33% of Americans Think They Need $1.5 Million+ to Retire, Yet 33% Have Under $50K Saved

One of the unfortunate truths about America today is that there is a major disconnect between the amount of money you need to retire comfortably and the amount of money most people have. There is a big concern that far too many people aren’t taking saving seriously enough to be ready to call it quits. […] The post 33% of Americans Think They Need $1.5 Million+ to Retire, Yet 33% Have Under $50K Saved appeared first on 24/7 Wall St..

One of the unfortunate truths about America today is that there is a major disconnect between the amount of money you need to retire comfortably and the amount of money most people have. There is a big concern that far too many people aren’t taking saving seriously enough to be ready to call it quits.

The idea of saving money for retirement isn’t as easy as people think.

Most people don’t realize just how hard it is to save over $1 million for retirement.

It’s better to set smaller financial goals that are easier to attain.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points

This theme is reflected in the 2024 Retirement Confidence Survey from the Employee Benefit Research Institute and Greenwald Research. According to this survey, approximately 33% of Americans believe they need more than $1.5 million to retire, but few have this much.

Survey Results

The survey paints a clear picture: a million-dollar dream meeting reality. When you consider that 33% of Americans believe they need $1.5 million or more, but an equal number, one-third, have less than $50,000 in savings, and another 14% have less than $1,000, a trend and a concern are taking place, and not for the better.

Consider that if someone has $50,000 at age 50 and is looking for a moderately conservative portfolio return of just 6%. By the time they turn 65, this money only turns into $138,000, which is far, far short of the $1.5 million they likely hoped they would have. In other words, the gap between expectations and financial habits is worsening.

According to the survey, younger workers are also clearly the most vulnerable. Only 28% of workers expect to be able to retire at 65, while more than half expect to have to work beyond 65. Three-quarters expect to work in retirement, while only three in ten of those already retired are doing so.

There are two main concerns here. Those looking for the $1.5 million are rightfully banking on increasing healthcare costs and eroding their savings. The other factor is that workers are not accounting for savings that need to last between 20 and 30 years in retirement, something the EBRI survey clearly points out.

This longevity concern seems boosted by the fact that the survey also indicates that only 36% of workers are confident in their retirement prospects, which circles right back to the million-dollar dream meeting reality.

Setting Realistic Retirement Savings Goals

If you want to reach the $1.5 million goal, there are some practical ways to do so that go beyond earning a huge salary.

Assess Personal Needs

Let’s set aside the $1.5 million number for the moment and consider what someone might need for their lifestyle. According to the survey, those who spend time calculating how much they need in retirement based on their lifestyle are more confident in hitting such a number. For example, someone who believes they can live on $40,000 annually only needs to hit $1 million to sustain their lifestyle for 25 years at a 4% safe withdrawal rate.

Social Security and Other Income

This survey does not consider that there is no calculation for how Social Security and other income sources, like pensions or annuities, might play a role. The caveat is that Social Security is only expected to provide as much as 40% of pre-retirement living, so it’s not a single source of income. However, those planning for retirement needs and accounting for Social Security are again more confident in hitting a target number.

