Analysts reset Alphabet stock price target after Apple's warning

Here’s what could be next for the Google parent.

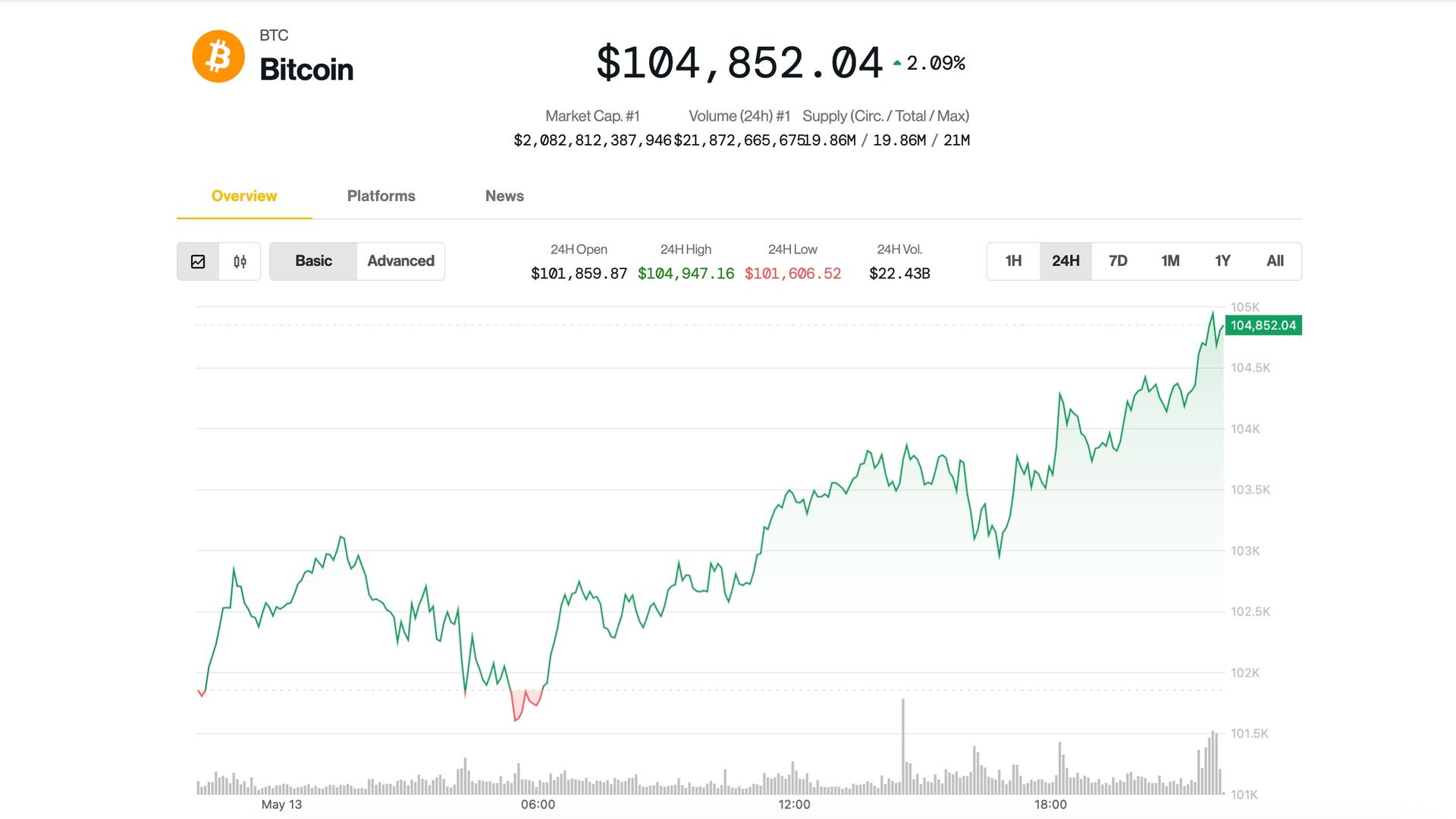

For the first time ever, people are searching less on search engines, and Apple (AAPL) says artificial intelligence is the reason.

