The Average American Doesn’t Understand How the National Debt Works

While most Americans know about the national debt, their level of understanding is remedial at best. Understanding there is a national debt and learning about how it all works are two very different things, and it’s fair to say the average American doesn’t know a lot. To be fair, it’s okay if most people don’t […] The post The Average American Doesn’t Understand How the National Debt Works appeared first on 24/7 Wall St..

While most Americans know about the national debt, their level of understanding is remedial at best. Understanding there is a national debt and learning about how it all works are two very different things, and it’s fair to say the average American doesn’t know a lot.

The US national debt is not a doomsday scenario as many people might mistakenly believe.

There is little reason to fear that the US will go bankrupt anytime soon.

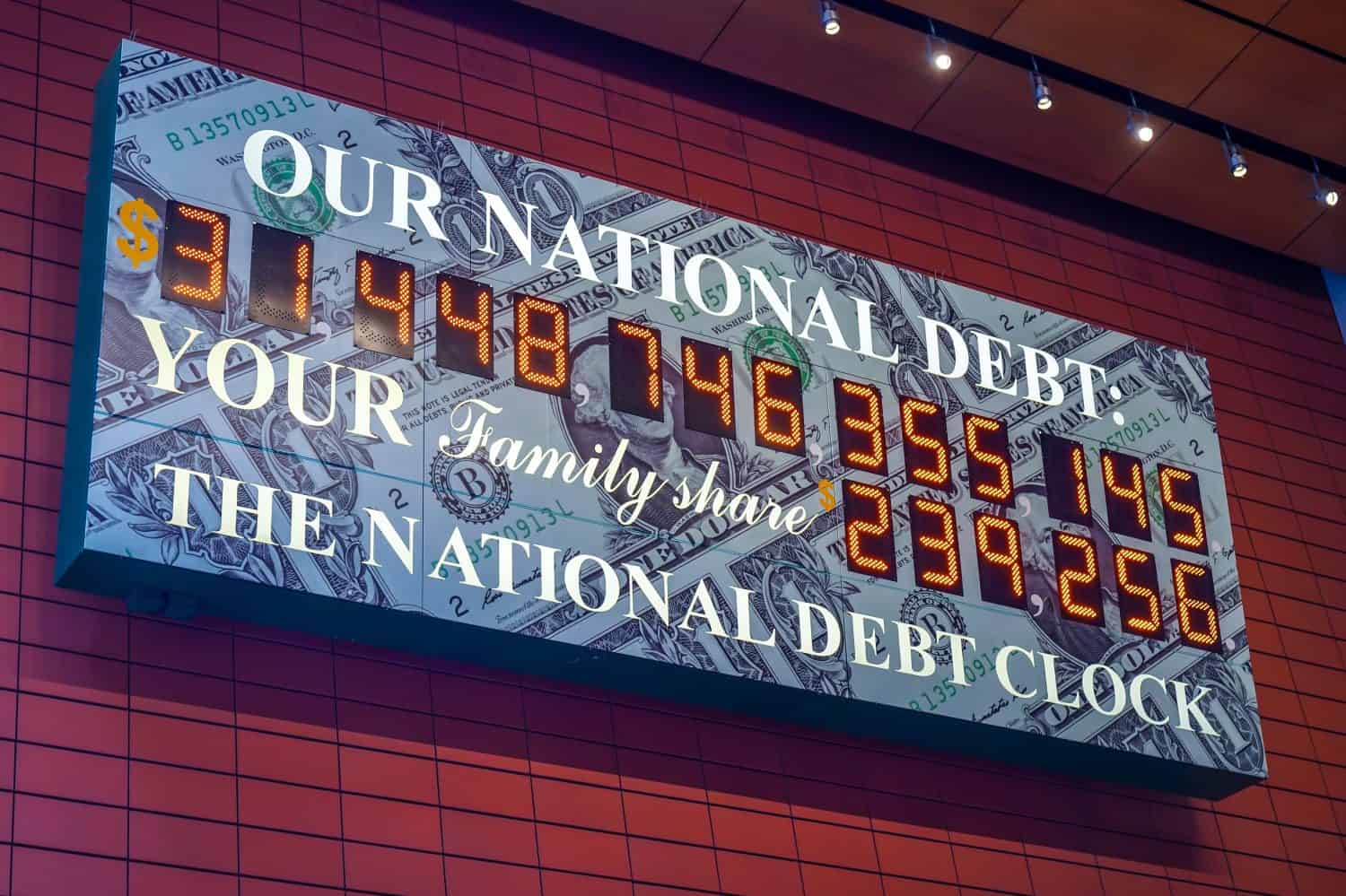

There is no question that the average American is more fearful of the national debt clock than they should be.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Key Points

To be fair, it’s okay if most people don’t understand the national debt, as it won’t be something you wouldn’t think about daily. However, understanding the national debt and why it matters is important, as the repercussions of the debt ceiling could affect all Americans.

7. A Debt Crisis Is Happening Soon

If you jump on any financial news site, there is a good chance you’ll see a story about how the US is near a debt crisis. Fortunately, as long as the federal government can continue borrowing money it controls, we’ll continue to be in good shape. A good example is Greece, which was borrowing against money it was unable to print, so it caused a major European crisis.

There Are Challenges Ahead

While the US isn’t likely to be Greece anytime soon, the average American must understand that the national debt isn’t all sunshine and rainbows. If the US debt were to grow faster than our GDP, interest rates could spiral out of control, which again, is very bad.

6. Reducing The Debt Is Good

There is a misunderstood belief by the average American that if we reduced the national debt, things would be going a lot better in this country. However, the truth is somewhere in the middle. If the US government tried to reduce our debt too fast, it would end up doing more harm than good and likely end up causing a recession that would harm average Americans.

It’s A Balancing Act

One reality around the national debt isn’t to try to reduce it all to zero but to ensure it remains manageable. If the US debt were too low, it might signal to the country and other nations that we are underspending, which could cause a lack of confidence in the US economy and, again, do more harm than good.

5. Too Much Wasteful Spending?

Something many Americans believe is true is that the government spends too much on waste. While there is some definite truth to this, the reality is that a lot of the national debt comes from things like the War on Terror when Iraq and Afghanistan added up to $3 trillion in national debt. The same goes for COVID-19, which added as much as $5 trillion to the national debt.

Telling The Whole Story

As wasteful spending is always a hot topic politically, the average American must understand that discretionary spending, which funds many unique programs, only accounts for less than one percent of the American budget. On the other hand, defense, Social Security, Medicare, and other staple programs of the US economy account for more than 60% of spending.

4. Future Generations Will be Responsible

Another big battle cry from politicians is how we will leave all this debt to our children to pay off, but this is another scare tactic. As a reminder, the national debt doesn’t have a due date, so unlike a credit card bill, future generations don’t have to pay off the national debt by a specific date. Future generations will instead work with the debt as we do now, through new borrowing.

There Will Be Some Burden

While there shouldn’t be big fears over future generations and the national debt, there is a genuine concern over interest rates growing too fast. When interest rates rise, less money goes to public services like roads and other infrastructure. In other words, the biggest concern is that future generations won’t spend responsibly, not that they will be responsible for the debt.

3. America Will Go Bankrupt

Anytime anyone says that America is about to go bankrupt because of the national debt, they are just playing on fear. The reality is that America won’t go bankrupt because its outstanding debt is owed to the US government and foreign nations. The bigger concern is trying to print too much money to pay off the debt, which causes inflation and lowers buying power.

The Real Risks

Instead of worrying about America going bankrupt, what should be understood about the national debt is that the US has a $28 trillion economy. The bigger concern would be if America’s economy stopped growing or interest rates were rising unchecked, which would be a concern, but there is no doomsday scenario about to happen.

2. Foreign Governments Only

One thing politicians like to scare Americans with is that foreign countries mostly own the national debt. Not only is this not true, but around 30% of the national debt is owned by foreign nations like Japan and China. Of the current national debt, Japan is owed the most with $1.06 trillion, and China is owed approximately $759 billion.

Why This Matters

The idea that foreign powers own some American debt is more of a sign that US debt is a safe asset and not an attempt to control America’s economy. In other words, this isn’t the political disaster some politicians might have you believe. Instead, global trust in the US dollar ensures that interest rates remain low.

1. This Isn’t Household Debt

It’s easy to think of the federal government paying for everything, like a family using a checkbook to pay all its bills. Unfortunately, this is an oversimplification of how the federal government operates. Because the US government can issue its currency in the dollar, it has far more flexibility than a household. In other words, a homeowner who doesn’t pay a mortgage can face repossession and bankruptcy, but the federal government has far more tools at its disposal.

Can’t Just Pay It Off

One of the most important things to remember about government debt is that you can’t just pay it off. The national debt isn’t like a credit card bill where you can get in serious trouble. No clock says the government must pay off the debt on or before a specific date. Unlike a person with a finite lifespan, the federal government has all the time to issue a repayment.

The post The Average American Doesn’t Understand How the National Debt Works appeared first on 24/7 Wall St..