Why This 14%-Yielding Dividend Stock May Perform Well in a Recession

There are warning signs of a possible recession as the U.S. federal government looks to slash jobs, while tariffs could touch off a trade war. The Atlanta Federal Reserve's estimate for real gross domestic product (GDP) growth for the first quarter has gone from predicting growth of more than 2% in late February to a 2.4% decline as of its last estimate on March 6. While the specter of a recession is generally not good for the market, there is one high-yielding dividend stock that could perform well in this environment: AGNC Investment (NASDAQ: AGNC).AGNC is a mortgage real estate investment trust (REIT), which is an investment company that owns a portfolio of mortgage-backed securities (MBS). It generates income through the spread between the yield of the mortgages it holds in its portfolio and its funding costs (the short-term debt it takes on to buy the MBS). For example, if funding costs were 4% and it bought a mortgage-backed security with a 7% yield, it would earn a 3% spread on its investment.Continue reading

There are warning signs of a possible recession as the U.S. federal government looks to slash jobs, while tariffs could touch off a trade war. The Atlanta Federal Reserve's estimate for real gross domestic product (GDP) growth for the first quarter has gone from predicting growth of more than 2% in late February to a 2.4% decline as of its last estimate on March 6.

While the specter of a recession is generally not good for the market, there is one high-yielding dividend stock that could perform well in this environment: AGNC Investment (NASDAQ: AGNC).

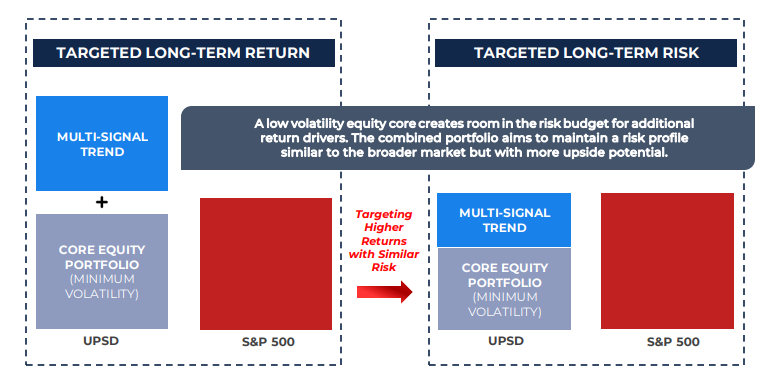

AGNC is a mortgage real estate investment trust (REIT), which is an investment company that owns a portfolio of mortgage-backed securities (MBS). It generates income through the spread between the yield of the mortgages it holds in its portfolio and its funding costs (the short-term debt it takes on to buy the MBS). For example, if funding costs were 4% and it bought a mortgage-backed security with a 7% yield, it would earn a 3% spread on its investment.