Quantum computing stock sent reeling by financing decision

Here's why Quantum computing shares are tumbling.

What is the speed of light? You might be familiar with the answer of 299,792,458 meters per second in a vacuum. But is that a scientific fact? It depends on how you think about it (Yes, I am bringing the skepticism to the next level today).

We often mistake things that are beliefs as facts -- even scientists do it, sometimes unintentionally, sometimes because it is convenient -- and sometimes, unfortunately, because there is a monetary incentive.

The reality is that the speed of light has never been measured in one direction, it is always measured by reflecting the light of a mirror. As a result, there is no proof that light travels at the same speed in both directions, it is only a convention. But what is a convention other than convenient belief?

Related: OpenAI makes shocking move amid fierce competition, Microsoft problems

You can prove anything with mathematics. If you add unverifiable assumptions to the mix and claim that they just can't be proven "with current technology", you can create beautiful mathematical proofs for your nonsense.

A great example is String theory in physics. According to the paper on String theory by Brian R. Green, there are about five consistent string theories, and they all require 10 space-time dimensions. As if that weren't enough, there is even a spin-off (M-theory) and because it is "so much better" it needs 11 space-time dimensions.

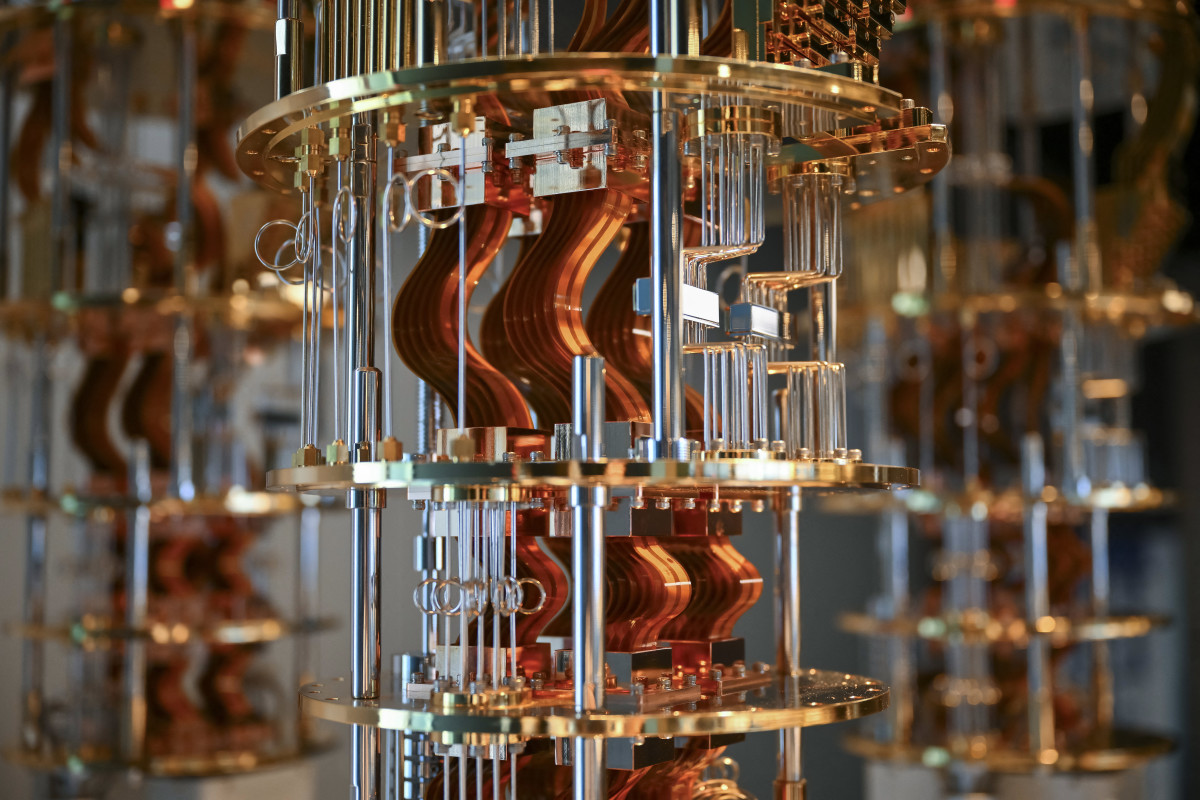

Another curiously magical scientific theory is quantum mechanics. Quantum proponents have been promising us incredible computers since the 80s, and the industry has had a resurgence lately. At the center of it all is the company with the incredibly "original" name of Quantum Computing.

Quantum computing revenue is growing, but tiny

Quantum Computing (QUBT) announced on June 17, that it completed the sale of its first commercial entangled photon source to a research institution in South Korea. The institution plans to use this equipment for its work on quantum networking and secure communications.

On May 15th, Quantum Computing reported its results for Q1 of fiscal 2025.

Related: Analysts reset Qualcomm stock price target, send warning

Here are the highlights:

- Net revenues of $39,000 (33% gross margin) compared to $27,000 (41% gross margin) year-over-year.

- Net income of $17.0 million, or $0.13 per basic share for Q1 2025, compared to a net loss of $6.4 million or $(0.08) per basic share in Q1 2024.

- Cash and cash equivalents on March 31, 2025, increased by $87.5 million to $166.4 million from year-end 2024.

- During the first quarter, the company raised total net proceeds of $93.6 million through a private placement offering of common stock.

The company completed construction of its Quantum Photonic Chip Foundry in Tempe, Arizona, during the first quarter. According to the company, the foundry was built to meet the growing demand for thin film lithium niobate photonic chips.

More Tech Stocks:

- Amazon tries to make AI great again (or maybe for the first time)

- Veteran portfolio manager raises eyebrows with latest Meta Platforms move

- Google plans major AI shift after Meta’s surprising $14 billion move

Quantum Computing stock tumbles on private placement

The company announced on June 23rd, that it has entered into securities purchase agreements with institutional investors for the purchase and sale of about 14 million shares of common stock in a private placement at a purchase price of $14.25 per share.

Related: Analysts revamp forecast for Nvidia-backed AI stock

Expected gross proceeds from the transaction are $200 million, before deducting offering expenses. The company's total cash position should exceed $350 million following closing.

Because private placements increase the number of shares outstanding, they can dilute, or reduce the percentage of ownership, of existing shareholders.

The stock took a tumble on the announcement, and at last check, QUBT shares were trading 14% lower near $16.

During the Q1 2025 earnings call Dr. Yuping Huang, interim CEO and chairman of Quantum Computing, noted that the company is at the stage, in which it is working on the discovery of its customers, explaining its offerings, and letting its customers validate its products.

The company's intention to use the net proceeds from the offering is to speed up commercialization efforts, among other things.

Related: Surprising tech giant aims to lead quantum computing revolution