My Favorite Tariff Safe-Haven Stock to Buy on the Dip

Uncertainty has weighed on stocks over the past several weeks, pushing the three major indexes lower -- the S&P 500 (SNPINDEX: ^GSPC) even temporarily slid into a bear market. What's driven this negative momentum is investors' concerns about the potential impact of import tariffs on corporate earnings. President Donald Trump earlier last month announced a broad set of tariffs on countries worldwide. The result of this could be higher prices at home, dragging down companies' sales and increasing their costs.The president halted most tariffs temporarily to allow for negotiations, a move that's positive, as it suggests final duties might be lower than those initially announced. Still, investors have been eager to get in on stocks with low exposure to this upcoming headwind. These would be companies that produce a great deal of their products in the U.S. or in a variety of countries that are likely to face low tariff levels.Right now, a fantastic tariff safe-haven stock, one that's climbed nearly 70% in three years, is offering investors a great buying opportunity. This top biotech player has lost about 15% over the past few days, but for a reason that won't impact its long-term growth. Let's check out my favorite tariff safe-haven stock to buy on the dip.Continue reading

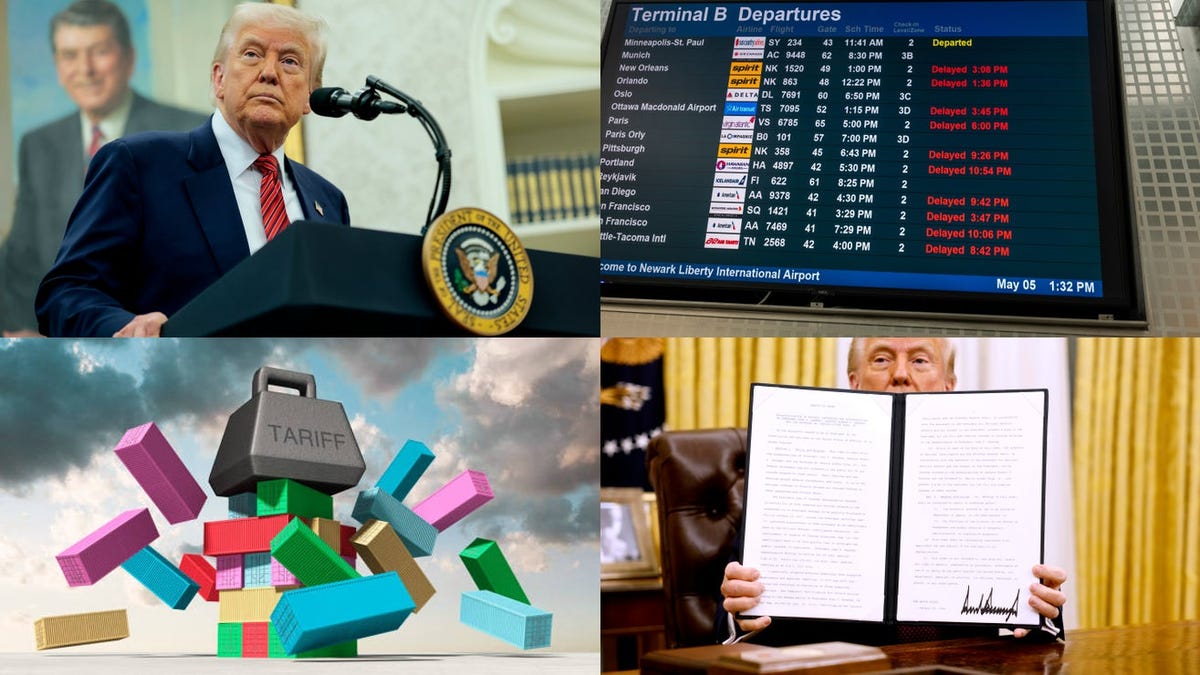

Uncertainty has weighed on stocks over the past several weeks, pushing the three major indexes lower -- the S&P 500 (SNPINDEX: ^GSPC) even temporarily slid into a bear market. What's driven this negative momentum is investors' concerns about the potential impact of import tariffs on corporate earnings. President Donald Trump earlier last month announced a broad set of tariffs on countries worldwide. The result of this could be higher prices at home, dragging down companies' sales and increasing their costs.

The president halted most tariffs temporarily to allow for negotiations, a move that's positive, as it suggests final duties might be lower than those initially announced. Still, investors have been eager to get in on stocks with low exposure to this upcoming headwind. These would be companies that produce a great deal of their products in the U.S. or in a variety of countries that are likely to face low tariff levels.

Right now, a fantastic tariff safe-haven stock, one that's climbed nearly 70% in three years, is offering investors a great buying opportunity. This top biotech player has lost about 15% over the past few days, but for a reason that won't impact its long-term growth. Let's check out my favorite tariff safe-haven stock to buy on the dip.