Analysts raise Micron stock price target, send warning

Analysts provided their opinion on this business growing thanks to the AI boom.

Artificial intelligence. Can you escape it? It is getting increasingly more difficult, especially for businesses. They are all thinking about how they can use AI to make more money.

I wouldn't be surprised to see "AI powered" cereal at this point, whatever that means. I just did a search for this, with Brave search, and the first result was: "Cereal Creator Pro-Free AI-Powered Cereal Box Design."

Many companies feel pressured to find some use for the technology, and this pressure grows the data center and supercomputer markets because very powerful computers are needed to train the AI.

Related: Quantum computing stock sent reeling by financing decision

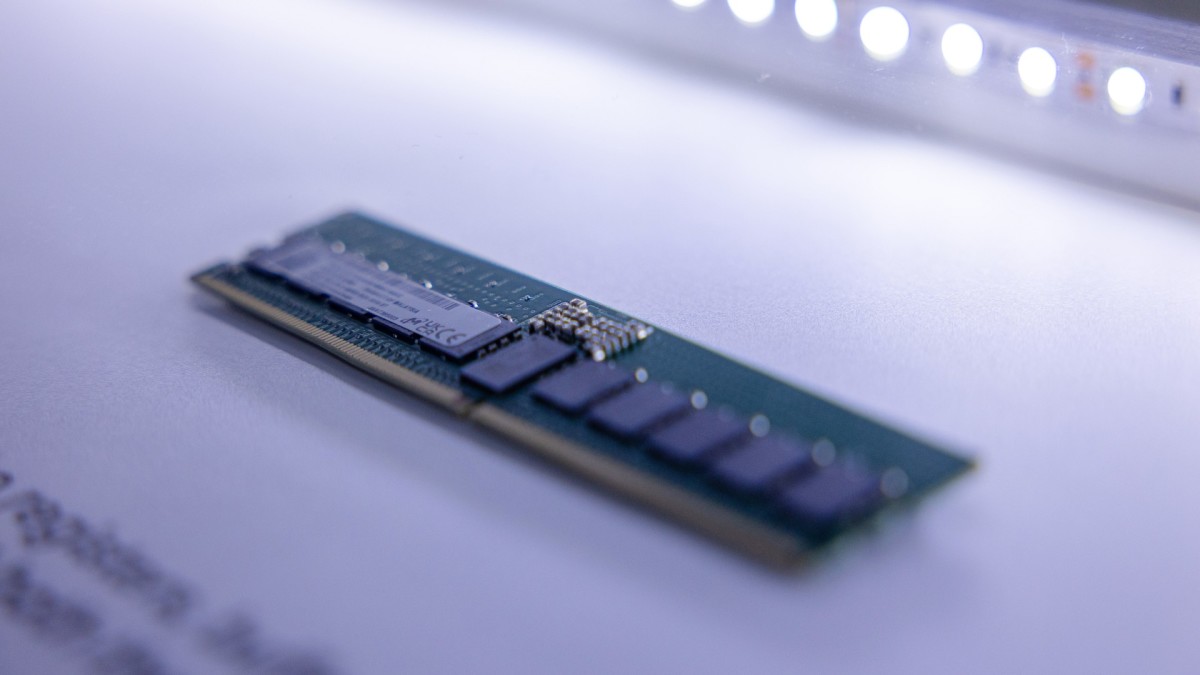

A domino effect of this AI wave is increased demand for high-bandwidth memory (HBM) chips, which are indispensable to the AI market. GPUs that power AI systems are becoming increasingly powerful, but they are bottlenecked by memory bandwidth.

HBM provides the bandwidth necessary to leverage these powerful processors most effectively and efficiently. According to Gartner, HBM revenue is projected to grow from $1.1 billion in 2022 to $5.2 billion in 2027.

Micron Technology is one of the manufacturers of HBM that stands to profit from this AI boom.

Micron rides AI wave to sales, profit growth

Micron (MU) recently announced plans to expand its U.S. investments to approximately $150 billion in domestic memory manufacturing and $50 billion in research and development.

On June 25th, Micron reported its results for Q3 of fiscal 2025.

Here are the highlights:

- Revenue of $9.30 billion versus $8.05 billion for the prior quarter and $6.81 billion for the same period last year

- Gross margin of $3.5 billion or 37.7% of revenue compared to $1.8 billion or 26.9% of revenue in Q3 2024.

- Net income of $1.89 billion, or $1.68 per diluted share, compared to $332 million, or $0.30 per diluted share, in Q3 2024.

Related: Amazon's latest big bet may flop

The company provided an outlook for Q4 of fiscal year 2025:

- Revenue of $10.7 billion ± $300 million

- Gross margin of 41.0% ± 1.0%

- Diluted earnings per share $2.29 ± $0.15

"In fiscal Q3, DRAM revenue reached a new record driven by a nearly 50% sequential growth in HBM revenue. We remain the sole supplier in volume production of LPDRAM in the data center," said Sanjay Mehrotra, chairman, president, and CEO of Micron during the earnings call.

More technology stocks

- Amazon tries to make AI great again (or maybe for the first time)

- Veteran portfolio manager raises eyebrows with latest Meta Platforms move

- Google plans major AI shift after Meta’s surprising $14 billion move

"In NAND, we achieved a new quarterly record for market share across data center SSDs as well as client SSDs in calendar Q1. For the first time ever, during calendar Q1, Micron has become the number two brand by share in data center SSDs according to third-party data," continued Mehrotra.

Bank of America analysts raise Micron stock price target

Following the earnings report, Bank of America analyst Vivek Arya and his team updated their opinion on Micron shares.

"We rate Micron Neutral. The company benefits from several secular trends in the data center and cloud computing markets, particularly in AI (high-bandwidth memory and data center-grade DRAM and SSDs). However, we see muted near-term memory pricing environment on lackluster PC/phone demand, putting pressure on [gross margins] for the foreseeable future," said the analysts.

Related: Popular AI stock inks 5G network deal

However, Arya and his team noted some key risks facing Micron:

- Larger than expected decline in the average selling price of memory.

- Greater competition from China newcomers.

- Share loss to large competitors.

- Softening of demand across major end markets such as data centers, smartphones, or PCs.

- NAND pricing and start-up costs impact on gross margins.

According to Bloomberg Intelligence Micron's HBM market share in 2033 is expected to grow to 23%. SK Hynix is expected to drop from about 50% to 40% market share and Samsung is to be at 35%.

In May 2024 Reuters reported that Huawei is aiming to produce HBM2 chips in partnership with other China companies by 2026. The same report said that two Chinese chipmakers are in the early stages of producing HBM.

Micron's outlook for Q4 shows a sequential jump in revenue that seems a bit modest compared to the expected HBM demand growth due to the AI wave.

Analysts set the target price at $140, based on a 2.3 multiple of their estimate for the price-to-book ratio for the calendar year 2026, which is in the upper range of Micron's long-term range of 0.8 to 3.1, and they believe we are potentially in the memory upcycle.

Related: Elon Musk's DOGE made huge mistakes with veterans' programs