Jim Cramer sends strong message on Nvidia stock at all-time highs

The long-time stock picker offers blunt words on Nvidia shares.

The Pareto Principle, or 80/20 rule, suggests that most outcomes result from a minority of inputs. When applied to investing, the message is simple: most of your returns will come from a minority of your choices.

Those lucky enough to own Microsoft since the early days of PCs, Amazon since the dawn of the Internet, and more recently, Nvidia since the start of the artificial intelligence revolution have seen the principle in action.

The returns produced by these technology titans have been downright life-changing for many. And in each case, there were plenty of doubters along the way.

Related: Gemini, ChatGPT may lose the AI war to deep-pocketed rival

That's certainly been true for AI-darling Nvidia. After OpenAI's ChatGPT became the fastest app to reach 1 million users in 2022, seemingly everyone has been tripping over themselves to get in on the AI action. And that's certainly been good news for investors, who have ridden Nvidia to whopping returns in recent years.

Yet many have questioned Nvidia's ascent, wondering if AI is a bubble about to burst and musing that Nvidia's valuation is too rich for a cyclical semiconductor company.

The naysayers got particularly loud earlier this year, when Nvidia shares retreated over 40% from their early-year peak to their lows in April. The doubters have so far been proven wrong, and that's caught long-time investor Jim Cramer's attention.

Cramer, who has been tracking the market for decades, had some choice words for the Nvidia bears this week.

Nvidia captures the AI zeitgeist

Just like the sellers of picks and shovels profited from the 1800s gold rush, Nvidia has found itself the biggest beneficiary of surging spending on training and running AI chatbots and AI agents.

The company's graphic processing units, or GPUs, were initially designed to elevate video gaming, but since then, their ability to process information faster and more efficiently than CPUs has led to their widespread adoption for use in cryptocurrency, and more recently, AI research and development.

Related: Veteran analyst drops bold new call on Nvidia stock

Coupled with software that boosts performance, Nvidia's GPUs have become the most desired piece of network infrastructure coveted by enterprise and cloud networks. And since most existing network servers are powered by CPUs, upgrades and new capacity have meant surging revenue and profit for Nvidia and its shareholders.

The company's revenue has leaped from $27 billion in 2022 to $130 billion last year. And that momentum has carried over into 2025, given sales in the first quarter rose 69% year-over-year to $44 billion.

The bulk of the sales growth has come from a consistent rollout of newer, more powerful, and pricey products. Demand has shifted from the H100 to the H200 to its latest Blackwell lineup, which can fetch up to $50,000 more in certain configurations. The B100 costs about $30,000 to $35,000, while the GB200 Superchip can fetch over $60,000.

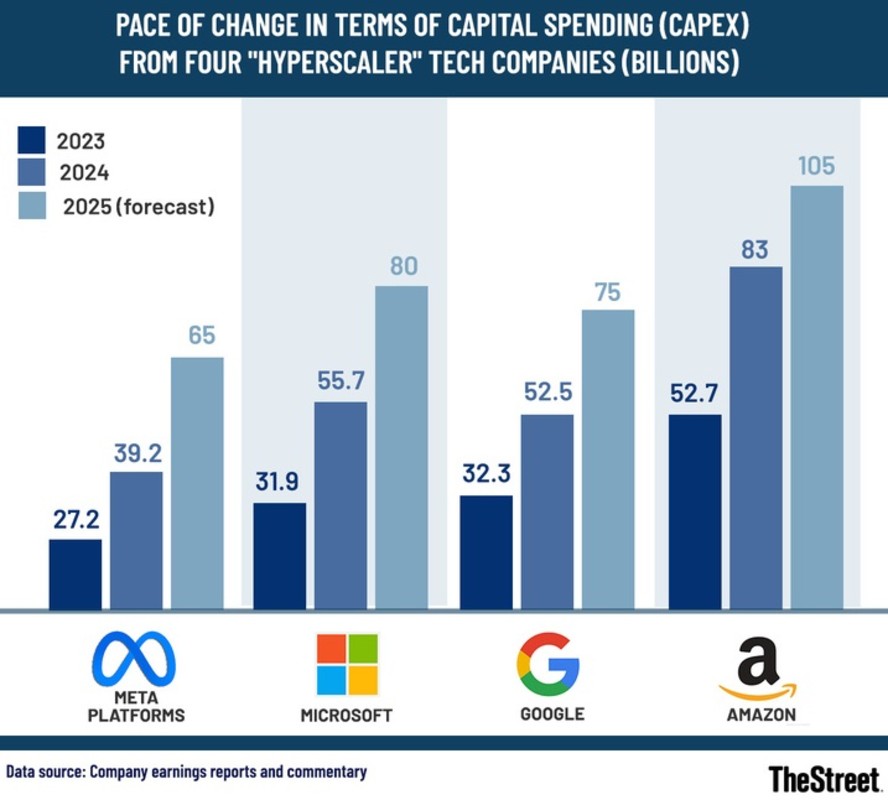

The sheer amount of AI activity is particularly staggering, and keeping up with companies' projects has led to hyperscalers plowing hundreds of billions of dollars into their networks. Last year alone, Meta Platforms, Google, Microsoft's Azure, and Amazon's AWS boasted Capex of $192 billion. TheStreet, Company earnings reports and commentary.

Jim Cramer delivers sharp rebuke of Nvidia sellers

Stocks don't rise or fall in a straight line. Even the biggest and best-performing stocks of our lifetime have seen nausea-inspiring pullbacks along the way, and Nvidia is no exception.

Those who have profited most from these big winners have been the investors who have been able to withstand the terrifying volatility, staying the course even when the odds appear to be against them.

Related: Legendary fund manager issues stock market prediction as S&P 500 tests all-time highs

Perhaps, for that reason, Cramer, a long-time fan of Nvidia, took to X to deliver a blunt victory lap on behalf of those who stood by Nvidia's stock during its painful retreat this spring.

"I remember a list of billionaires who bailed on Nvidia. Some even touted the sells. Where are these sellers? Shouldn't we run that list??," posted Cramer.

Cramer took his fair share of barbs for defending Nvidia when it was out of favor. Now that Nvidia's stock is hitting all-time highs, the shoe is on the other foot.

In response to a post by long-time technology analyst Dan Ives praising artificial intelligence, Cramer said, "Still many non-believers!"

The rally since April 9, when President Trump paused most reciprocal tariffs that had sent stocks reeling earlier that month, has climbed a proverbial wall of worry, leading veteran Wall Street analyst Tom Lee to call it a "most-hated rally."

More Nvidia:

- Analysts revamp forecast for Nvidia-backed AI stock

- Nvidia stock could surge after surprising Taiwan Semi news

- Nvidia CEO sends blunt 7-word message on quantum computing

Stocks tend to perform best when people are fearful, especially when that fear has led them raise cash, or to bet against leaders expecting more downside.

Certainly, Nvidia's large drawdown sparked plenty of fear, and likely short selling. Now, those sellers are likely feeling a bit of FOMO. For them, Cramer has a blunt message.

"NVDA is back at an all-time high, and this old fave is the biggest and the best," said Cramer.

Todd Campbell has owned shares of Nvidia since 2017.

Related: Veteran Wall Street firm makes surprise call on tech stocks