2 Emerging Markets ETFs That Go Beyond China

Diversifying into markets outside of the U.S. can be a smart move, especially if it means side-stepping any potential U.S.-focused stock market plunges like the one we’re going through right now. Indeed, the international markets tend to follow in the footsteps of the S&P 500. At the end of the day, everything falls back to […] The post 2 Emerging Markets ETFs That Go Beyond China appeared first on 24/7 Wall St..

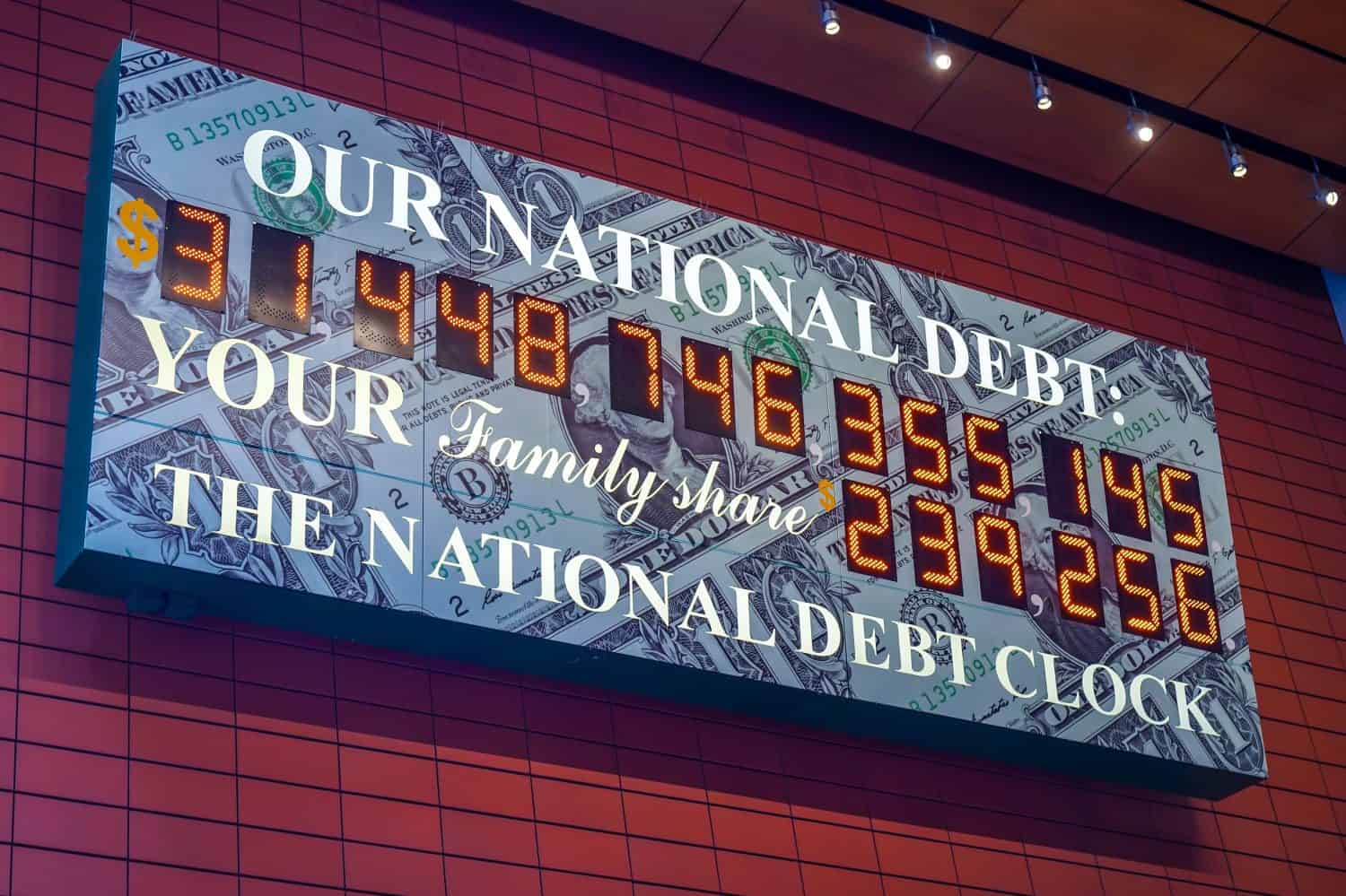

Diversifying into markets outside of the U.S. can be a smart move, especially if it means side-stepping any potential U.S.-focused stock market plunges like the one we’re going through right now. Indeed, the international markets tend to follow in the footsteps of the S&P 500. At the end of the day, everything falls back to what’s happening during to U.S. stocks, right?