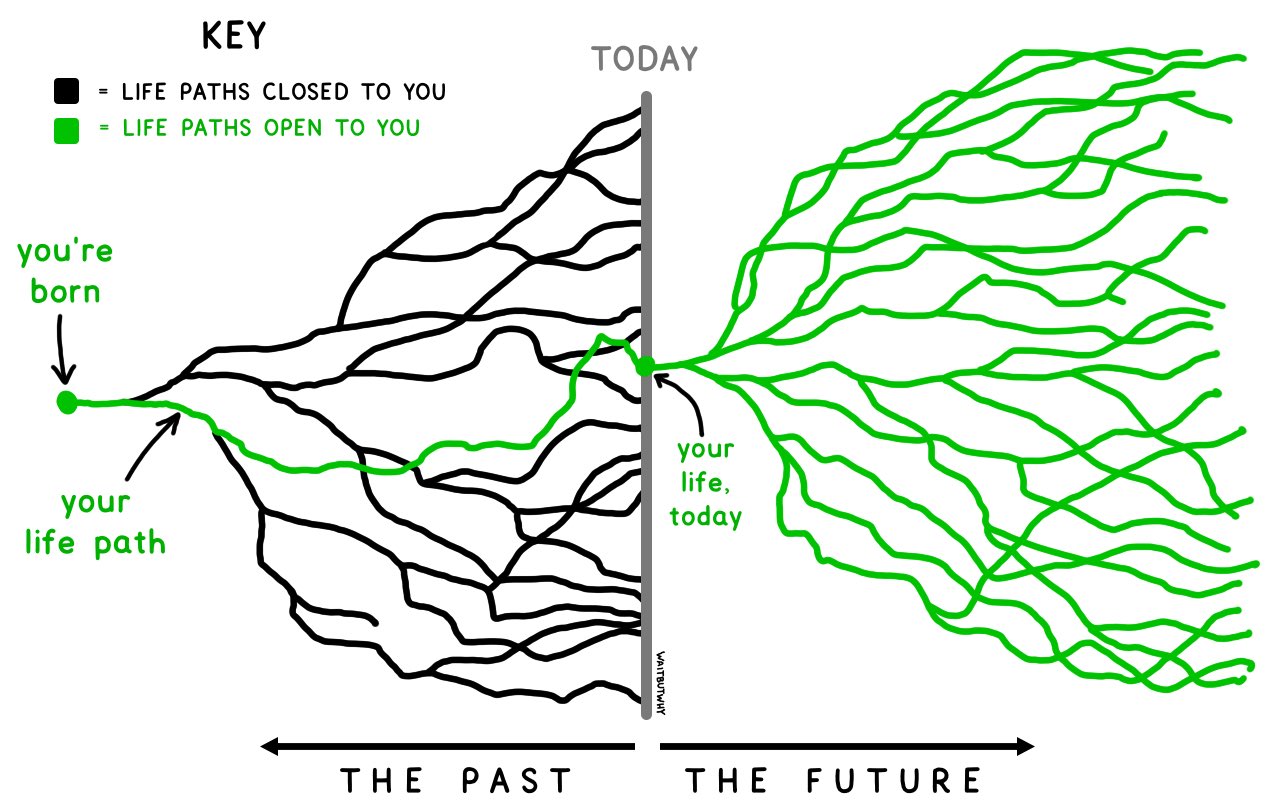

Break Up Your Goals

The worst thing anyone can do is set themselves up for failure by having one goal in mind and focusing only on that. Instead, try to create milestones for yourself that align with your needs. This might mean having a specific dollar amount by hitting 30, 40, and 50.

For example, perhaps you want a $100,000 retirement savings portfolio by turning 40. This goal is much more manageable than saying it’s $1.5 million or bust. The survey supports the idea of hitting benchmarks or milestones, as those who have these smaller, more clear-cut goals are more likely to hit their target.

Another example is that someone who can set aside $500 monthly between 30 and 40 years of age, with the same 6% modest return, would have $100,000 in 10 years.

Practical Steps to Bridge the Retirement Savings Gap

There is no question that those who participated in this survey will find jumping from $50,000 in savings to $1.5 million incredibly challenging. However, there are some practical steps these individuals can take to try and attain attainable goals.

