Stablecoin Disruption: Time to Sell Your Visa Stock?

This week, stablecoin legislation was approved by the United States Senate. The bill -- called the GENIUS Act -- still needs to go through the other side of Congress and on to the President's desk, but it is one step closer to bringing stablecoins into the financial system. By regulating the new currencies pegged to the U.S. dollar, issuers of the coin will now need to keep ample reserves to pay back customers and also go through regular audits.Investors are betting that legislation will spur customer adoption, which is a threat to Visa (NYSE: V). If stablecoins are adopted wholesale by consumers, it could mean less payment volume through Visa's network. Less volume means less profit.Does that mean it is time to sell your Visa stock? Not really. Here's why stablecoins are not a large threat to Visa's business model today.Continue reading

This week, stablecoin legislation was approved by the United States Senate. The bill -- called the GENIUS Act -- still needs to go through the other side of Congress and on to the President's desk, but it is one step closer to bringing stablecoins into the financial system. By regulating the new currencies pegged to the U.S. dollar, issuers of the coin will now need to keep ample reserves to pay back customers and also go through regular audits.

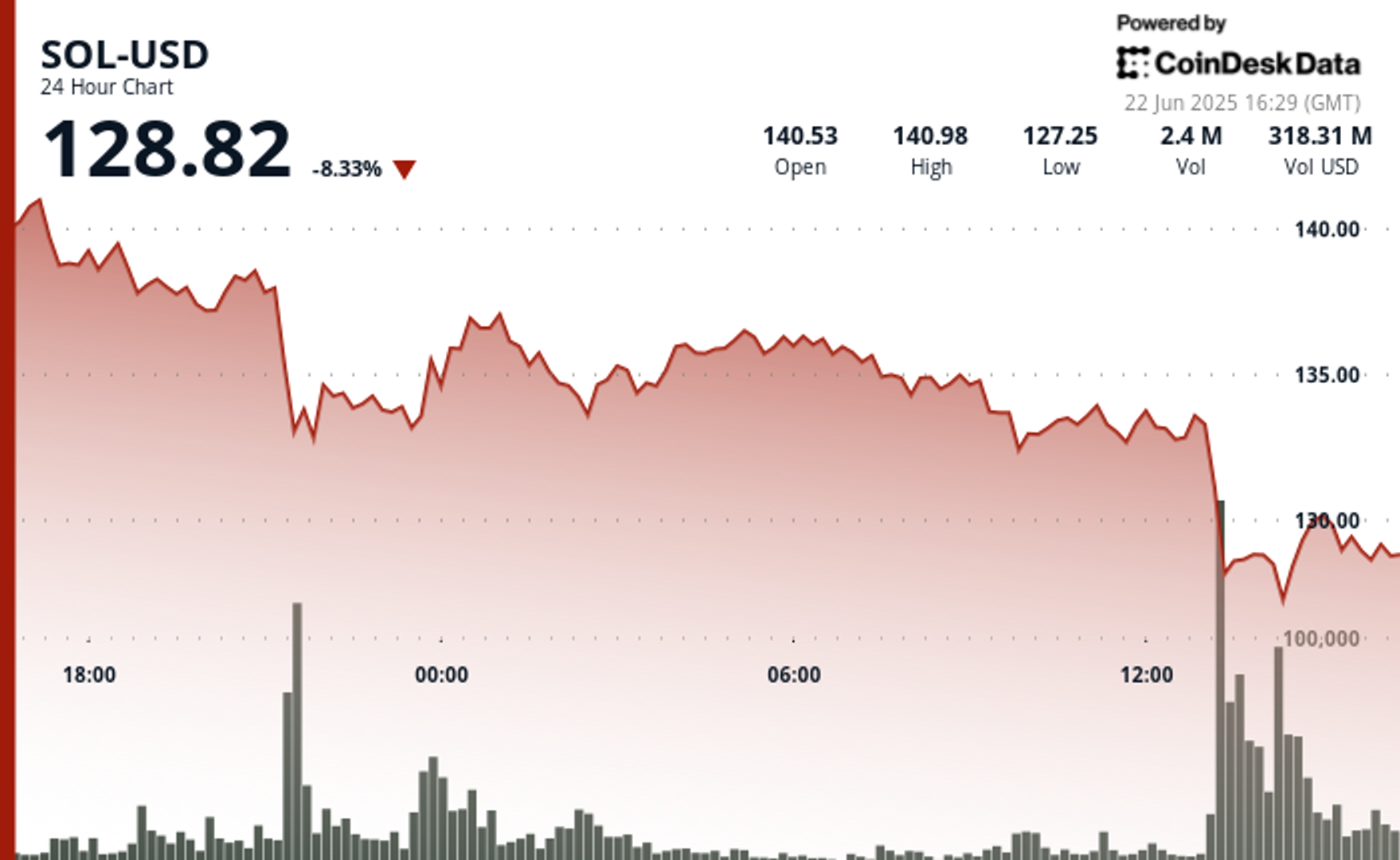

Investors are betting that legislation will spur customer adoption, which is a threat to Visa (NYSE: V). If stablecoins are adopted wholesale by consumers, it could mean less payment volume through Visa's network. Less volume means less profit.

Does that mean it is time to sell your Visa stock? Not really. Here's why stablecoins are not a large threat to Visa's business model today.