Stock Market Today: Stocks bounce on shutdown optimism, bargain hunting

The S&P 500's correction slump is the seventh-fastest since 1929.

U.S. equity futures bounced higher in early Friday trading, setting up a potential rebound from last night's rout, as investors look to close out a challenging week on Wall Street while eyeing developments in the burgeoning global trade war.

Stocks ended sharply lower again last night, pulling the S&P 500 into correction territory, defined as 10% pullback from a recent high, in the fastest such move since the Covid pandemic and the seventh-fastest since 1929.

With the Nasdaq having suffered a similar correction retreat last week, U.S. stocks have now erased more than $5 trillion in market value in less than a month, an astonishing pullback tied directly to the economic and tariff policies of President Donald Trump.

"At the start of the year, investors were anticipating a growth-friendly administration that would reinforce the narrative of U.S. exceptionalism and enact policies likely to strengthen the U.S. economy relative to the rest of the world," said Seema Shah, chief global strategist at Principal Asset Management.

"However, policy has not panned out quite as expected. Not only has the sequencing of economic policies been different, but the tariff policy proposals have been considerably more severe than anticipated," she added. "With policy uncertainty extraordinarily elevated, the U.S. economy has already begun to be negatively impacted."

Gold prices were back on record watch in the overnight session as safe-haven buying extends the bullion's weekly gain to around 2.6% and puts in on pace to test the $3,000 mark later next week.

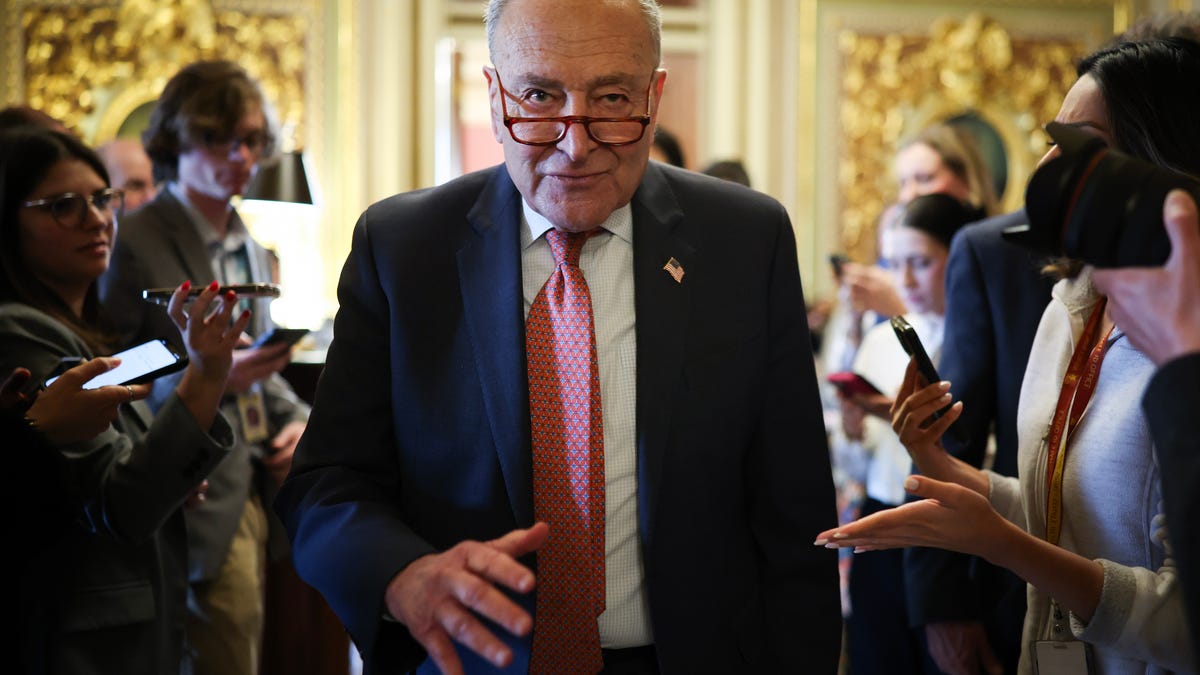

In equity markets, however, investors are looking for bargains in the early Friday session, however, as the prospect of a government shutdown faded overnight after Senate Minority Leader Chuck Schumer indicated he and some of his Democratic colleagues would support a Republican stopgap funding bill.

Related: Another U.S. bank warns on stocks amid $4 trillion market rout

That optimism was somewhat tempered, however, but the lack of progress in reaching a ceasefire agreement between Russia and Ukraine, with Russia President Vladimir Putin indicating tepid support on the basis of concerns that it would allow for Ukraine's military to regroup.

Still, stocks look set for solid early gains, even with a modest nudge higher in Treasury yields and a firmer U.S. dollar, with futures contracts tied to the S&P 500 suggesting an opening bell gain of around 45 points.

The Nasdaq, meanwhile, is called 205 points higher with the Dow Jones Industrial Average poised for a 235 point advance.

More Wall Street Analysis:

- Analyst says AI stock picked by Cathie Wood will surge

- Analysts make surprise move on MongoDB stock price target

- Analysts reboot Rocket Lab's stock price target after earnings

In Europe, the Stoxx 600 benchmark rose 0.55% in mid-day Frankfurt trading, but remains on pace for a 2% decline for the week amid the tit-for-tat tariff threats, the latest of which includes a 200% levy on wine and spirit exports to the United States.

Britain's FTSE 100 was also higher, rising 0.3% in London, but a surprise contraction in January GDP underscored the broader economy's challenges heading into the Spring Budget Statement from Chancellor Rachel Reeves later this month.

Overnight in Asia, the regional MSCI ex-Japan benchmark rose 0.81% into the close of trading on bets that the avoidance of a U.S. government shutdown would spark a Friday rally on Wall Street.

In Tokyo, the Nikkei 225 rose 0.72% to take the benchmark's weekly gain to 0.45%, the first advance in four, with chip and tech stock's pacing the session.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast