Stock Market Today: Stocks get boost from Microsoft, Meta with jobs data on deck

Stocks are set to kick-off the month of May on a high note, with megacap tech earnings driving solid premarket gains.

U.S. equity futures jumped higher in early Thursday trading, while the dollar consolidated recent gains and Treasury yields eased, as investors reacted to a pair of impressive megacap tech earnings that could inject much-needed confidence into both domestic stocks and the broader American asset trade.

Stocks ended modestly higher on Wednesday, with the S&P 500 edging 0.15% into the green by the close of trading to trim its overall April loss to around 0.76% even after the impact of a bigger-than-expected contraction reported for first quarter GDP.

The Nasdaq, meanwhile, ended the month with a modest 0.73% advance, and looks to lead gainers in early Thursday trading following stronger-than-expected earnings from Microsoft (MSFT) and Meta Platforms (META) that could restore investor faith in both the AI investment and ad spending narratives, respectively, in global tech stocks.

Microsoft said its flagship Azure cloud unit, the epicenter of its AI revenue generation, saw revenues rise 33% from last year to $26.8 billion, with nearly half of that growth powered by AI demand. The tech giant also forecast a marginally higher growth rate for the three months ending in June, the group's fiscal fourth quarter.

Shares in the group were last marked 8.33% higher in premarket trading to indicate an opening bell price of $428.40 each.

Meta Platforms, meanwhile, topped Wall Street forecasts for its overall revenues, the vast majority of which are derived from ad sales, and forecast current-quarter tallies that were just ahead of analysts' estimates.

Meta shares jumped 6.8% to suggest an opening bell price of $586.12 each, a move that would trim all but around 2% of its year-to-date decline.

Apple (AAPL) and Amazon (AMZN) will follow with March quarter earnings updates after the close of trading, but the robust outlooks and positive momentum from last night's earnings are not only driving megacap tech gains, but adding an extra dose of support to the broader U.S. asset story following weeks of tariff and trade policy uncertainty.

Related: Analyst reboots Apple stock price target ahead of earnings

The U.S. dollar index, which tracks the greenback against a basket of six global currency peers, was last marked 0.39% higher at 99.853 heading into the start of the New York trading session, while stock futures suggest a solid set of opening bell gains on Wall Street.

The S&P 500, which remains down 5.3% of the year, is priced for a 66 point advance while the Nasdaq is called 344 points higher. The Dow Jones Industrial Average, meanwhile, is set for a 280 point jump.

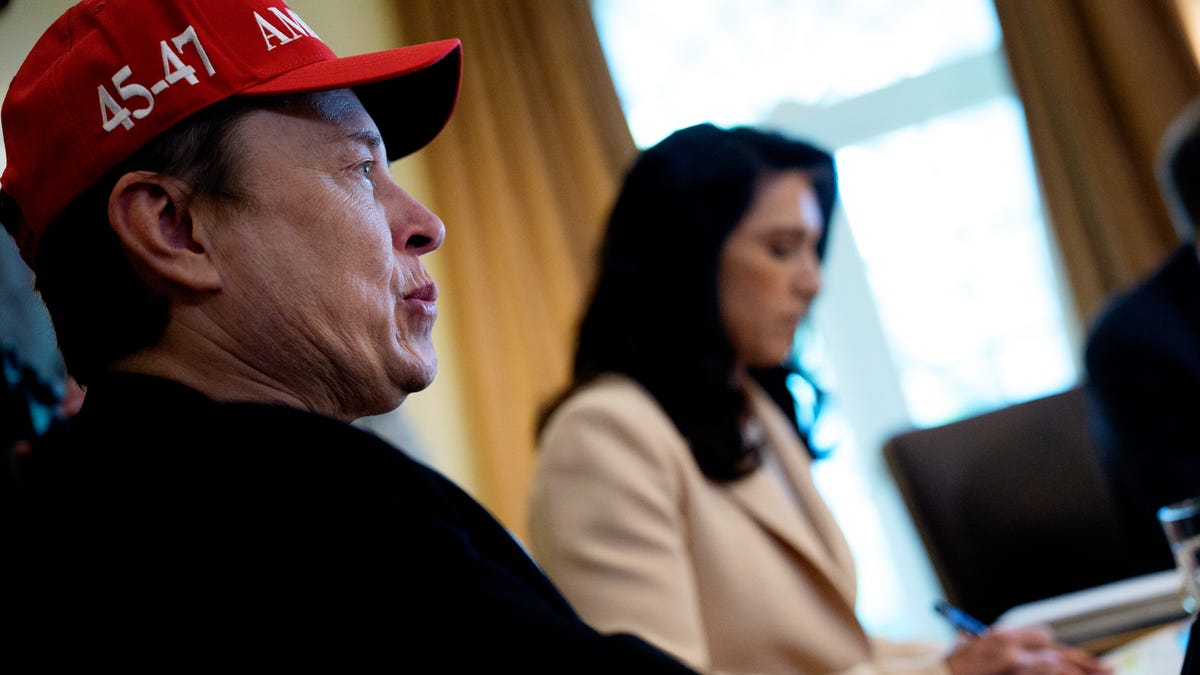

Tesla (TSLA) shares were a notable early mover as well, rising 0.7% in premarket trading after the EV maker denied a report from the Wall Street Journal that suggested the board has started looking for a potential replacement for CEO Elon Musk.

It is an EXTREMELY BAD BREACH OF ETHICS that the @WSJ would publish a DELIBERATELY FALSE ARTICLE and fail to include an unequivocal denial beforehand by the Tesla board of directors! https://t.co/9xdypLGg3c— Elon Musk (@elonmusk) May 1, 2025

Benchmark 10-year Treasury note yields eased to around 4.151% in overnight trading, buoyed by reports of a potential outreach on trade talks by the United States to officials in China as well as the chances of smaller deals being completed over the coming weeks.

Investors are also eying weekly jobless claims data at 8:30 am Eastern time ahead of Friday's crucial April Employment report, as well as ISM manufacturing activity data at 10:00 am Eastern time.

Overseas markets were largely quiet, owing to the traditional May Day holiday observances around the world, with Britain's FTSE 100 rising 0.07% in mid-day London trading and Japan's Nikkei gaining 1.13% in Tokyo.

More Economic Analysis: