4 Strong Buy Bargain Energy Stocks With Ultra-High-Yield Dividends From 7% to Over 20%

These four energy stocks have been sold off for various reasons. They offer massive dividends and solid entry points, and they look like incredible values now. The post 4 Strong Buy Bargain Energy Stocks With Ultra-High-Yield Dividends From 7% to Over 20% appeared first on 24/7 Wall St..

Investors love dividend stocks, especially those with ultra-high yields, because they offer a significant income stream and have substantial total return potential. Total return includes interest, capital gains, dividends, and distributions realized over time. In other words, the total return on an investment or a portfolio consists of income and stock appreciation. Let’s take a closer look at the concept of total return. If you purchase a stock at $20 that pays a 3% dividend ($0.60 per share) and the price rises to $22 in a year, your total return is ($22 + $0.60 – $20) / $20 = 13%. This combines the price appreciation and the dividend received.

24/7 Wall St. Key Points:

-

Benchmark oil pricing has fallen to the lowest level since 2021.

-

Oil drillers are starting to back off as the spot price is falling below breakeven levels.

-

Long-term growth and income investors can snap up bargains with huge dividends.

-

Do you have an energy allocation in your portfolio? It makes sense to sit down with a financial advisor near you for a review to determine the best course of action. rget=”_blank” rel=”noopener”>Click here to get started today. (Sponsored)

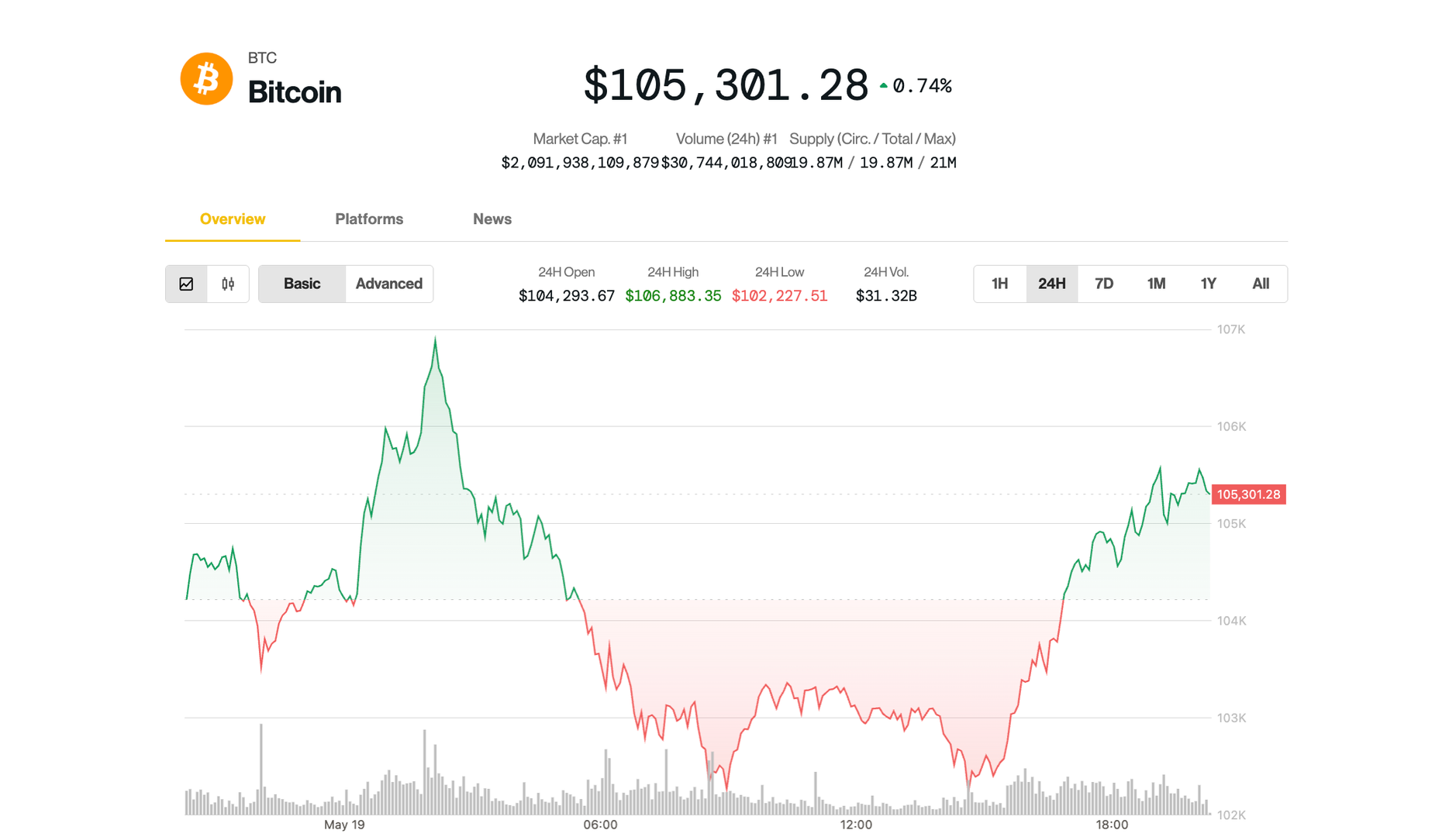

The energy sector in 2025 is experiencing a period of volatility and transition, influenced by fluctuating commodity prices, shifting demand patterns, and evolving geopolitical dynamics. Declining oil prices have been the big story so far in 2025. Crude oil prices have fallen to their lowest levels since 2021. West Texas Intermediate (WTI) dipped below $60 per barrel at one point. Some in the industry attribute this decline to concerns over a potential recession and reduced global demand.

While some of the integrated super majors have posted solid results so far, it remains uncertain how the sector will perform in the second half of 2025. We screened our 24/7 Wall St. energy research database, looking for quality companies that have been sold off for various reasons, offering massive dividends and solid entry points. Four look like incredible values now, and all are rated Buy at the top firms we cover on Wall Street.

Why do we cover ultra-high-yield energy stocks?

While not suited for everyone, those trying to build strong passive income streams can do exceptionally well with some of these top companies in their portfolios. Paired with more conservative blue-chip dividend giants, investors can employ a barbell approach to generate substantial passive income streams.

Energy Transfer

Energy Transfer L.P. (NYSE: ET) is one of North America’s largest and most diversified midstream energy companies. This top master limited partnership is a safe option for investors seeking energy exposure and income, as the company pays a substantial distribution. Energy Transfer owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with a strategic footprint in all of the major domestic production basins.

The company is a publicly traded limited partnership with core operations that include:

- Complementary natural gas midstream, intrastate, and interstate transportation and storage assets

- Crude oil, natural gas liquids (NGL), and refined product transportation and terminalling assets

- NGL fractionation

- Various acquisition and marketing assets.

Following the acquisition of Enable Partners in December 2021, Energy Transfer owns and operates over 114,000 miles of pipelines and related assets in 41 states, spanning all major U.S. producing regions and markets. This further solidifies its leadership position in the midstream sector.

Through its ownership of Energy Transfer Operating, formerly known as Energy Transfer Partners, the company also owns Lake Charles LNG Company, the general partner interests, the incentive distribution rights, and 28.5 million standard units of Sunoco L.P. (NYSE: SUN), and the public partner interests and 39.7 million standard units of USA Compression Partners L.P. (NYSE: USAC).

Morgan Stanley has an Overweight rating, accompanied by a $26 target price.

Mach Natural Resources

Mach Natural Resources L.P. (NYSE: MNR) is an independent upstream oil and gas company that acquires, develops, and produces oil, natural gas, and NGL.

The company is focused on the acquisition, development, and production of oil, natural gas, and NGL reserves in the Anadarko Basin region, which spans western Oklahoma, southern Kansas, and the panhandle of Texas.

Mach Natural Resources assets are located throughout western Oklahoma, southern Kansas, and the panhandle of Texas and consist of approximately 5,000 gross operated proved developed producing wells.

Additionally, it owns a portfolio of midstream assets that support its leases, including ownership in four processing plants with a combined processing capacity of 353 million cubic feet per day, as well as 1,480 miles of gas-gathering pipelines. It also owns water infrastructure consisting of 880 miles of gathering pipeline and 88 disposal wells.

Despite missing Wall Street estimates, the company announced a massive $0.79 distribution for the quarter and reaffirmed its earnings outlook for the year. The shares will go ex-dividend on May 22nd, so buyers early this week will receive the payout. Investors should note that this quarter’s distribution is way above recent quarters. It could be lower over the rest of the year and beyond

Stifel has a Buy rating with a target price of $23.

MPLX

MPLX LP (NYSE: MPLX) is a diversified, large-cap master limited partnership formed by Marathon Petroleum Corp. (NYSE: MPC). This is one of the top holdings in the Alerian MLP Energy exchange-traded fund, and it pays a healthy dividend. MPLX is primarily engaged in transporting crude oil and refined products, with termini in the U.S. Midwest and Gulf Coast regions, as well as natural gas gathering and processing in the Northeast, following its acquisition of MarkWest Energy in 2015.

The company’s assets include:

- Network of crude oil and refined product pipelines

- Inland marine business

- Light-product terminals

- Storage caverns

- Refinery tanks

- Docks

- Loading racks and associated piping

- Crude and light-product marine terminals

MPLX also owns:

- Crude oil and natural gas gathering systems

- Pipelines, natural gas, and NGL processing and fractionation facilities in key U.S. supply basins

Barclays has a $52 target to accompany its Overweight rating.

TXO Partners

With a massive dividend and trading near a 52-week low, TXO Partners L.P. (NYSE: TXO) is a master limited partnership that focuses on the acquisition, development, optimization, and exploitation of conventional oil, natural gas, and natural gas liquids (NGL) reserves in North America.

The company’s acreage positions are concentrated in three main areas:

- Permian Basin of West Texas and New Mexico

- San Juan Basin of New Mexico and Colorado

- Williston Basin of Montana and North Dakota

Its assets consist of approximately 1,117,628 gross (549,229 net) leasehold and mineral acres located primarily in the Permian Basin, San Juan Basin, and Williston Basin. The assets include a 50% interest in Cross Timbers Energy.

As an operator, it designs and manages the development, recompletion, or workover of all the wells it operates, and supervises operation and maintenance activities on a day-to-day basis. The Company markets the majority of the natural gas, NGL, crude oil, and condensate production from the properties on which it operates.

Stifel has a Buy rating with a $20 target price.

4 Strong-Buy High-Yield Dividend Stocks Under $20 to Buy Hand-Over-Fist Now

The post 4 Strong Buy Bargain Energy Stocks With Ultra-High-Yield Dividends From 7% to Over 20% appeared first on 24/7 Wall St..