Stock Market Today: S&P 500, Nasdaq fade after hitting new highs

Stocks push higher based on hopes for trade deals, lower taxes and lower interest rates. But a fade sets in on worries of a frothy market.

Updated 2:30 p.m. EDT

It's mid-afternoon, and, in some cultures, time for a nap.

Well, the stock market is still higher, but it has dropped back a bit from its big highs right after the open. Maybe a few folks are taking a break.

At 2:30 p.m. EDT, the S&P 500 was up 7 points to 6,148 after hitting a 52-week high of 6,187.68 at 12:30 p.m.

The Nasdaq Composite actually down 19 points to 20,149, down from its high of 20,312, and the Nasdaq-100's gain has faded to a loss of 4 points at 22,440 after reaching an all-time high 2,603.22

Not to be outdone, the Dow Jones Industrial Average was still up a healthy 329 points to 43,718, but that was down from its intraday high of 43,966. It's off 4.3% from its all-time high of 45,704, reached on Dec. 4.

Just a note on, well, hyper-excitement

We note — to inject a little caution into today's exuberance — the following:

A total of 55 stocks in the S&P 500 on this Friday were sporting relative strength indexes of 70 or more. For some, that's a high number.

Relative strength is a popular measure to gauge if a stock is too high. A reading above 70 suggests a stock is overbought. Above 75 suggests it's at or near a top. Above 80, it's definitely over the top.

Jabil Circuit (JBL) currently spots an RSI of 90, which means it's vulnerable. Microsoft (MSFT) , which reached nearly to $500, has an RSI of 80. Goldman Sachs (GS) has an RSI of nearly at 81.

The Street Pro's Bob Lang noted the market exuberance, too, and added:

"The Nasdaq is in full bull mode right now, with very strong momentum that is just not letting up. The parabolic move from the April lows is quite extraordinary, but an overbought condition can smack the bulls hard if you’re not careful."

And, he added, "I am not saying it is time to cut and run, we know stocks will move much more than expected and with the strong tailwind from momentum that makes it very likely, but if you’re so inclined then adding some puts for protection would be prudent (and cheap, with VIX at 16%).

Jay Woods of Freedom Capital Markets was less worried. The market, he said in a note, "Doesn’t seem overbought across the board, and overbought is not always a bad thing."

Updated 12:03 p.m. EDT

Broad buying pushes stocks higher

Buyers came to the market. They saw that stock prices were higher. And they bought more stocks.

They bought because the Standard & Poor's 500 Index hit new highs. The Nasdaq Composite hit new highs. The Nasdaq-100 Index hit new highs. The Dow Jones industrials were up more than 400 points.

They bought because consumer just maybe are not so freaked as they were in April when President Trump's trade proposal unnerved so many.

They bought because they interest rates may be headed lower.

They bought because the Middle East is calming down.

And with just Friday and Monday left in the quarter, the second quarter is proving a big-time winner.

At 11:55 a.m. EDT, the S&P 500 was up 35 points to 6,184.61, just below its new 52-week high of 6,184.73. The Nasdaq Composite had added 139 points to 20,303, and the Nasdaq-100 surged 149 points to 22,596.

Not to be outdone, the Dow Jones Industrial Average surged 480 points to 43,867, still roughly 2.8% below its all-time high of 45,702.

The market was seeing winners all over the place with big gains seen among stocks like Nike (NKE) , up more than 15, Taiwan Semiconductor (TSM) Doordash (DASH) , Netflix (NFLX) , and banks. Doesn't matter if you're talking about JPMorgan Chase (JPM) or Northern Trust (NTRS) .

