I Was Approved for Social Security but How Do I “Prove” I Stopped Working?

The age at which you’re eligible to begin collecting Social Security benefits is usually a memorable time; whether you’ve retired or not, a little bit of extra cash will line your pockets. Unfortunately, the rules about when you can begin taking payments, alongside the best strategic time to begin receiving benefits, can be confusing. For […] The post I Was Approved for Social Security but How Do I “Prove” I Stopped Working? appeared first on 24/7 Wall St..

The age at which you’re eligible to begin collecting Social Security benefits is usually a memorable time; whether you’ve retired or not, a little bit of extra cash will line your pockets. Unfortunately, the rules about when you can begin taking payments, alongside the best strategic time to begin receiving benefits, can be confusing. For example, if an individual starts claiming benefits before reaching full retirement age, they may receive smaller payments each month. A Reddit user shared her recent frustrations with the online community; she says she was approved for benefits yet hasn’t received a payout.

Across the United States, millions of older adults seek to collect early Social Security. Because the yearly earnings limit for early claimants in around $22k, accidentally exceeding this amount can result in withheld benefits. For teachers, like our Reddit poster, who are usually paid on extended contracts, this can lead to not receiving benefits for months. Though these withheld amounts are eventually paid once the recipient reaches full retirement age, it can still be a financial strain on newly retired individuals.

This slideshow explores the ‘earnings test’, explaining how it works and why it matters. We cover how to document retirement status and what to do if your benefits are delayed. If you are considering taking early Social Security benefits, check out this practical advice on navigating Social Security payments.

You Can Claim Social Security While Working

- Social Security benefits can start as early as age 62

- However, claiming before full retirement age (FRA) subjects you to earnings limits

- If you exceed these limits, part or all of your benefit may be withheld

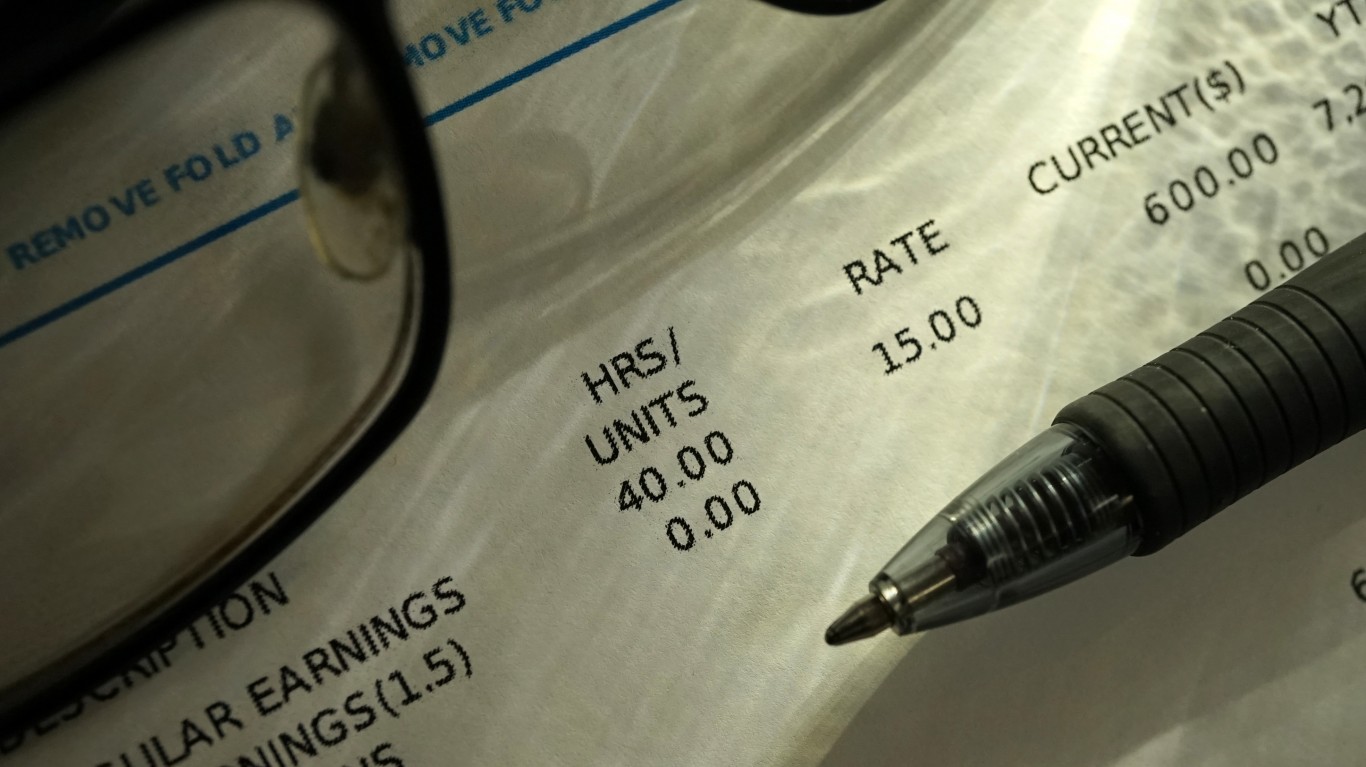

Understand the Earning-Test Limit

- In 2025, the annual earnings-test limit is $22,320

- For every $2 earned over this limit, $1 in benefits is withheld

- The earnings test only applies before you reach FRA

A Retiring Teacher’s Situation

- A Reddit poster reported being approved for Social Security but not receiving payments

- The teacher was told she needed to prove she was no longer working

- Extended teacher contracts can delay benefit eligibility due to ongoing pay

Why Benefits Might be Withheld

- Summer pay extensions for teachers may count as earned income

- If income from these months exceeds the earnings-test limit, Social Security may withhold benefits

- This is a temporary delay, not a permanent loss

How to Prove you’re no longer Working

- Obtain a letter from your employer confirming contract end

- Submit pay stubs or termination notices to the SSA

- Documentation helps clarify benefit eligibility

You Will Get That Money Back

- Benefits withheld under the earnings test are not lost forever

- Social Security repays them starting at full retirement age

- These delayed benefits result in slightly higher future payouts

Avoiding Surprises in Retirement

- Understanding the timing of your final pay is crucial

- Early planning helps avoid unexpected benefit delays

- Teachers should especially watch out for summer income effects

Why Working with a Financial Advisor Helps

- Financial advisors understand Social Security complexities

- They can help align benefit timing with your financial goals

- Expert guidance reduces confusion and frustration

What if the SSA Keeps You Waiting?

- Delays may be caused by incomplete documentation

- Follow up persistently and be proactive

- Use SSA online tools or contact your local office

The Bottom Line

- Early Social Security can provide flexibility, but comes with caveats

- Know the earnings limits and how your job affects eligibility

- With preparation, you can navigate the transition to retirement smoothly

The post I Was Approved for Social Security but How Do I “Prove” I Stopped Working? appeared first on 24/7 Wall St..