Dutch Bros (BROS) Price Prediction and Forecast 2025-2030 (March 2025)

Shares of Dutch Bros (NYSE:BROS) have been battered over the past month, falling by a sizable -27.94% since Feb. 18. On the year, the stock has still managed to post a 9.27% gain, and over the past year, it has still rewarded investors by remaining up 80.18%. As the third-largest coffee shop in the U.S. […] The post Dutch Bros (BROS) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..

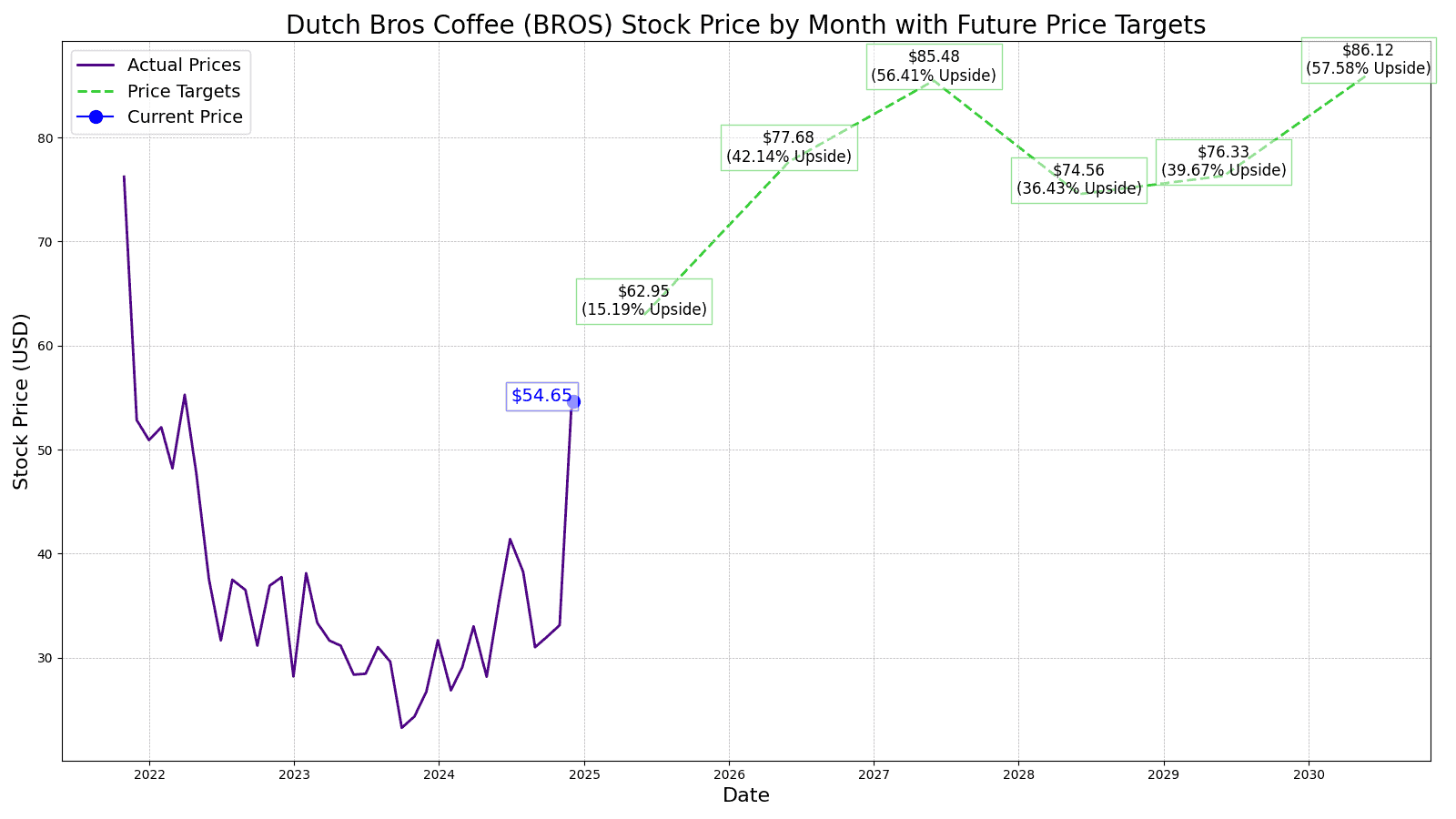

Shares of Dutch Bros (NYSE:BROS) have been battered over the past month, falling by a sizable -27.94% since Feb. 18. On the year, the stock has still managed to post a 9.27% gain, and over the past year, it has still rewarded investors by remaining up 80.18%.

As the third-largest coffee shop in the U.S. behind Starbucks (NASDAQ:SBUX) and Dunkin Brands, Dutch Bros has 950 stores in 18 states. But the company trails its rivals by a significant margin. In comparison, Dunkin has over 9,000 locations in the U.S. and over 13,000 globally. Starbucks is even bigger, with almost 16,500 locations domestically and another 12,600 or so in international markets.