A lot of the time, international markets build on action in the U.S. But not every bump and slip in the U.S. equity markets sends shockwaves across global markets. With the Vanguard Total International Stock Index Fund ETF (NASDAQ:VXUS) — which represents international stocks minus U.S. names — off less than 2% from 52-week highs, while the S&P 500 is down just shy of 8%, it’s clear that those who have diversified internationally are having an easier time riding out this latest correction.

Indeed, diversifying internationally can be tricky, given that many ex-U.S. international ETFs tend to have arbitrary concentrations to nations you may not be all too enthused to invest in. That’s why a “total” ETF solution may not be right for most.

Key Points

-

Investors looking to diversify internationally without exposure to Chinese stocks have ample options out there.

-

The EMM and EMXC are top ex-China ETFs to consider for investors seeking global growth solutions without the excessive geopolitical risk.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

China stocks have more than their fair share of risks.

Notably, many ex-U.S. ETFs have a heavy concentration in China, a market that’s been in a funk for many years due to a sluggish economy that may not be quick to bounce back. Indeed, it’s not just China’s weak economy that may cause some to pause on investing considerable sums within the region; it’s the geopolitical risk. Some pundits view such geopolitical risks as making Chinese stocks uninvestable.

Of course, not everyone shares that same sentiment. Dr. Michael Burry, the man who bet against the housing market in the face of the Great Financial Crisis (also featured in the film The Big Short), is a risk-taker who’s clearly not afraid of the added risks in China, with his recent big bets in Chinese internet giants.

While the volatile ride may be worth getting on for a shot at better value, it’s hard to know what to make of the geopolitical risks surrounding Chinese stocks. Also, delisting threats and growing tensions amid tariffs could add to the list of worries about investing within the region, even at a time of perceived undervaluation.

If you’ve lost money in them before, you may be looking to go out of your way to limit exposure to the nation. Fortunately, there are ETFs for that. Just as there are ex-U.S. ETFs for American investors looking to broaden their horizons, there are ex-China ETFs.

In this piece, we’ll look at two emerging market ETFs for those who already have enough exposure to Chinese stocks or are seeking to steer clear due to the added risks of investing in the names.

Global X Emerging Markets ex-China ETF (EMM)

The Global X Emerging Markets ex-China ETF (NYSEARCA:EMM) is a fantastic option for gaining exposure to emerging markets minus the Chinese stocks. Though it’s a great mix of international names with unique exposure across a wide range of names, do know that you’ll pay a higher price (0.75% total expense ratio) compared to many other global ETFs that don’t exclude Chinese stocks.

The largest holding is Taiwan Semiconductor (NYSE:TSM), a name that still has some geopolitical risks in the event that China goes after Taiwan. Though unlikely, I do think such risks should be considered, especially since the name comprises more than 13% of the ETF at the time of writing. In any case, I consider the ETF to be “growthier” than other international ETFs, weighed down by the recent underperformance of various Chinese stocks.

iShares MSCI Emerging Markets ex China ETF (EMXC)

The iShares MSCI Emerging Markets ex-China ETF (NASDAQ:EMXC) is another option for investors looking to diversify internationally without adding considerable geopolitical risk to their portfolios.

The EMXC has a three (out of five) star rating from Morningstar, with a much lower expense ratio of 0.25%. Like with EMM, Taiwan Semi is the largest holding (13% weighting). With plenty of overlap with the EMM and a lower expense ratio, I prefer the EMXC slightly over the EMM. Over the past year, the EMXC has been flat versus the EMM, which is down just north of 2%.

The post 2 Emerging Markets ETFs That Go Beyond China appeared first on 24/7 Wall St..