If you own your house, you’re sitting on a “mountain of cash” right now

There’s a reason so many people have struggled to buy a home in recent years. U.S. home values have soared in the past half-decade. But the combination of elevated home values and mortgage rates is making it difficult for new buyers to afford a house. As difficult as the situation is for buyers, though, […] The post If you own your house, you’re sitting on a “mountain of cash” right now appeared first on 24/7 Wall St..

Key Points

-

U.S. home values are up right now.

-

There are ways to use your home equity to your advantage.

-

You may want to act soon, since housing market conditions could change.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

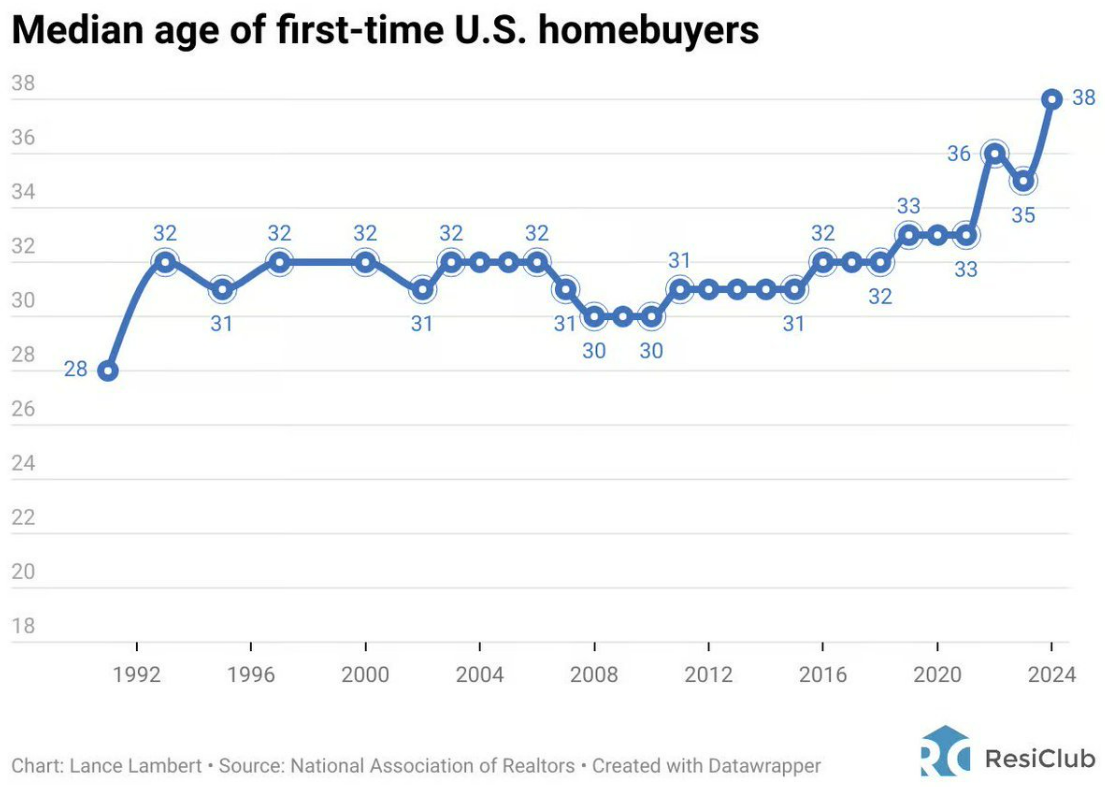

There’s a reason so many people have struggled to buy a home in recent years. U.S. home values have soared in the past half-decade. But the combination of elevated home values and mortgage rates is making it difficult for new buyers to afford a house.

As difficult as the situation is for buyers, though, homeowners are in a great spot right now. As this Reddit poster says, if you own a house, you’re probably sitting on a “mountain of cash right now.” And the poster thinks more people should be taking advantage.

How to use home equity to your benefit

Recent data from CoreLogic finds that the average U.S. homeowner with a mortgage has roughly $311,000 in home equity. And there are ways you can tap that equity to better your financial situation.

For one thing, you could borrow against your home equity with a home equity loan or a home equity line of credit (HELOC). This is a good option if you have a need for money and want a relatively affordable way to borrow. You might get a better rate on a home equity loan or HELOC than with a personal loan, since home equity loans and HELOCs are secured while personal loans are not.

Another option is to take cash out of your home with a cash-out mortgage refinance. A traditional mortgage refinance has you taking out a new loan in the amount of your mortgage balance. Usually, this is done to secure a better rate.

With a cash-out refinance, you can borrow more than what you owe on your mortgage. From there, the loan proceeds aren’t restricted, so you can use the money for any purpose.

Of course, all of these options require you to borrow money to tap your home equity. Another option, of course, is to downsize. This could allow you to cash out your home equity without having to commit to another loan.

Downsizing tends to be a popular option among retirees or near-retirees. But it may be an appropriate move for you, depending on where you are in life.

Let’s say you have a large home that’s eating up a lot of your income, and you’re falling behind on other savings goals in order to pay for it. If your home is worth $900,000 and you have $500,000 of equity in it, it may be possible to sell your home and use your proceeds to buy a replacement home outright. That eliminates a mortgage payment in your budget so you’re able to put more money into savings and investments.

You may not want to wait to tap your home equity

If you’re sitting on a nice amount of home equity now, you may be eager to get at it. But you also may not want to wait.

Home values are strong right now, but we don’t know what the next year or so will bring. There’s already broad concern about an economic slowdown.

If the economy takes a turn for the worse and home values fall, you could end up getting stuck with less equity to tap. So you may want to get moving on exploring your options.

And it could be a good idea to consult a financial advisor about how to use your home equity to your advantage. They can help you make the most of that equity so it lends to your long-term goals.

The post If you own your house, you’re sitting on a “mountain of cash” right now appeared first on 24/7 Wall St..