Stock Market Today: Stocks lower following debt downgrade

How will investors react to Moody's downgrade of US debt this week?

Updated at 10:25 EDT

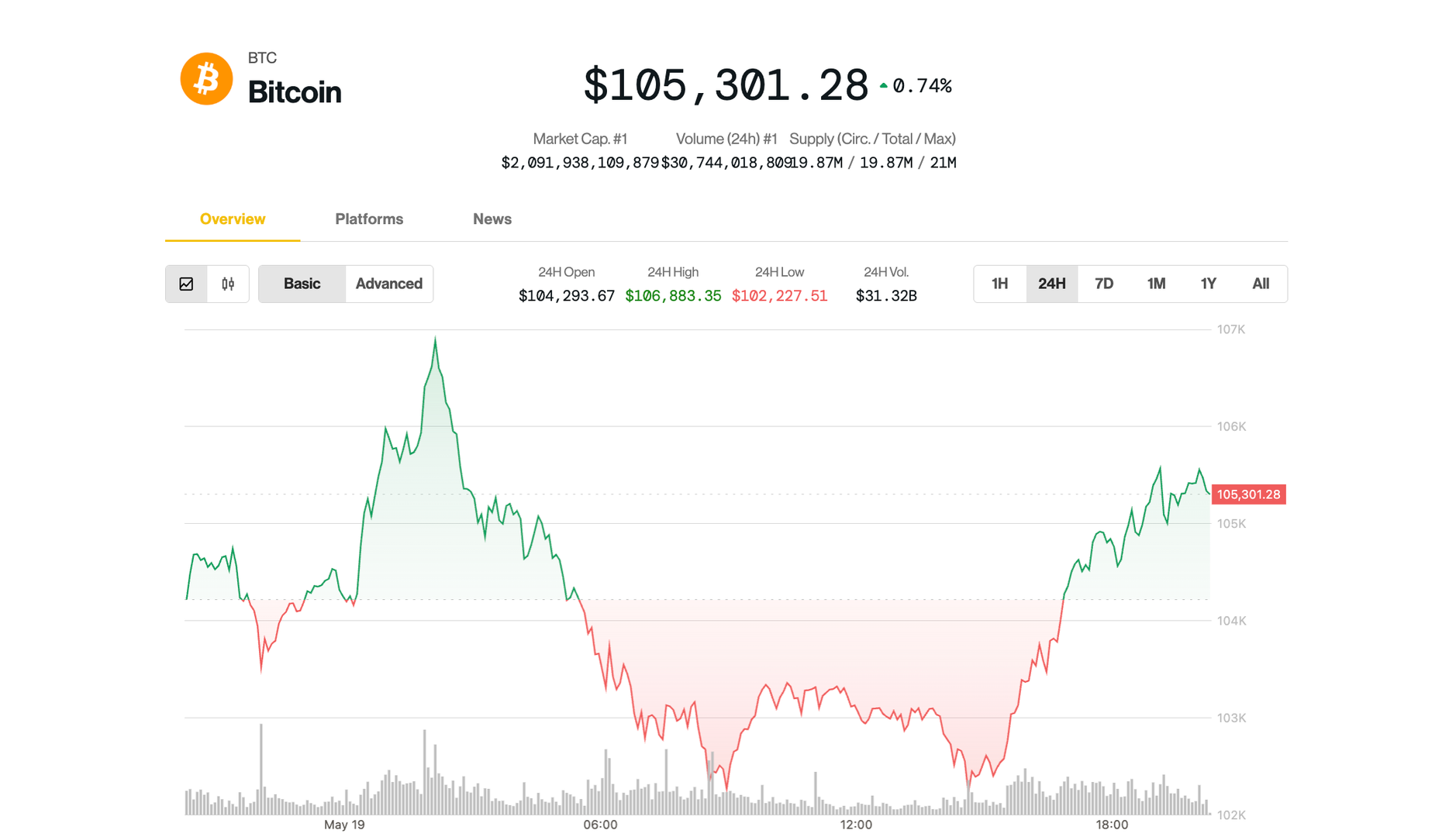

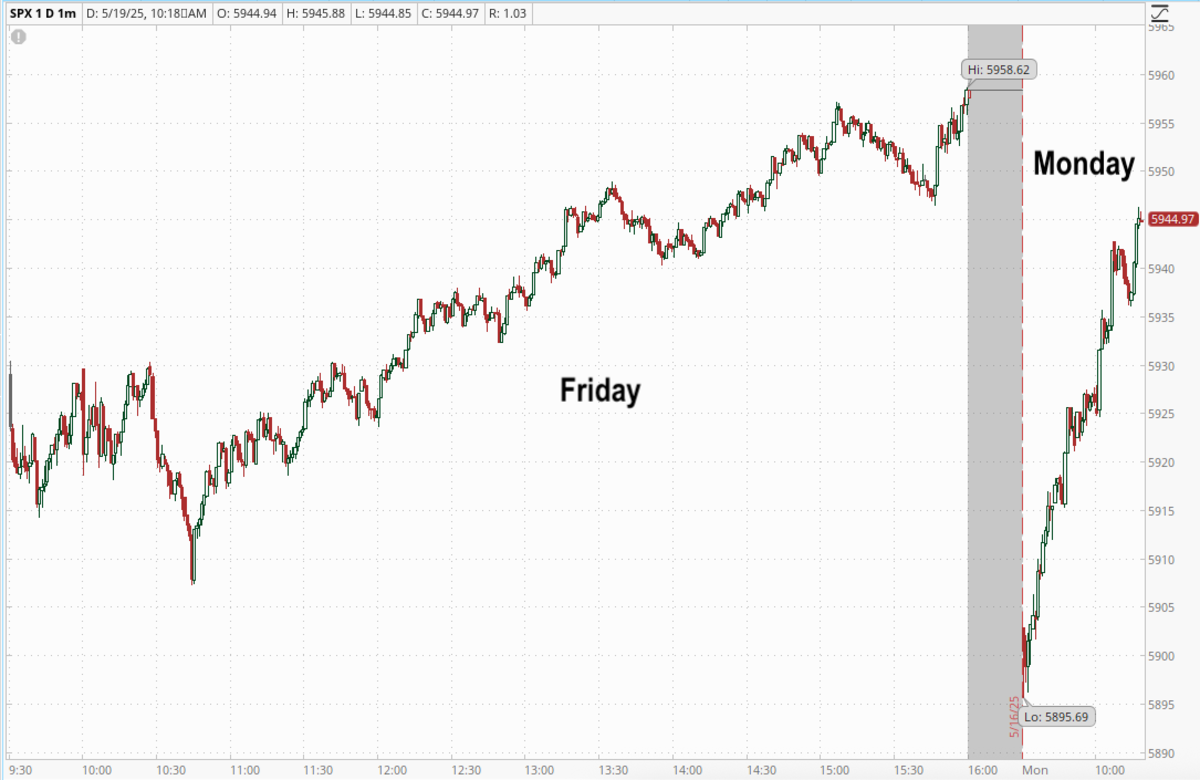

Dip buyers showed up following the market's 1% lower open, driving the S&P 500 within range of Friday's close.

S&P 500 breadth remains negative with 7 losers for every 3 gainers. The weakest stocks in the S&P 500 include megacap names Tesla (TSLA) , down 3%, Apple (AAPL) , down 2%, and FedEx (FDX) , down 2%. Megacap winners include United Health (UNH) , up 3%, and Gilead Sciences (GILD) , up 1.7%.

Bonds remain lower but are also recouping. The dollar is off its lows, at 100.35, while gold futures are higher by $50.80.

Meanwhile, Bessent has said consumers will bear some of the brunt of US tariffs on China. Read the following article:

Related: Secretary Bessent sends message on Walmart price increases due to tariffs

Stock Market Today

Stocks are looking lower today.

- S&P futures are off 61

- Nasdaq futures off 302

Treasury bonds are looking lower, too, on the heels of the U.S. credit rating downgrade from Moody's on Friday.

What's looking up? Gold and the VIX, the CBOE's benchmark of market volatility based on the S&P 500 Index.

Over on TheStreet Pro, James "Rev Shark" DePorre discusses the debt downgrade in Will a Surprise Downgrade of the U.S. Credit Rating Derail the Stock Market Rally?

He notes that bond prices began to sell off immediately, and bond yields, which move inversely to prices, for the 30-year US Treasury moved over 5% for the first time since November 2023.

