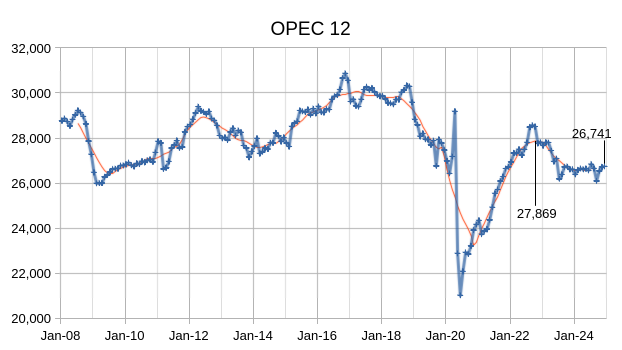

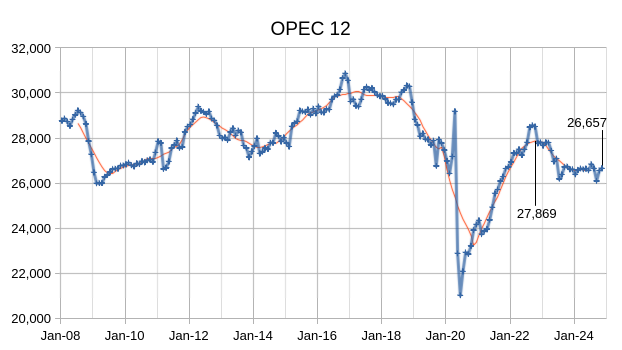

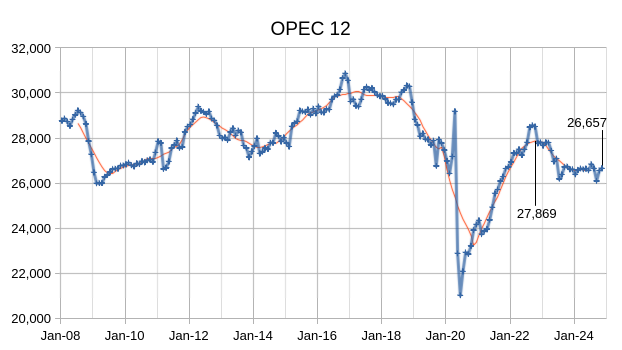

OPEC Update, December 2024

The OPEC Monthly Oil Market Report (MOMR) for December 2024 was published recently. The last month reported in most of the OPEC charts that follow is November 2024 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts below the blue line with markers […]

