Should You Actually Buy Stocks as President Trump's Tariffs Continue? Here's What History Says.

Tariff turmoil has ensnared the market. While the last two weeks have seen a partial rebound in stock prices -- especially high-growth technology companies -- the S&P 500 index (SNPINDEX: ^GSPC) is still down around 6% so far in 2025, down 10% from recent all-time highs, and has gone through some extreme volatility not seen since the COVID-19 shutdown.Wall Street is nervous about what high tariff rates will do to the global economic order, especially the supply chain relationship between China and the United States, and what that means for corporate profits. What should you do with your portfolio in the face of these high tariffs? Here's what history says tariffs will do to corporate profits and the United States economy, and what it might mean for your portfolio.Let's cut to the chase: Tariffs are a headwind to business profitability and economic growth. They are not a good thing for stocks. If a company is importing goods from China that have a 100%-plus tariff, the total cost of bringing that product to end customers goes up significantly. Sure, a company can pass on these tariff fees to customers, but at such a high rate, these price hikes will almost assuredly lead to demand destruction. Why buy a new toy for your child's Christmas if it costs $300 instead of $150 a year ago (just as an example). Only high luxury brands such as Hermes may be able to pass on these tariffs to customers without seeing demand fall off a cliff.Continue reading

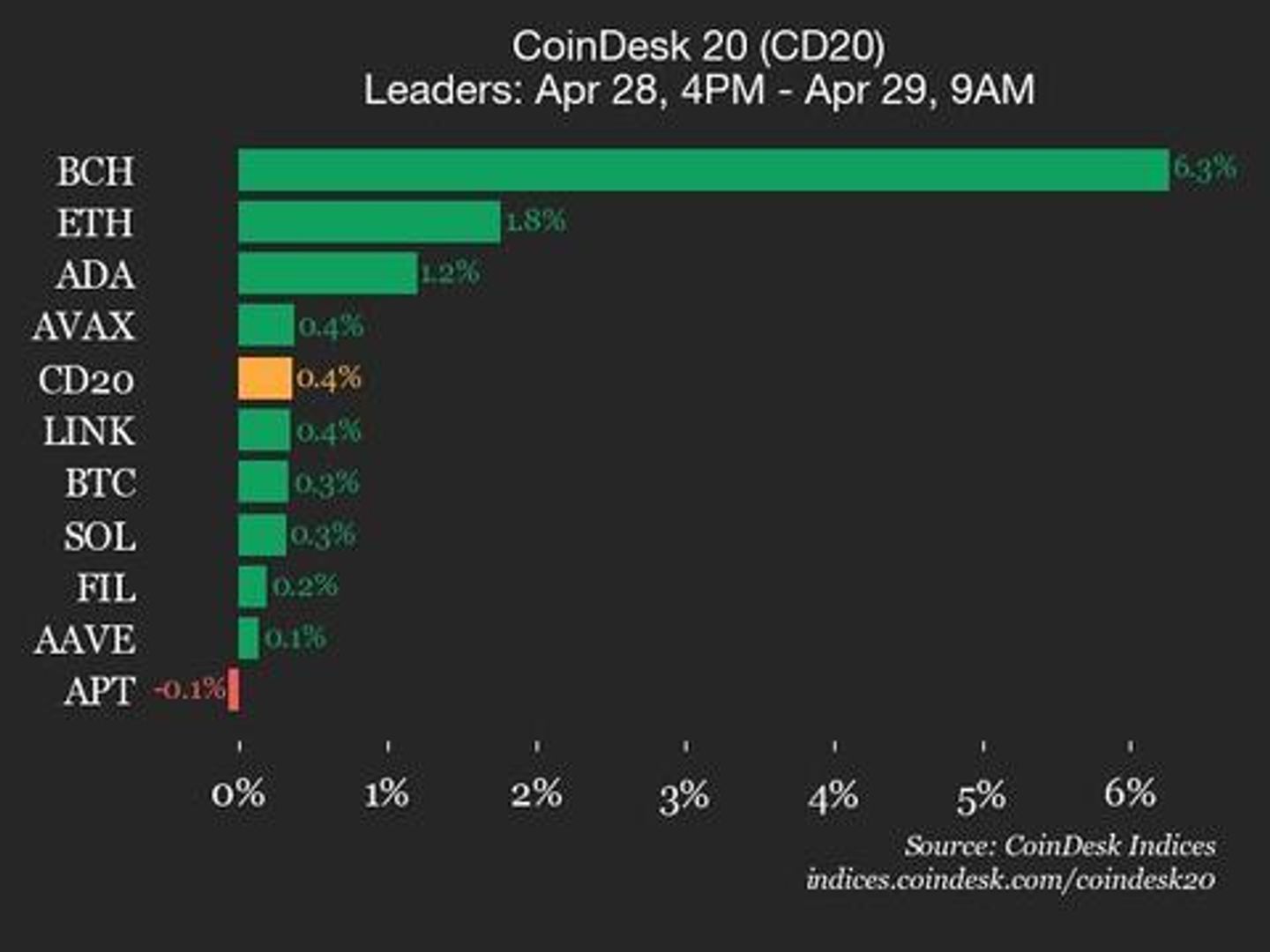

Tariff turmoil has ensnared the market. While the last two weeks have seen a partial rebound in stock prices -- especially high-growth technology companies -- the S&P 500 index (SNPINDEX: ^GSPC) is still down around 6% so far in 2025, down 10% from recent all-time highs, and has gone through some extreme volatility not seen since the COVID-19 shutdown.

Wall Street is nervous about what high tariff rates will do to the global economic order, especially the supply chain relationship between China and the United States, and what that means for corporate profits. What should you do with your portfolio in the face of these high tariffs? Here's what history says tariffs will do to corporate profits and the United States economy, and what it might mean for your portfolio.

Let's cut to the chase: Tariffs are a headwind to business profitability and economic growth. They are not a good thing for stocks. If a company is importing goods from China that have a 100%-plus tariff, the total cost of bringing that product to end customers goes up significantly. Sure, a company can pass on these tariff fees to customers, but at such a high rate, these price hikes will almost assuredly lead to demand destruction. Why buy a new toy for your child's Christmas if it costs $300 instead of $150 a year ago (just as an example). Only high luxury brands such as Hermes may be able to pass on these tariffs to customers without seeing demand fall off a cliff.