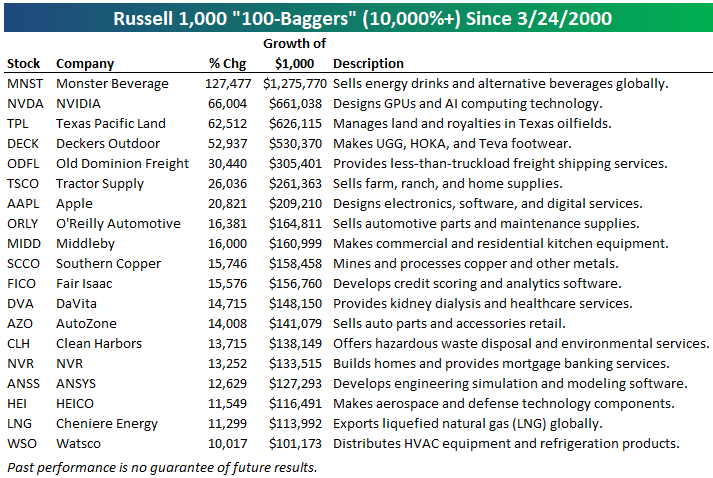

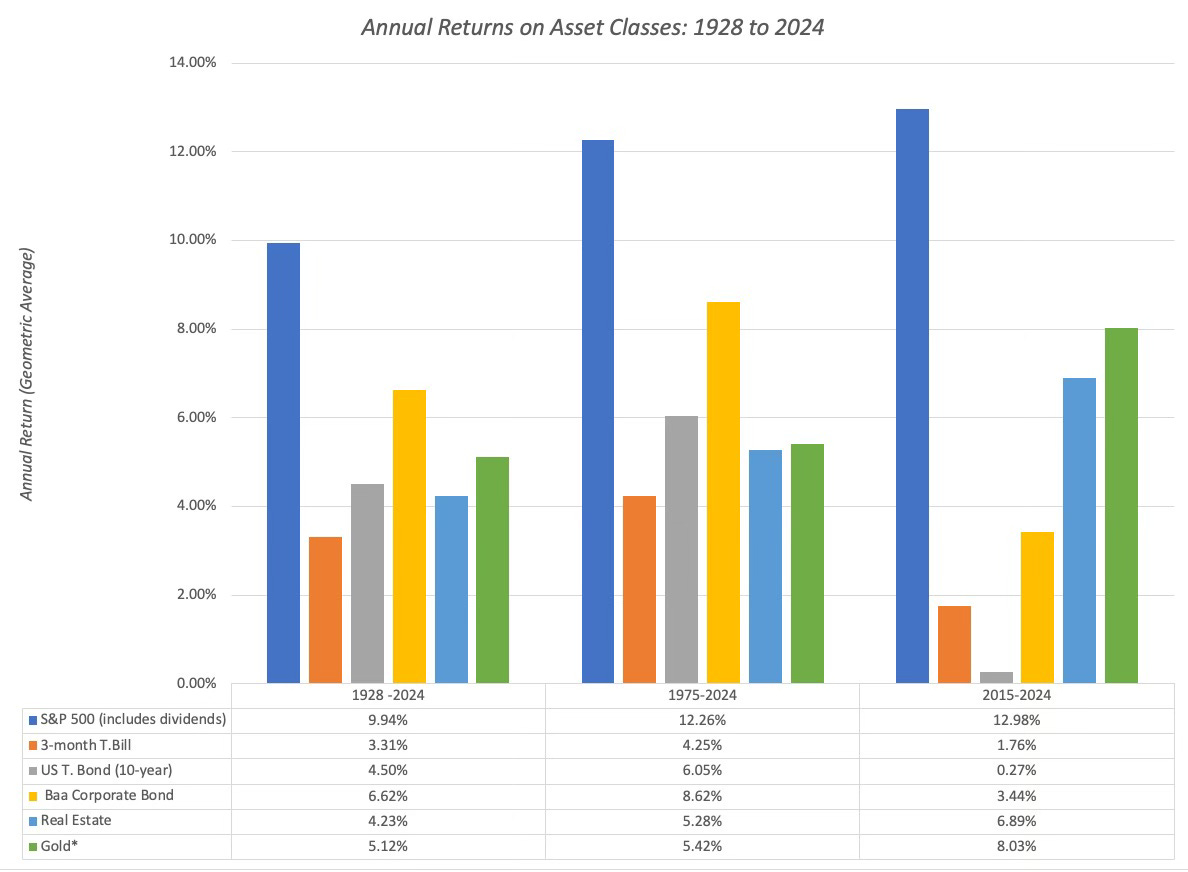

Long-Term Investments

The most significant step anyone can take is to take advantage of long-term investments, the most common of which is a 401(k) account. If your employee offers a 401(k) account with matching, taking advantage of this should be your first step. Employee matching is essentially “free” money, and if it’s a 4% or 6% match, it could result in hundreds of thousands of dollars in compounding returns over 30 years.

Create A Budget

To be fair, you don’t have to just create a budget, but you have to create a very disciplined budget to force you to set aside savings. As noted above, a budget that allows you to set aside $500 monthly for 10 years between 30 and 40 years of age equals $100,000 at a 6% interest rate. There is no question that if you can be disciplined with spending, you are more likely to hit a target goal.

In fact, you should consider automating your savings, as in having the bank automatically transfer this $500 every month, so you can’t say, “Well, this month I want to go on a vacation.” The survey indicates that those who automate their savings plan are more likely to be successful than those who manually transfer money every month.

Professional Guidance

One step that too few people take advantage of is that you should look at working with a fiduciary financial planner. There is no question that those who do so, according to the EBRI survey, are more confident about not just achieving their retirement goals but also about their retirement plans in general. Even robo-advisors can be helpful if you’d prefer not to pay someone for help every month.

The post 33% of Americans Think They Need $1.5 Million+ to Retire, Yet 33% Have Under $50K Saved appeared first on 24/7 Wall St..