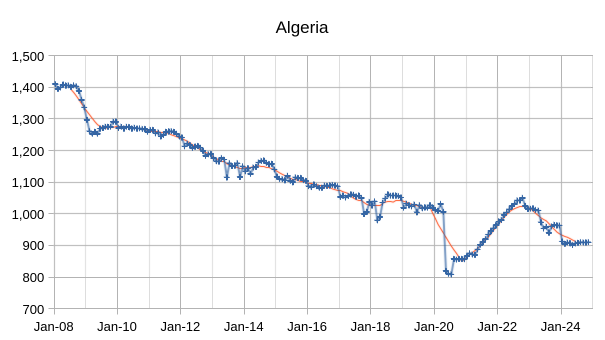

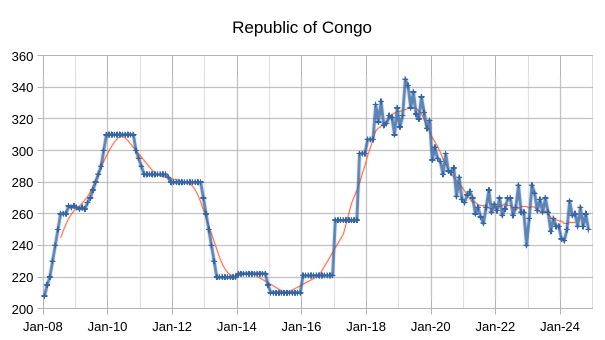

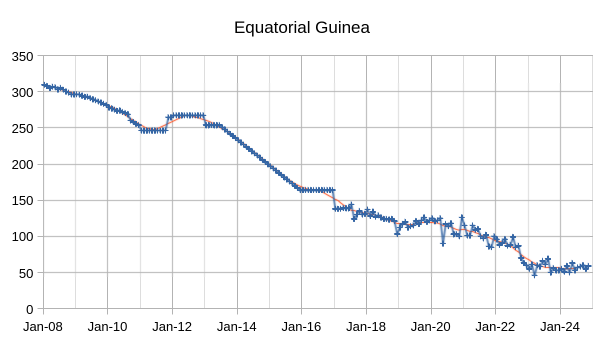

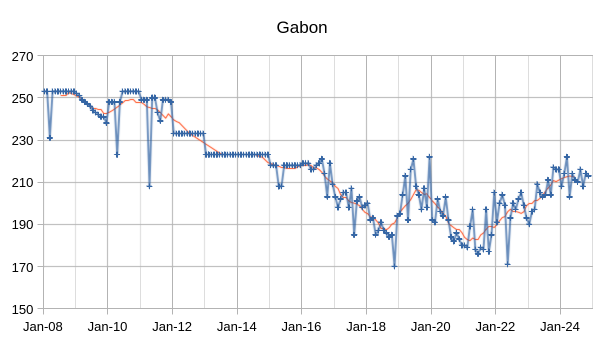

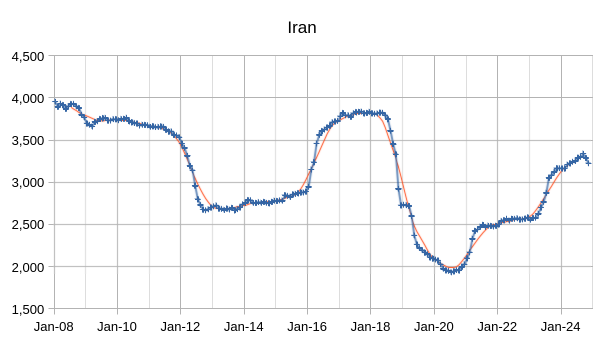

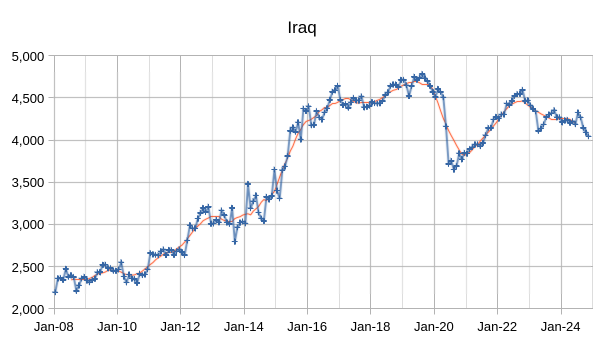

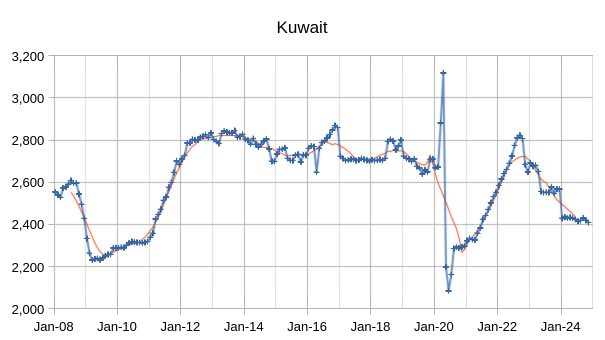

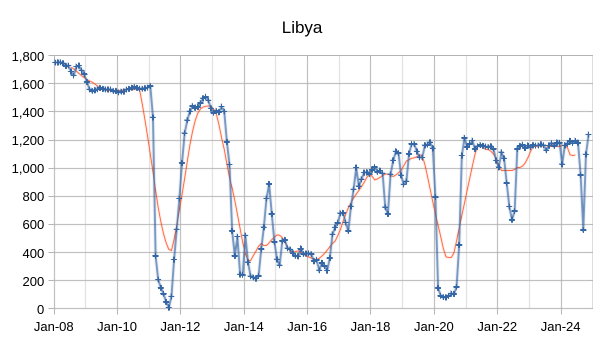

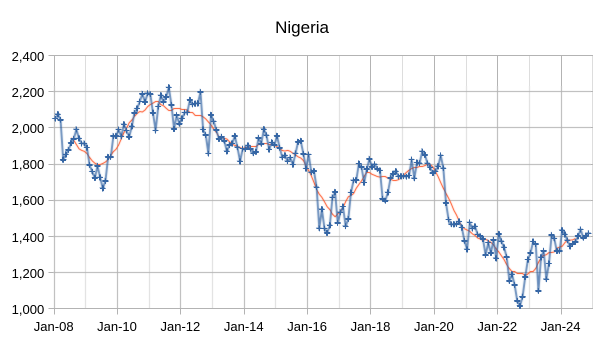

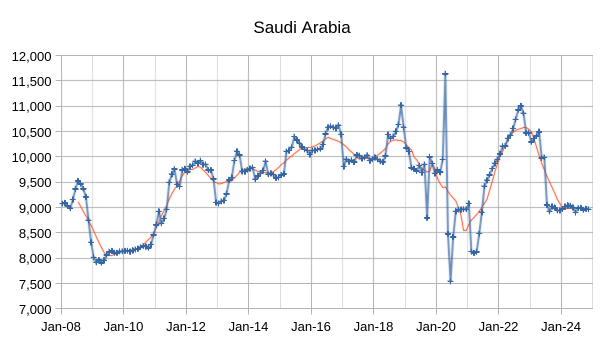

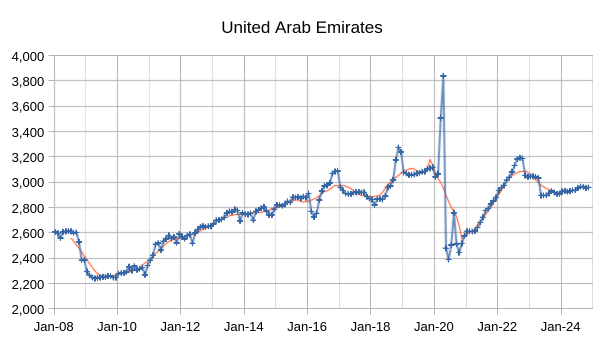

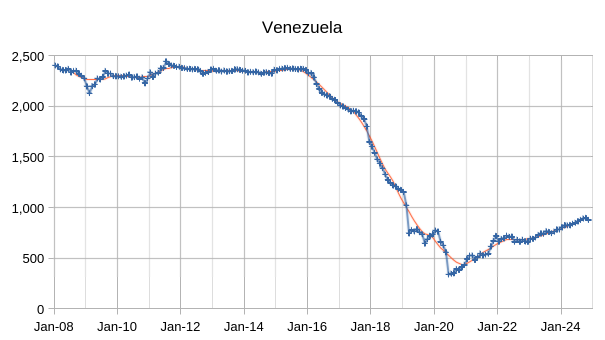

The OPEC Monthly Oil Market Report (MOMR) for December 2024 was published recently. The last month reported in most