Still, Dutch Bros is rapidly expanding, implementing a “fortressing” strategy to flood a market with stores to create mind share with customers and generate efficiency in its operations.

It is much newer to the market than either of its peers, having gone public in September, 2021 at an offer price of $23 a share. Today, BROS stock trades at nearly $55 a stub, up 140% since then

However, as investors, we want to know whether Dutch Bros will be a good investment over the next three or five years and beyond.

24/7 Wall Street is offering readers insights into our assumptions about the stock’s prospects, what sort of growth we see in BROS stock for the next several years. We aim to give you our best estimates for Dutch Bros’ stock price each year through 2030.

Key Points in This Article:

- Dutch Bros is one of the fastest-growing coffee chains in the country.

- Its drive-thru model allows for quick, relatively inexpensive expansion in new and existing markets.

- BROS prefers a “fortressing” strategy of adding more locations to existing markets to create mind share in consumers and improve operating efficiency.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Dutch Bros performance from IPO to today

The following is a table of BROS’ revenues, operating income, and share price for its first three years as a public company.

The table summarizes performance in share price, revenues, and operating losses from 2021 through the first three quarters of 2024.

| Year | Share Price (end of year) | Revenue | Net Income |

| 2021 | $50.91 | $497.876 million | ($12.679 million) |

| 2022 | $28.19 | $739.012 million | ($4.753 million) |

| 2023 | $31.67 | $965.776 million | $1.718 million |

| 2024 | $56.31 | $1.281 billion | $35.258 million |

Dutch Bros is rapidly expanding. It has opened 30 or more stores every quarter for the last 13 consecutive quarters. It anticipates opening a total of 150 new locations this year.

That helps explain the rapid increase in revenue it is experiencing even though the fortressing strategy can cannibalize sales at existing locations. Although individual unit sales can decline from the practice, revenue as a whole rises. It has been one of the primary driving forces behind pizza chain Domino’s (NYSE:DPZ) success.

As Dutch Bros adds new features such as mobile ordering, the coffee shop is now solidly profitable, with plenty of room for additional expansion in the years to come.

Key Drivers of Dutch Bros Stock Performance

1. Fortressing Growth Strategy: As previously discussed, Dutch Bros has been able to rapidly increase its footprint by flooding a market with more locations. Not only does it help with imprinting the brand on consumers, but it allows the company’s marketing budget to stretch further as advertising covers more stores in a region. It ultimately lowers the coffee chain’s expenses.

2. Drive-Thru Windows: Dutch Bros is a drive-thru coffee shop, which minimizes a store’s size, making it cheaper to open more locations. With mobile ordering now expanding to more stores, it will allow for faster service and customer satisfaction.

3. Operational Efficiency: With a healthy balance between company-owned stores and franchised locations, as well as a sound balance sheet, Dutch Bros should continue to improve its operational efficiency and manage costs to have net income growth rates above revenue growth.

Dutch Bros (BROS) Stock Price Prediction in 2025

Wall Street’s current consensus one-year price target for Dutch Bros is $83.11 per share, which implies potential upside of 52.07% from today’s share price. Of the 10 analysts covering Dutch Bros, nine rate the company as a buy with only one rating it as a sell. Overall, the stock receives a “Strong Buy” rating.

24/7 Wall Street‘s 12-month forecast projects BROS stock price to be $62.95, representing potential upside of 15.18%. We see Dutch Bros continuing its near 30% growth and earnings coming in at $0.50 per share.

Dutch Bros (BROS) Stock Forecast Through 2030

Valuing Dutch Bros’ stock price for the coming years, we’ll begin with management’s expected revenue of $1.26 billion for 2024 and its adjusted EBITDA of as much as $220 million. Then we’ll give our best estimate of the market value of the company by assigning a price-to-sales multiple.

At this point, Dutch Bros footprint should have expanded to a majority of the states, but it will still be able to deploy the fortressing strategy as it grows.

With sales widening now at a steady 15% annually, the market will see it as a mature competitor and will hold its valuation at 3.5 times sales. That will support a long-range forecast for a stock price target of $86.12 per share, or 63% upside from today.

| Year | Revenue* | EPS | Stock Price | % Change From Current Price |

| 2025 | $1.575 | $0.50 | $62.95 | 15.19% |

| 2026 | $1.969 | $0.59 | $77.68 | 42.14% |

| 2027 | $2.363 | $0.71 | $85.48 | 56.41% |

| 2028 | $2.835 | $0.84 | $74.56 | 36.43% |

| 2029 | $3.317 | $0.98 | $76.33 | 39.67% |

| 2030 | $3.814 | $1.13 | $86.12 | 57.58% |

*Revenue in millions of dollars.

The post Dutch Bros (BROS) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..