Workers May Be Underestimating Social Security: 62% of Retirees Depend Heavily on It

For many Americans who wish to preserve their lifestyle in retirement, Social Security probably won’t be nearly enough to cut it. Undoubtedly, your 401(k) and brokerage account will need to do some of the heavy lifting if you’re to sustain a retirement that’s comfortable and not leaning too heavily on one single pillar of retirement. […] The post Workers May Be Underestimating Social Security: 62% of Retirees Depend Heavily on It appeared first on 24/7 Wall St..

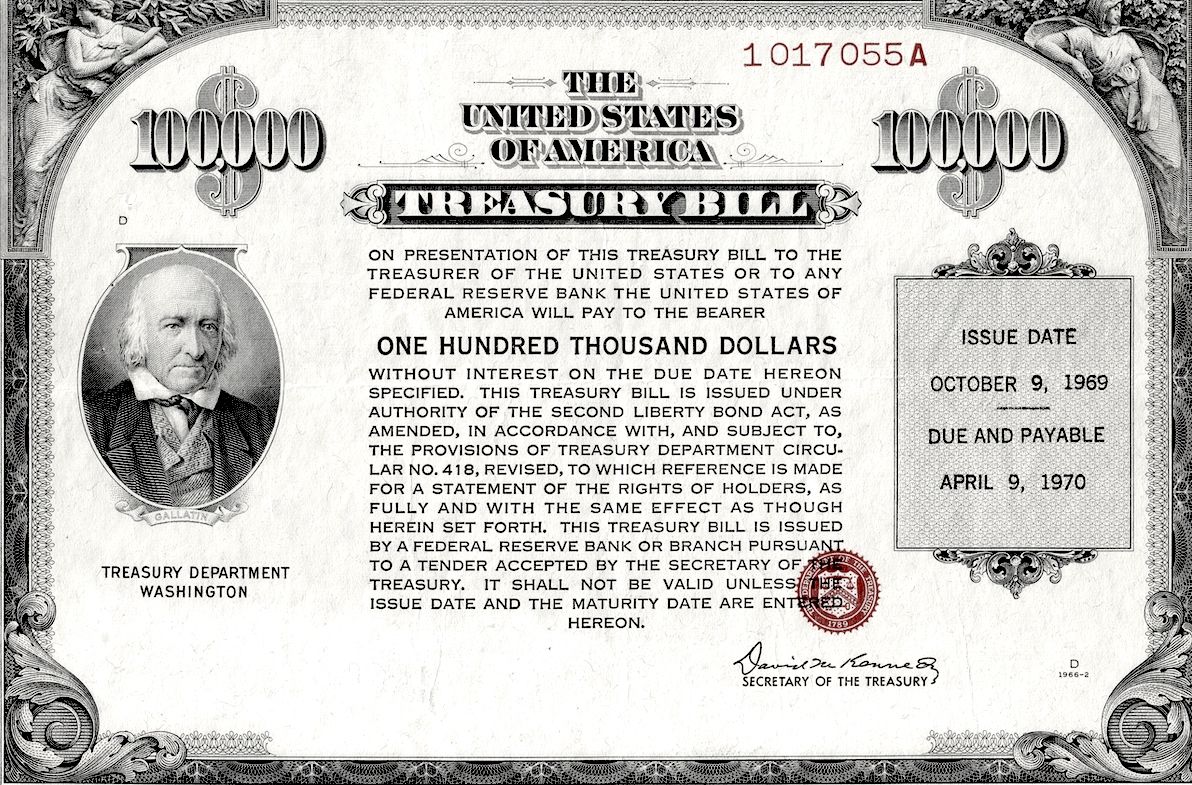

For many Americans who wish to preserve their lifestyle in retirement, Social Security probably won’t be nearly enough to cut it. Undoubtedly, your 401(k) and brokerage account will need to do some of the heavy lifting if you’re to sustain a retirement that’s comfortable and not leaning too heavily on one single pillar of retirement.

According to a 2024 retirement confidence survey conducted by the EBRI (Employee Benefit Research Institute), around 62% of retirees view Social Security as a significant source of income. Undoubtedly, it’s not too far-fetched to think that the number of retirees who lean more heavily on Social Security could rise in the coming years if inflation weighs heavily and stock market returns come up well short of expectations. Indeed, the stock market has had a rough start to the year, thanks in part to Trump tariff threats. And while it’s hard to say for sure how stocks will do under the current administration, it’s important to have a set of realistic expectations.

Even if market returns are modest (let’s say 6-8% per year for the next decade), reaching for more risk for higher returns isn’t the answer for many prospective retirees who should be derisking (whether it be shifting gears to achieve a 60/40 stock-to-bond allocation or one that’s closer to a 40/60 allocation).

Key Points

-

Depending too much on Social Security may not be the best way to go for those looking to retire comfortably.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. If you’ve saved and built a substantial nest egg for you and your family; get started by clicking here.(Sponsor)

Younger workers seem to be heavily underestimating Social Security.

For younger Americans (think Millennials and Gen Z) who aren’t expecting all too much from Social Security, time is on their side as they take control of their retirement portfolios. With index fund and ETF (exchange-traded fund) total expense ratios continuing to come down (Vanguard recently slashed their fees again), it’s never been this affordable and convenient to invest in the broad U.S. stock market or just about any global market for that matter.

Of course, pension benefits seem to be a thing of the past. But for younger investors, there’s more than enough time to ride out any prolonged period of stagflation or mild stock returns. Though some may choose to go down the path of cryptocurrencies — which stands out as far too volatile to comprise too large a portion of an investment portfolio, in my humble opinion — most young investors playing the long-term game on retirement, I believe, are on the right track, with stock ETFs and surprisingly conservative strategies given their higher ability to take risks compared to their Boomer parents.

Though some mistakes (think active trading) are sure to be made along the way, the important thing is younger investors are on track to lean less heavily on Social Security, with some overachievers within the generation pursuing movements such as FIRE (Financial Independence, Early Retirement), which implies no reliance at all on Social Security.

The bottom line

Not everyone is fortunate enough to have a workplace retirement savings plan that can supplement Social Security. These days, prospective retirees may need to save up a fatter personal retirement savings account to make up for what Social Security can’t cover when it’s time to finally leave the workforce for good.

In any case, the key takeaway is to shoot for a personal retirement investment portfolio that can help supplement your income once you turn age-old enough to start receiving Social Security benefits. Indeed, if you’re closing in on your expected retirement date, it may prove difficult to make up for lost time.

Of course, Millennials and Boomers may have differing viewpoints on financial independence and the firepower that Social Security will have come retirement. As more Boomers look to lean more heavily on Social Security, reportedly, almost half of Millennials are inclined to agree they probably “won’t get a dime” of said benefits when it’s their time. Perhaps expecting less (or nothing) and planning for the worst is the best way to achieve a better outcome in retirement.

The post Workers May Be Underestimating Social Security: 62% of Retirees Depend Heavily on It appeared first on 24/7 Wall St..