Top economist El-Erian says tariffs have put the era of U.S. exceptionalism ‘on pause’

El-Erian said American exceptionalism for years led the world to bring its money to the U.S.

- Top economist Mohamed El-Erian said U.S. exceptionalism was “on pause” and warned about the negative effects of a prolonged trade war. He said tariffs could be used as a tool for renegotiating better trade terms, but a longer trade war could harm the U.S. instead of protecting U.S. industry.

Mohamed El-Erian, chief economic advisor at Allianz, said the era of U.S. exceptionalism is at a standstill, although it’s still not over.

El-Erian, who is also president of Queen’s College at the University of Cambridge, told MarketWatch that he was not completely opposed to tariffs, but warned about the implications of a prolonged trade war on the U.S. as a whole.

“It’s been put on pause,” El-Erian said of American exceptionalism. “It’s too early to say if the damage inflicted is irreversible.”

El-Erian said that a strategy of elevating tariffs to work out better trade terms with other countries and then de-escalating could be beneficial, but the idea of levying tariffs to raise external revenue while also protecting U.S. industry makes little sense.

“Some of these objectives are contradictory,” he said, adding that this kind of move is “liable to inflict collateral damage.”

As a result of a prolonged trade war, other countries may put their own tariffs on China or start their own tariff escalations amongst each other, leading to higher prices worldwide.

El-Erian’s comments come as trade negotiations continue, with the U.K. most recently having struck a deal with the U.S. earlier this month. The U.S. maintained a 10% duty on most U.K. goods but lowered tariffs on a set number of British auto imports, and exempted U.K. steel and aluminum from tariffs. The U.K. agreed to eliminate tariffs on a quota of up to 13,000 metric tons of American beef and 1.4 billion liters of ethanol.

Still, the Trump administration has been slow to reach agreements with other foreign countries, and last week the president said the government would set tariff rates for the rest of the world over the “next couple of weeks,” adding that those rates would be higher than the 10% rate agreed to with the U.K.

For years, the strong economy and exceptionalism of American industry led to “the world outsourcing its savings to America,” El-Erian noted.

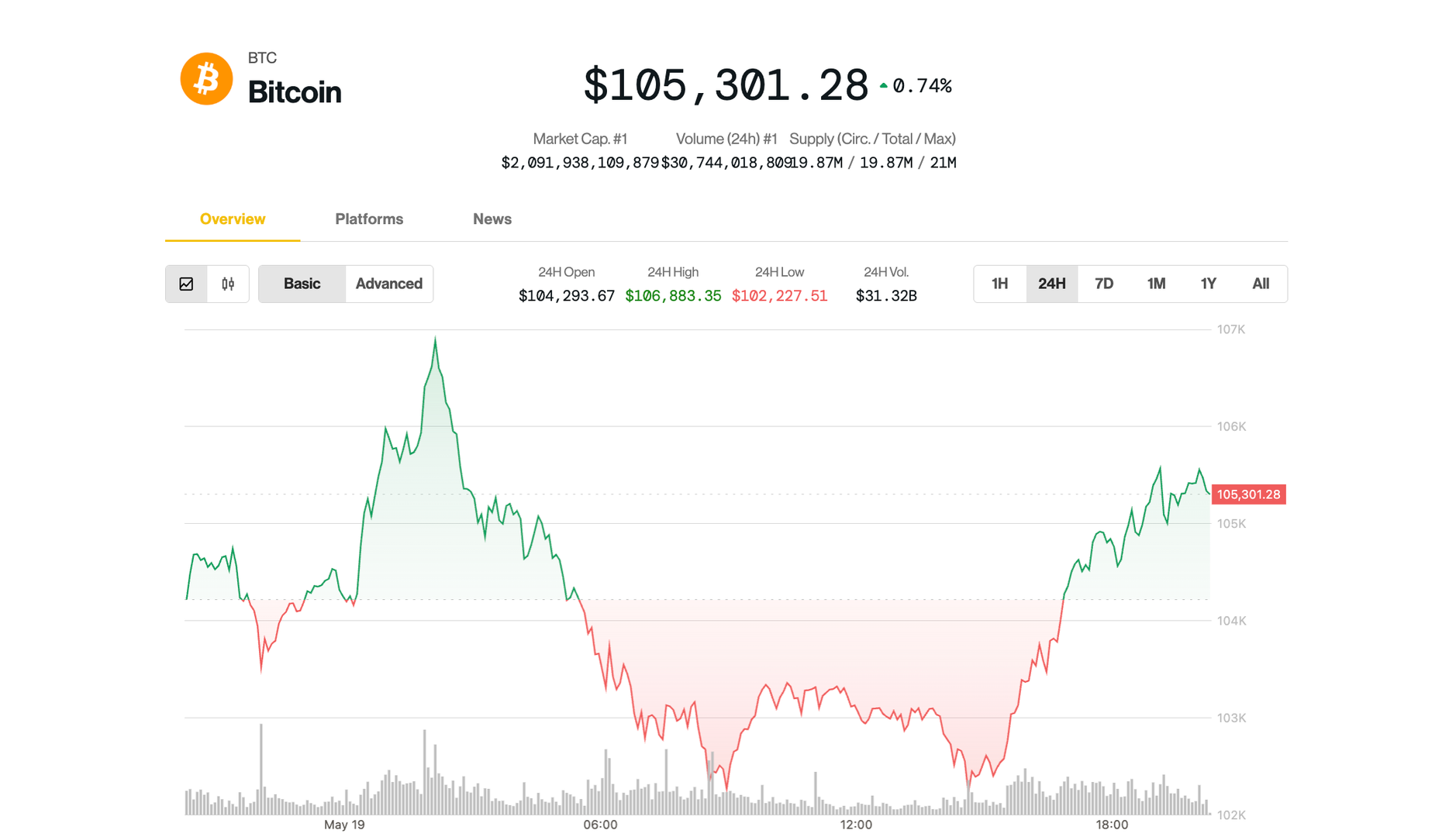

Yet, it's unclear if this trend will continue in the future, as investors look to offload their American assets. On Monday, the 30-year Treasury yield hit 5%, after Moody’s became the last credit agency to strip the U.S. of the highest credit rating possible.

In a Monday post on X, El-Erian wrote that Moody’s downgrade wasn’t too consequential but was still “enough to amplify the conversation about America's political ability to address its fiscal deficit and debt.”

This story was originally featured on Fortune.com