Treasury Secretary Scott Bessent dismisses the downgrade, but many strategists believe it will hasten the rotation out of US assets. As a result, the Dollar Index is down 0.835 to 100.268.

Related: Secretary Bessent sends message on Walmart price increases due to tariffs

Why did Moody's downgrade US debt? Failure to control federal deficits and a pending tax bill that could make things worse.

US debt was last downgraded in 2011 and Helene Meisler thought it would be helpful to look at that period to see if it could provide a roadmap for what we might expect in the coming weeks.

In What Does the US Debt Downgrade Mean for Stocks? Let's Take a Trip Back to 2011, she looks at stock and bond prices both before and after the debt downgrade and determines that 2011 will not likely be a helpful road map. Despite what many are saying, the market today is just too different from what it was doing 14 years ago.

Related: A critical industry is slamming the economy

Here on TheStreet, Charley Blaine covered Walmart in Tariffs, surprise downgrade will weigh on market, and finds that Walmart is warning of price increases because of the tariffs.

Charley says that the world's largest retailer sources much of its nongrocery merchandise from China, and those products still may be subject to 30% tariffs.

Although President Donald Trump wants the retailer to eat the tariffs and not pass them along to consumers, Charley notes that the tariff bill could easily be larger than Walmart's operating profit. If that's the case, the company will have no choice but to pass the added expenses on to consumers.