Meta Platforms (META) Price Prediction and Forecast 2025-2030 For March 12

Shares of Meta Platforms Inc. (NASDAQ: META) lost -1.55% in morning trading on Wednesday, compounding a rough week and month that has seen the stock fall by -3.94% and -14.26%, respectively. Year-to-date, the company has eked out a meager 3.76% gain. It has been mostly downhill since hill for META since hitting its one-year high […] The post Meta Platforms (META) Price Prediction and Forecast 2025-2030 For March 12 appeared first on 24/7 Wall St..

Shares of Meta Platforms Inc. (NASDAQ: META) lost -1.55% in morning trading on Wednesday, compounding a rough week and month that has seen the stock fall by -3.94% and -14.26%, respectively. Year-to-date, the company has eked out a meager 3.76% gain.

It has been mostly downhill since hill for META since hitting its one-year high on Feb. 14, but the stock is still enjoying a gain of more than 24% over that period. As the only company in the Magnificent Seven that has yet to undergo a stock split, shares are up 1,526.37% since its IPO on May 18, 2012.

But since then, a lot has changed. For starters, on Feb. 1, 2024, the company announced — alongside authorizing a $50 billion stock buyback — that shares of META would begin paying a dividend. And while its current yield of 0.33% may not seem like much, at its current price, that equates to $0.50 per share quarterly, or $2.00 per share annualized.

META is the dominant player in the social media landscape but it is now branching out more broadly into tech, and specifically, the artificial intelligence (AI) space. It is the latter that the company is most heavily investing in now, and for that reason, it is also the primary driver of 24/7 Wall Street price predictions and forecasts for 2025-2030.

Key Points in This Article:

- “Meta AI is on track to be the most used AI assistant in the world by the end of the year,” according to CEO Mark Zuckerberg.

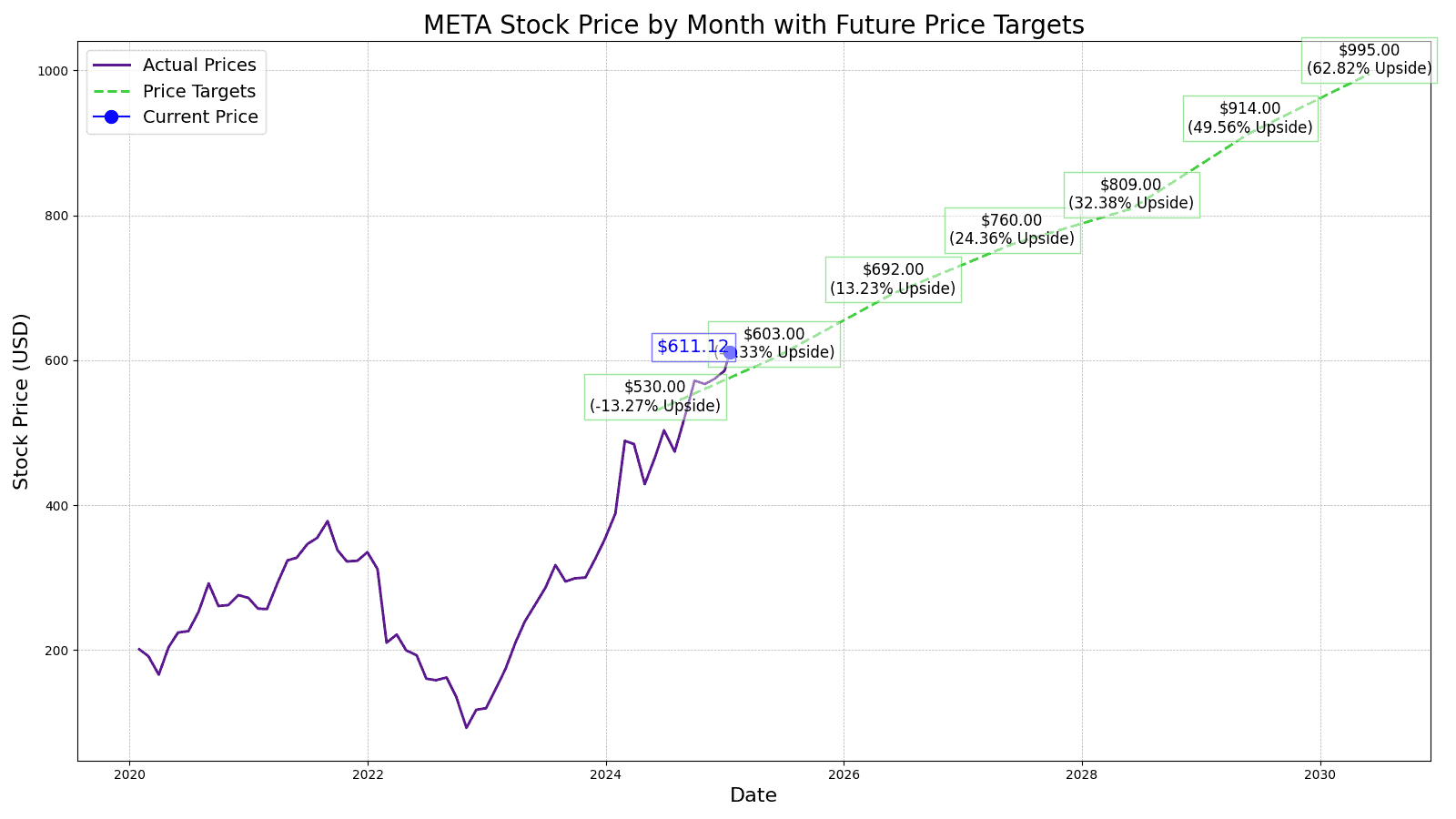

- 24/7 Wall Street projects a 62.82% upside potential for the stock through the end of the decade.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. The report includes a complete industry map of AI investments that includes many small caps.

Meta Platforms’ 10-Year Results

Here’s a table summarizing the performance in share price, revenues, and profits (net income) of META stock from 2014 to 2024:

| Share Price | Revenues* | Net Income* | |

| 2014 | $80.78 | $12.466 | $2.940 |

| 2015 | $104.66 | $17.928 | $3.688 |

| 2016 | $115.05 | $27.638 | $10.217 |

| 2017 | $176.46 | $40.653 | $15.934 |

| 2018 | $133.20 | $55.838 | $22.112 |

| 2019 | $208.10 | $70.697 | $18.485 |

| 2020 | $273.16 | $85.965 | $29.146 |

| 2021 | $336.35 | $117.929 | $39.370 |

| 2022 | $120.34 | $116.609 | $23.200 |

| 2023 | $353.96 | $134.902 | $39.098 |

| 2024 | $599.24 | $164.501 | $62.36 |

*Revenue and net income in %billions

Over the past decade, Meta Platforms’ revenue has grown 1,196.16% from $12.466 billion to over $164 billion, while its net income went from $2.940 billion to over $62.36 billion during the same period. The primary driver of that growth over the past 10 years has been ad space for the company’s social media platforms, which include Facebook, Instagram, Threads, Reel, and WhatsApp, among others.

While Meta Platforms has branched out into augmented reality and virtual reality — a business segment it refers to as Reality Labs — 99% of its revenue generation comes from its Family of Apps business segment, as of year-end 2023. But as the company looks to the second half of the decade, Zuckerberg and the company will focus on a few key focus areas that will have a large impact on Meta Platforms’ stock performance.

Key Drivers of Meta Platforms’ Stock Performance

- AI Investment: Founder and CEO, Mark Zuckerberg announced that Meta Platforms “released the first frontier-level open source AI model, we continue to see good traction with our Ray-Ban Meta AI glasses, and we’re driving good growth across our apps.” While the market for Meta’s social media advertising remains healthy and continues to drive the majority of the company’s revenue, it is focusing heavily on AI investments to expand through the end of the decade. Price-per-ad revenue saw a 10% year-over-year gain, and that success will fund its AI spending aimed at future growth. The company said shareholders should expect between $37 billion and $40 billion in capital expenditures this year that will fund a data center capable of powering its AI initiatives. That is likely to continue into next year, with CFO Susan Li stating that the META expects “significant capital expenditure growth in 2025 as we invest to support our artificial intelligence research and product development efforts.”

- Continued Renewable Energy Development: According to the company’s net zero plan, which it is aiming to achieve by 2030, “Since 2020, Meta’s global operations have been supported by 100% renewable energy. As of 2023, we have 10,000MW of contracted renewable energy across 6 countries.” As part of its net zero plan, Meta Platforms’ reliance on renewable energy will ultimately decrease the cost of its utility expenses, and ultimately, its carbon footprint through contracted and self-employed green technologies. Renewables already cost less than fossil fuel energy sources, and according to Canary Media, “By 2030, technology improvements could slash today’s prices by a quarter for wind and by half for solar.” The company has announced that its goal for its forthcoming data center is that it is 100% sustainable and net zero.

- Focusing on Growing Free Cash Flow: Zuckerberg labeled 2023 Meta Platforms’ “year of efficiency,” and their results were staggering. By year-end, the company recorded a record free cash flow of $43 billion. That is up from $21 billion in 2019, marking a nearly 105% increase in its cash position in four years. Meta’s free cash flow in 2024 stood at $52.1, another record that showed the company’s focus on its bottom line is driving decisions from the top down and has increasingly strong results.

Meta Platforms (META) Stock Price Prediction in 2025

The current consensus one-year price target for Meta Platforms is $764.61, which represents a 22.92% upside potential from today’s share price. Of all the analysts covering META stock, it receives a consensus “Strong Buy” rating with 44 of 48 analysts assigning it as a buy.

24/7 Wall Street’s forecast projects Meta Platforms’ stock price to be $603 by the end of 2025, based on the company’s ability to sustain its strong ad revenue while increasing efficiency, which in turn will drive its bottom line despite capital expenditures increasing toward its AI objectives.

Meta Platforms Price Estimates 2025-2030

| Year | Revenue | Net Income | EPS |

| 2024 | $161.579 | $54.960 | $21.18 |

| 2025 | $183.459 | $62.250 | $24.12 |

| 2026 | $205.257 | $70.680 | $27.71 |

| 2027 | $226.332 | $78.258 | $30.42 |

| 2028 | $245.319 | $85.912 | $32.38 |

| 2029 | $268.306 | $97.044 | $36.54 |

| 2030 | $274.947 | $91.227 | $39.70 |

Revenue and net income in $billions

How META’s Next 5 Years Could Play Out

META’s Price Target for 2030

META’s Price Target for 2030

By the end of the start of the next decade, we forecast that META’s stock price will reach $995.00, or 62.77% higher than it is trading for today, despite estimates that net income will pull back slightly from over $97 billion to over $91 billion. Revenue growth will continue, with an estimated 2.48% year-over-year increase from 2029.

| Year | Price Target* | % Change From Current Price* |

| 2024 | $530 | -14.12 |

| 2025 | $603 | -2.29% |

| 2026 | $692 | 12.13% |

| 2027 | $760 | 23.15% |

| 2028 | $809 | 31.09% |

| 2029 | $914 | 48.11% |

| 2030 | $995 | 61.23% |

*Revenue and net income in $billions

The post Meta Platforms (META) Price Prediction and Forecast 2025-2030 For March 12 appeared first on 24/7 Wall St..