of the OPEC charts that follow is November 2024 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts below the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

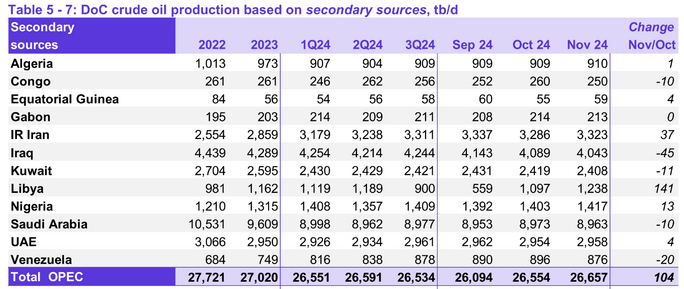

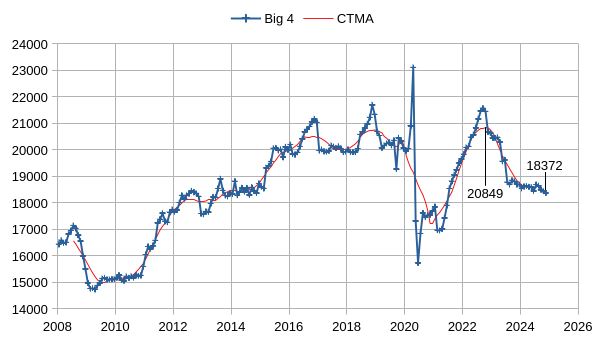

Output for October 2024 was revised higher by 19 kb/d and September 2024 output was revised higher by 25 kb/d compared to last month’s report. OPEC 12 output increased by 104 kb/d with most of the increase from Libya (141 kb/d.) Iran also increased by 37 kb/d while Iraq saw a decrease of 45 kb/d. Other OPEC members had small increases or decreases of 20 kb/d or less.

