Stock Market Live May 1: Bad Jobs News Is Good News for S&P 500 (VOO)

Bad news for the economy may be good news for the Vanguard S&P 500 ETF (NYSEMKT: VOO), which will seek to notch its eight straight up day on Thursday after the Department of Labor reported rising unemployment in the U.S. The Labor Department reported this morning that seasonally adjusted claims for unemployment insurance reached 241,000 […] The post Stock Market Live May 1: Bad Jobs News Is Good News for S&P 500 (VOO) appeared first on 24/7 Wall St..

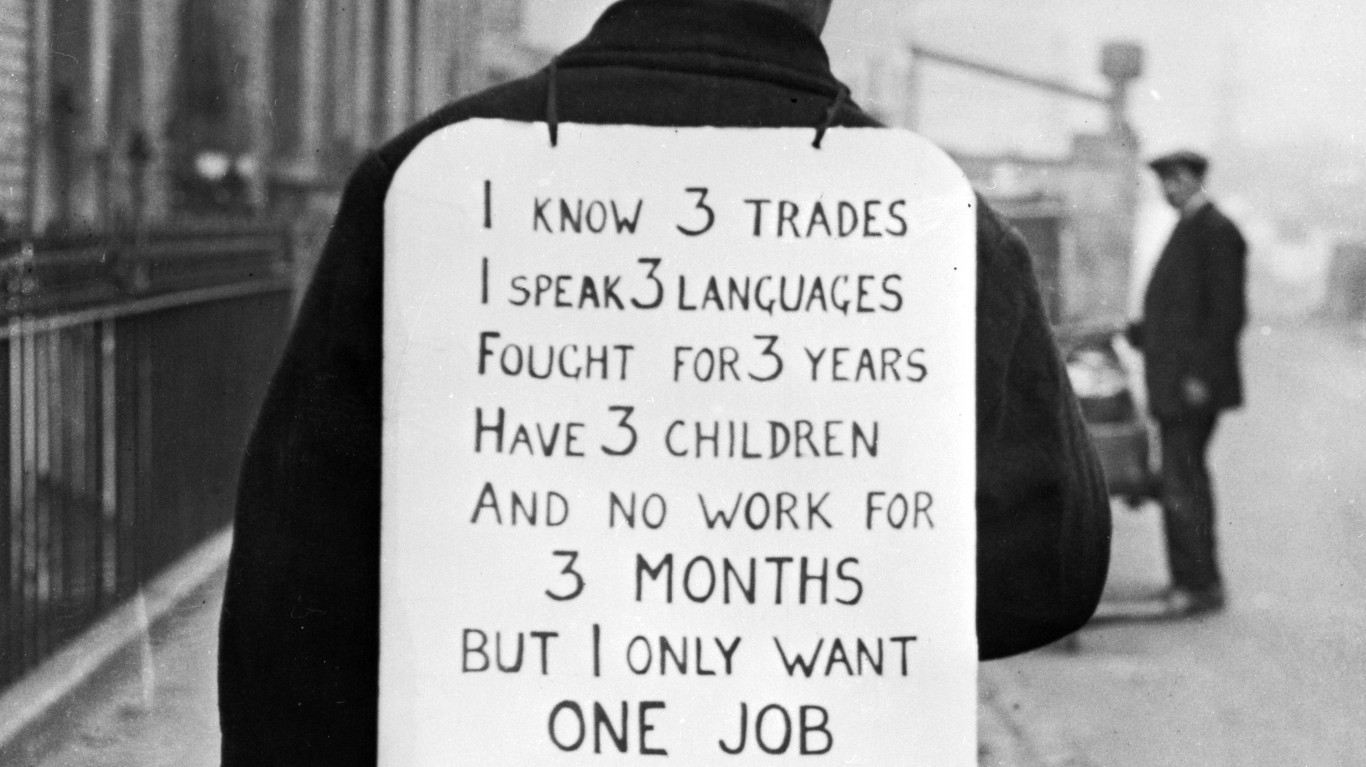

Bad news for the economy may be good news for the Vanguard S&P 500 ETF (NYSEMKT: VOO), which will seek to notch its eight straight up day on Thursday after the Department of Labor reported rising unemployment in the U.S.

The Labor Department reported this morning that seasonally adjusted claims for unemployment insurance reached 241,000 last week, higher than the expected 225,000 and up 18,000 from the previous week. Continuing unemployment benefits claims rose to 1.92 million and are at their highest levels since November 2021.

Bad news? It sure sounds like it. But a weakening economy boosts the chances the Federal Reserve will cut interest rates, and investors see that as good for the stock market. As a result, the S&P 500 opened 0.9% higher this morning, and “the Voo” is up a solid 1%.

Earnings

We’re in the heart of earnings season right now, with more than 100 companies reporting their Q1 profits this morning. Winners today include Estee Lauder (NYSE: EL), Becton Dickinson (NYSE: BDX), and Moderna (Nasdaq: MRNA), and Hershey (NYSE: HSY), all S&P 500 components and all reporting earnings beats.

Losers include Eli Lilly (NYSE: LLY), McDonald’s (NYSE: MCD), and Southern Company (NYSE: SO), all with earnings misses.

Analyst Calls

Speaking of misses, Caterpillar (NYSE: CAT) won an upgrade to outperform from Oppenheimer this morning, despite yesterday’s earnings miss. “While the global macro outlook is likely to remain a near-term overhang, CAT’s better than feared quarter highlighted relative resiliency of the demand and margin outlook,” said the analyst.

Conversely, Redburn-Atlantic downgraded Procter & Gamble (NYSE: PG) stock to neutral because: “After a stellar seven-year period where Procter & Gamble (P&G) grew organic sales and reported EPS ahead of peers, growth is now slowing – primarily a function of market dynamics.”

So I guess a lousy economy isn’t always good news after all.

The post Stock Market Live May 1: Bad Jobs News Is Good News for S&P 500 (VOO) appeared first on 24/7 Wall St..