Updated 10:10 a.m. EDT

S&P 500, Nasdaq, Nasdaq-100 hit new highs

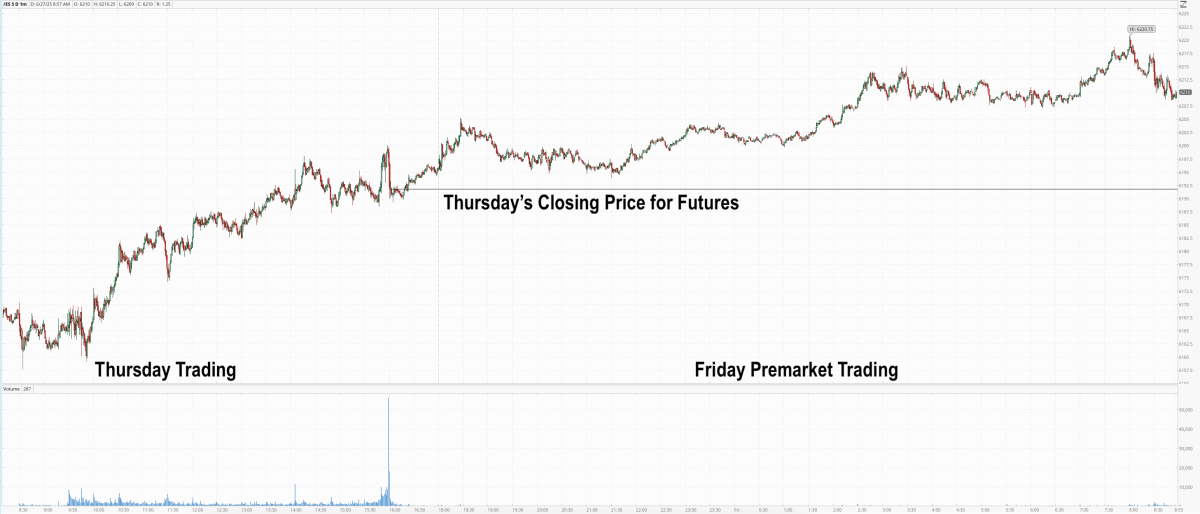

Stocks shot higher at the open on Friday as the Standard & Poor's 500 Index broke through to new highs, recovering 100% of its losses after its Feb. 19 peak.

The Nasdaq Composite and Nasdaq-100 indexes hit new 52-week highs, too.

Microsoft (MSFT) and Nvidia (NVDA) reached new 52-week highs, but crypto-exchange giant Coinbase (COIN) slid back after hitting a new high on Thursday.

At 10:20 a.m. EDT, the S&P 500 was up 35 points to 6,176. The Nasdaq Composite had added 127 points to 20,295, and the Nasdaq-100 surged 145 points to 22,592.

Not to be outdone, the Dow Jones Industrial Average surged 314 points to 43,701, still 4.6% below its all-time high of 45,702. Its 0.8% gain on the day was larger than those of the other indexes.

Catalysts are a possible trade deal with China and India as well, lower corporate taxes on corporations and the possibility the Federal Reserve will cut interest rates later this year.

Stock Market Today

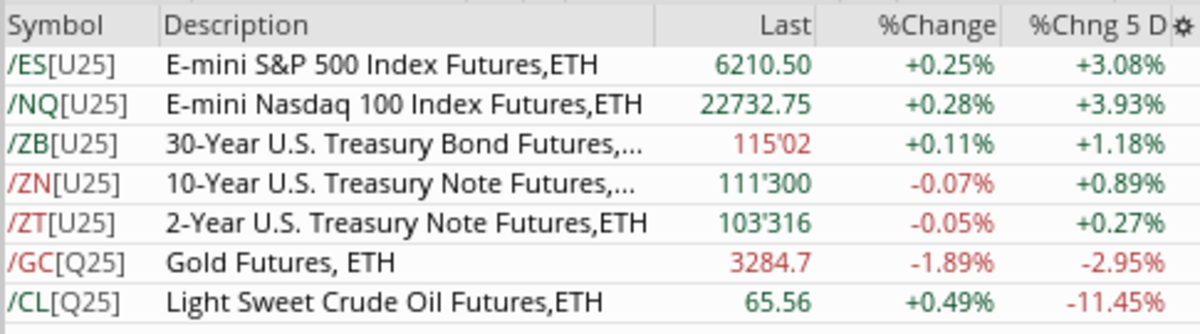

Stocks appear set to continue higher today based on three main factors:

- A trade deal with China appears to be close (and maybe with India, too)

- The tax bill would lower taxes on corporations and increase their profits

- Fed rate cuts in 2025

The Fed's preferred gauge of inflation, the PCE, or Personal Consumption Expenditures Price Index, was reported this morning.

According to the Bureau of Economic Analysis, May's PCE rose 0.1%, and 2.3% year-over-year, in line with expectations. However, Personal Income and Personal Spending were weaker than expected, dropping 0.4% and 0.3%.

How did stock futures react? They dropped but remain higher on the day.

Overall, stock futures are higher, bonds are mixed, and gold is lower.

Crude continues to bounce around the $65 level we've been discussing all week.

Later this morning, the University of Michigan will release its Consumer Sentiment index.