S&P 500 Sell-Off: How Reliable Dividend Stocks Like Realty Income Can Offer Peace of Mind

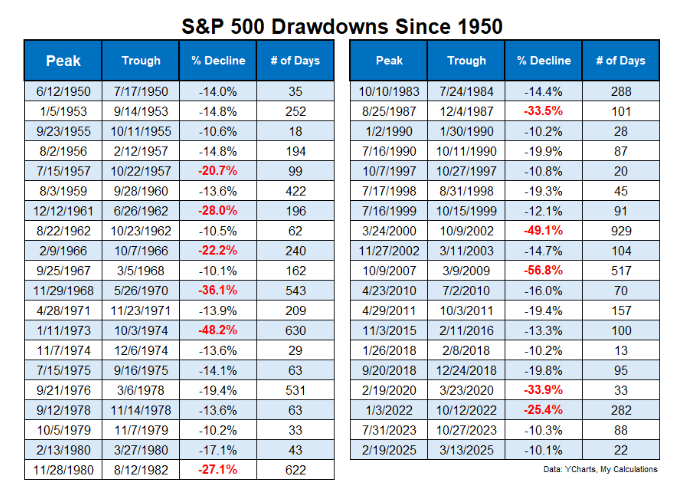

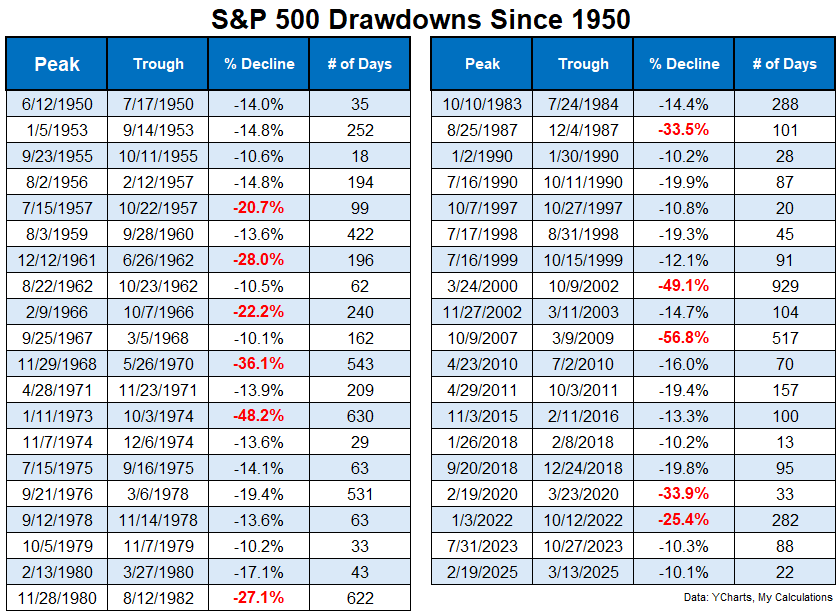

The saying "it's like watching a train wreck" exists for a reason. When something particularly bad is happening, human beings have a hard time looking away. That is as true of train wrecks as it is of Wall Street, where the wrecks that take place are called corrections, and can ultimately lead to the deeper correction known as a bear market.The S&P 500 index (SNPINDEX: ^GSPC) fell into correction territory on March 13, 2025. But you don't have to, and really shouldn't, hang on every ticker move. And there's an easy way to break that habit. Buy reliable dividend stocks like Realty Income (NYSE: O), NNN REIT (NYSE: NNN), and Federal Realty (NYSE: FRT).Markets go up and down over time, often in dramatic and swift fashion. That's just how they operate, with emotional investors pushing stocks one way and then the other. In fact, if investors were truly rational, as some academics insist they are, stock prices would never change. They would always represent the most appropriate price. In theory that sounds good, but in practice it is clearly a vast oversimplification of the way markets work.Continue reading

The saying "it's like watching a train wreck" exists for a reason. When something particularly bad is happening, human beings have a hard time looking away. That is as true of train wrecks as it is of Wall Street, where the wrecks that take place are called corrections, and can ultimately lead to the deeper correction known as a bear market.

The S&P 500 index (SNPINDEX: ^GSPC) fell into correction territory on March 13, 2025. But you don't have to, and really shouldn't, hang on every ticker move. And there's an easy way to break that habit. Buy reliable dividend stocks like Realty Income (NYSE: O), NNN REIT (NYSE: NNN), and Federal Realty (NYSE: FRT).

Markets go up and down over time, often in dramatic and swift fashion. That's just how they operate, with emotional investors pushing stocks one way and then the other. In fact, if investors were truly rational, as some academics insist they are, stock prices would never change. They would always represent the most appropriate price. In theory that sounds good, but in practice it is clearly a vast oversimplification of the way markets work.