaining acceptance for China in 2024’s second quarter, this opens the door for Novo Nordisk to gain a foothold in a potentially larger market than the entirety of its European share. China’s middle and wealthy classes have multiplied exponentially as China’s gross domestic product has grown. Obesity, heart diseases, and other ailments common in the West have escalated in China as diets and lifestyles adapted to mimic Western tastes and trends. Our price target for 2026 is $136.62.

The new obesity drug CagriSema is presently near completion of FDA phase-2 trials. Assuming there are no negative results to bar initiating clinical phase-3 trials, these would presumably occur throughout 2025 and 2026. Therefore, CagriSema is likely to be cleared for public dissemination and ready for market by 2027. Although it is administered via injection, rather than in pill form, early results show a 200% higher weight loss reduction in 32 weeks, over Wegovy. Our price target for 2027 is $153.01.

Although Novo Nordisk’s pipeline of new drugs under FDA review targets obesity, its revamped product menu has expanded via acquisitions. Revenues from its HGH, estrogen replacement, and wound treatment products, as well as other diabetes variants, should all contribute to the bottom line with full production, marketing, and sales integration by 2028. We predict a price of $165.26.

Obesity pill amecrytin, which acts as an appetite suppressant without the effects of amphetamines, is presently in FDA phase-1 trials, but should be cleared for market and ready for distribution in 2029. Its weight-loss efficacy doubles that of Wegovy in shorter three-month periods, and its pill configuration convenience should make it a hit prescription for doctors. Our price target is $186.74.

R&D for a genetic-based obesity drug is currently in the works by Novo Nordisk, Eli Lilly, and several other rivals. With the obesity treatment market expected to hit $100 billion in 2030, even the announcement of a genetic-based drug ready to start FDA trials would generate significant buzz. With Novo Nordisk the current market leader, such an announcement in 2030 is not a stretch. Our target price is $192.34. Cumulatively, 24/7 Wall St. anticipates Novo Nordisk to appreciate 139% over the next five years.

| Year | EPS | P/E multiple | Price |

| 2025 | $4.97 | 25 | $124.20 |

| 2026 | $5.46 | 25 | $136.62 |

| 2027 | $6.12 | 25 | $153.01 |

| 2028 | $6.61 | 25 | $165.26 |

| 2029 | $7.47 | 25 | $186.74 |

| 2030 | $7.69 | 25 | $192.34 |

Prediction: This Pharma Stock Will Be the Best Performer in 2025

The post Novo Nordisk (NVO) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..