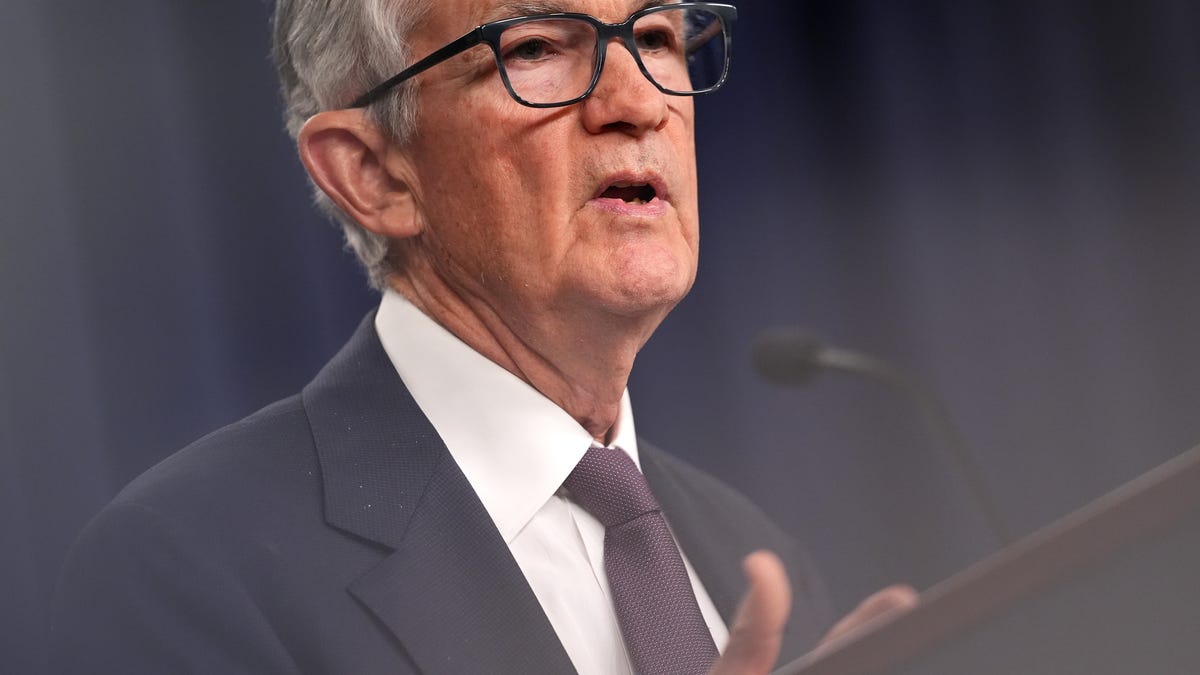

Those comments were made on May 7 by Apple’s senior vice president of services, Eddy Cue, during his testimony in the U.S. Justice Department’s lawsuit against Alphabet. Last year, a U.S. District Court judge ruled that Google has illegally held a monopoly in the online search market, including paying Apple to make its Chrome the default search engine.

Cue’s comments included that searches on Safari dipped for the first time last month, which he attributed to people using AI.

Cue also said he believes that AI search providers, including OpenAI, Perplexity AI Inc., and Anthropic PBC, will eventually replace standard search engines such as Alphabet’s Google. He added that he believes Apple will bring those options to Safari in the future.

Shares of Alphabet (GOOGL) dipped on the next trading day following the comments.

Chris Versace, a Wall Street veteran who runs TheStreet Pro portfolio, said he's not surprised about Apple's comments about AI replacing search engines, given the number of weekly ChatGPT users.

ChatGPT now has 400 million weekly users, and it plans to hit 1 billion users by the end of 2025, according to Brad Lightcap, OpenAI's chief operating officer.

Still, Versace warned against overlooking Google.

"While the AI landscape will become more competitive as new features are introduced over time, it would be a mistake to rule Google out," Versace wrote.

Investors expect Google to bring more

Google is pushing ahead with its AI strategy, aiming to integrate AI across its key platforms like Search, Shopping, and YouTube.

As of late March, Gemini, Google's generative AI chatbot, logged 350 million monthly active users and 35 million daily active users, according to a slide displayed by Google attorneys last week.

Related: Bank of America gives eye-popping Nvidia stock forecast amid tariffs

"Considering that we are still in a nervous market where folks sometimes react too quickly to headlines, we’ll look to see what Google has to say at its upcoming Google I/O event." The event will be held on May 20 and 21.

At last year’s developer conference, Google unveiled several updates to Gemini and its search products. Versace said he expects similar announcements later this month.

Versace said Cue’s comments raised two key questions: Will Apple build an AI-powered search engine into Safari? And could Google’s Gemini be one of the models it uses?

He believes Apple will eventually take that step as part of its broader AI strategy, though the timing remains uncertain. That’s one reason to watch closely when Apple’s 2025 Worldwide Developers Conference begins on June 9.

As for Gemini, Versace noted that Alphabet CEO Sundar Pichai has confirmed the company is close to striking a deal to bring Gemini to the iPhone. "Another reason we will be tuning into 2025 WWDC," Versace said.

Despite intensifying competition in artificial intelligence, Alphabet’s core search and advertising businesses continue to post strong results.

In April, the company reported first-quarter revenue of $90.23 billion, beating expectations of $89.12 billion, while earnings per share came in at $2.81 versus $2.01 expected.

Morgan Stanley remains bullish on Alphabet shares

Morgan Stanley analyst Brian Nowak said Alphabet shares are now trading at about 15 times the firm's FY26 $10 EPS estimate, which is what he calls "a trough multiple and in our view tactically a strong buying opportunity."

Related: Warren Buffett sends strong message on stock market drop

Nowak highlighted three key points. First, Morgan Stanley’s survey data shows no sign that commercial activity is shifting away from Google. Second, he believes that potential AI competitors like ChatGPT, Meta AI (META) , and Perplexity still lack the scale and product strength to meaningfully pull search behavior away from Google.

Third, he noted that Google’s recent slowdown in paid clicks may be tied to its rollout of AI-powered features like Overviews, AI Mode, and Gemini. These updates, including more personalized shopping links, could improve conversion rates by streamlining the commercial funnel and boosting ad relevance.

More Experts

- Treasury Secretary delivers optimistic message on trade war progress

- Shark Tank's O'Leary sends strong message on economy

- Buffett's Berkshire has crucial advice for first-time homebuyers

The firm maintains an overweight rating on Alphabet stock and a price target of $185.

Alphabet closed at $158.46 on May 12. The stock is down 16% year-to-date.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast