Is Aiming for $10M in Savings Enough for Early Retirement?

The pursuit of $10 million for early retirement is a popular goal in the Fat FIRE community. It is often viewed as a benchmark for true financial independence as it can provide a significant level of financial security and lifestyle flexibility. Aiming to go beyond this financial target, however, raises questions about whether the higher […] The post Is Aiming for $10M in Savings Enough for Early Retirement? appeared first on 24/7 Wall St..

The pursuit of $10 million for early retirement is a popular goal in the Fat FIRE community. It is often viewed as a benchmark for true financial independence as it can provide a significant level of financial security and lifestyle flexibility. Aiming to go beyond this financial target, however, raises questions about whether the higher sum ensures financial security at the expense of lifetime happiness.

A thought-provoking post on the r/FatFire subreddit argues that $10 million places individuals in the top 1% of wealth in most areas, and is sufficient for a comfortable retirement. Beyond this, accumulating more wealth may reduce lifetime happiness by prioritizing work over personal fulfillment, unless work itself is a source of joy.

The poster emphasizes that the amount should ultimately be adjusted for lifestyle and location, and questions why some continue working past this milestone. For those driven by passion, wealth accumulation aligns with happiness, but for others, it may detract from life’s true priorities.

A comfortable, luxurious early retirement is the goal of the Fat FIRE community, with $10 million in savings seen as a base target to shoot for.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

24/7 Wall St. Insights:

How Much Is Too Much?

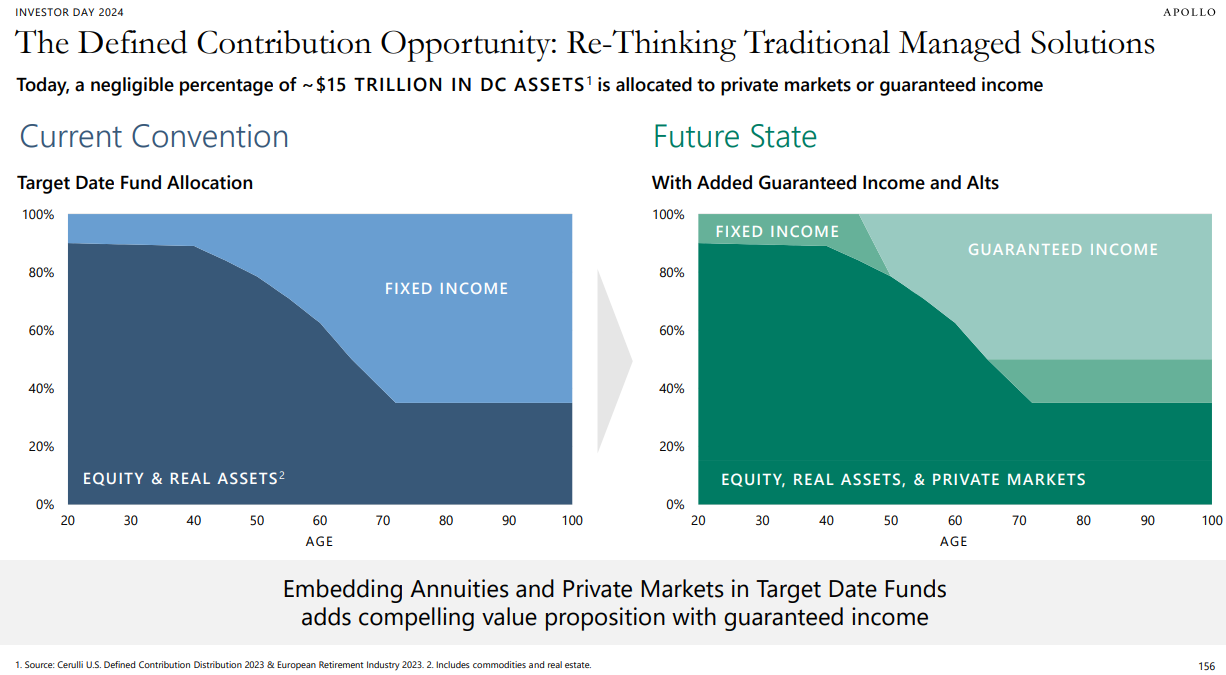

Determining if $10 million suffices hinges on individual circumstances. Using a 4% withdrawal rate, which is generally considered a safe amount to preserve capital through retirement, generates $400,000 of income annually, ample for luxurious living, including travel and healthcare.

In high-cost urban areas, this also covers private education and upscale homes, while in rural regions, $3 million to $5 million might achieve similar comfort. Lifestyle choices — such as frequent travel or philanthropy — will also impact the target.

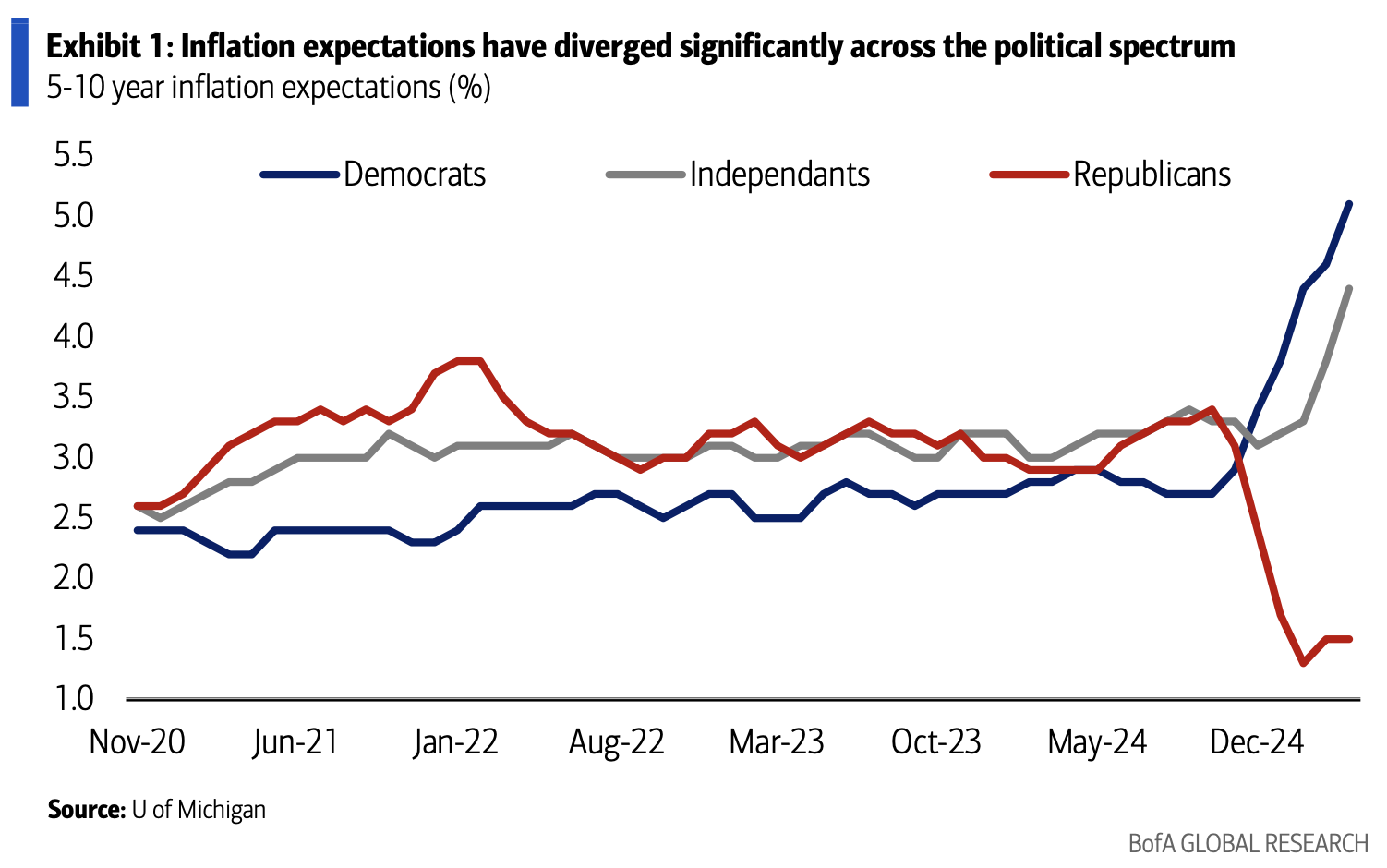

Inflation, currently at 2.3%, and rising medical costs (about 5% annually) could strain savings, suggesting the need for a buffer for longevity.

The Reddit post highlights a psychological angle: working beyond $10 million saved often reflects a need for security or status rather than necessity. Some with $12 million net worth continue low-stress jobs for fulfillment, blending income with purpose. However, chasing excess wealth can erode time for family or hobbies, diminishing happiness. Retirees must weigh financial goals against personal values, as the post suggests that $10 million typically meets needs without sacrificing joy.

For most early retirees, $10 million offers robust financial freedom, supporting diverse lifestyles. Yet, personal aspirations and economic factors like inflation require careful planning. Consulting a financial advisor ensures a tailored strategy, balancing income, growth, and life goals for a fulfilling retirement.

What Should Your Retirement Savings Goal Be?

Now I’m not a financial advisor, so these are only my opinions, but the r/FatFire post arguing that $10 million is sufficient for retirement provides a solid starting point for planning early retirement. For the original poster, determining the ideal retirement savings amount requires a structured approach tailored to personal goals, lifestyle, and financial realities. Here is some practical advice to refine that target.

Calculate your annual retirement expenses. Factor in location and lifestyle because, as the poster notes, $10 million places you in the top 1% in most areas, but costs vary widely. In high-cost cities, $400,000 annually covers luxury living — private schools, travel, and upscale housing. In lower-cost regions, $150,000 to $200,000 may suffice, dropping the savings target to $4 million to $5 million.

Create a detailed budget. Include housing, healthcare, travel, and discretionary spending. It can be helpful to use online financial tools to project expenses, and don’t forget to adjust for inflation.

Assess income sources. The poster questions why some work past $10 million, suggesting passion-driven jobs can complement savings. Evaluate potential income from pensions, Social Security, or part-time work, which reduces the savings needed. For example, $50,000 in annual passive income lowers the required nest egg by $1.25 million, assuming a 4% withdrawal rate.

Consider longevity and risk. Plan for a 30- to 40-year retirement, as life expectancy averages 80 to 85 years. Healthcare costs, projected at $315,000 per couple, according to Fidelity most recent data, demand a buffer. Then stress-test your plan for market downturns using Monte Carlo simulations via platforms like Vanguard’s Retirement Nest Egg Calculator to ensure sustainability.

Reflect on happiness. As the poster emphasizes, if work fulfills you, a lower savings target with continued income may optimize joy. Conversely, if freedom is paramount, prioritize a higher buffer.

Key Takeaway

It’s best to consult with a financial advisor to model scenarios, incorporating tax strategies such as Roth conversions, and estate planning. While $10 million suits many, your unique goals, whether it’s travel, philanthropy, or minimalism, dictate the true amount. Test your assumptions, align them with personal values, and build flexibility to ensure a fulfilling retirement.

The post Is Aiming for $10M in Savings Enough for Early Retirement? appeared first on 24/7 Wall St..