The chart above shows output from the Big 4 OPEC producers that are subject to output quotas (Saudi Arabia, UAE, Iraq, and Kuwait.) After the pandemic, Big 4 average output peaked in 2022 at a centered 12 month average (CTMA) of 20849 kb/d, crude output has been cut by 2477 kb/d relative to the 2022 CTMA peak to 18372 kb/d in November 2024. The Big 4 may have roughly 2477 kb/d of spare capacity when World demand calls for an increase in output.

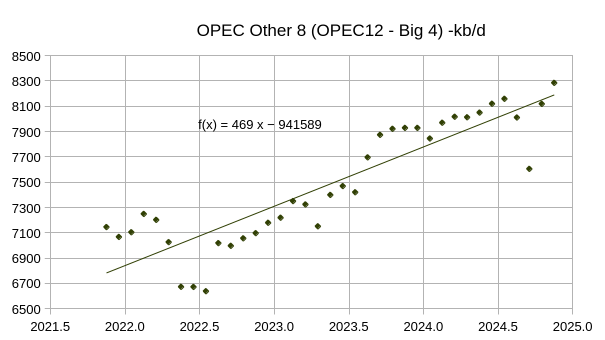

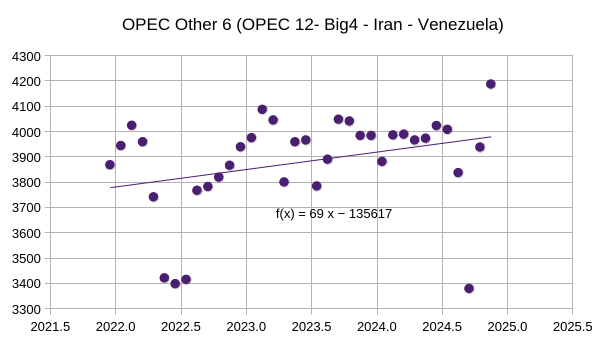

Most of the increase in the Other 8 OPEC nations (those OPEC 12 nations that are not part of the Big 4) came from Iran and Venezuela (about 400 of the 469 kb/d average annual increase), with the remaining 6 nations that were subject to quotas having relatively flat output over the 37 month period covered in the chart above (November 2021 to November 2024) . See chart below for OPEC Other 6 (OPEC 12 minus Big 4 minus Iran minus Venezuela) with an average annual increase of only 69 kb/d over past 3 years.

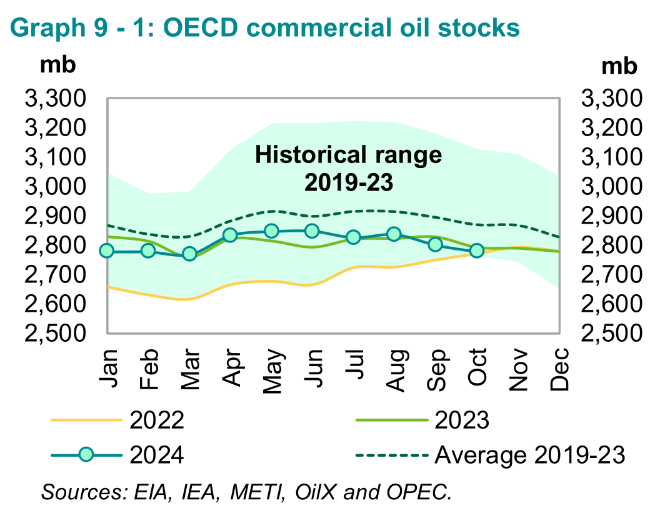

OECD Commercial petroleum stocks are near the bottom of the 5 year range from 2019 to 2023, so far the market seems to need less oil than earlier periods as oil prices remain relatively low.

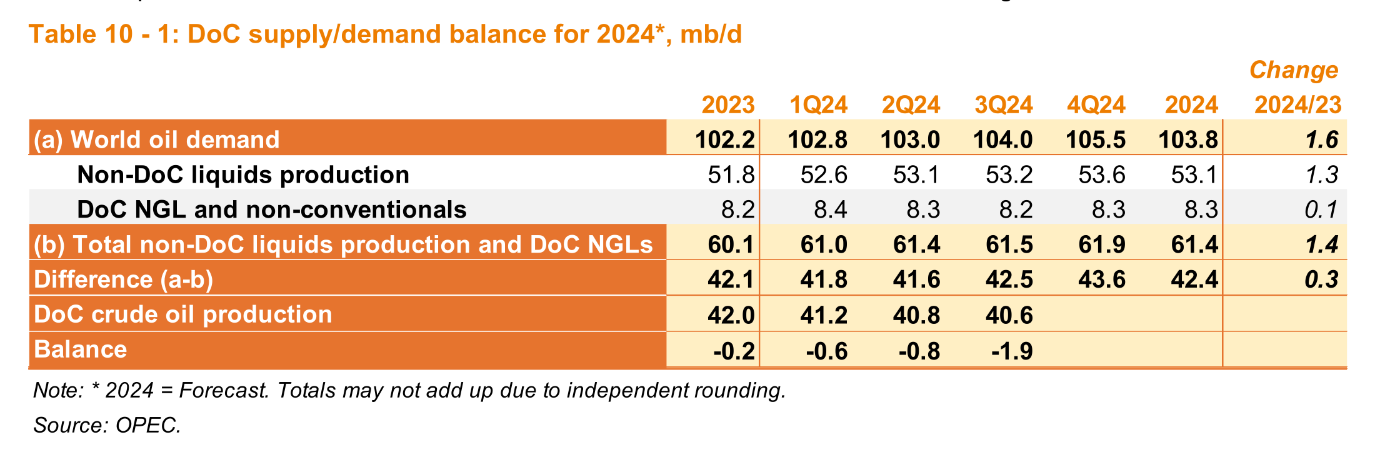

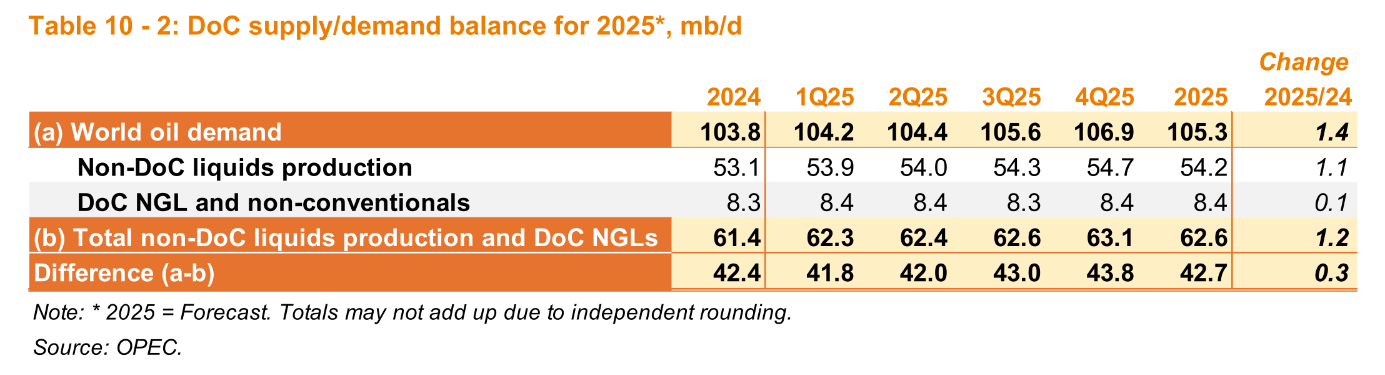

OPEC has reduced its estimate for World liquids demand growth in 2024 by 200 kb/d compared to last month’s oil report, but the expected growth in 2025 is unchanged.

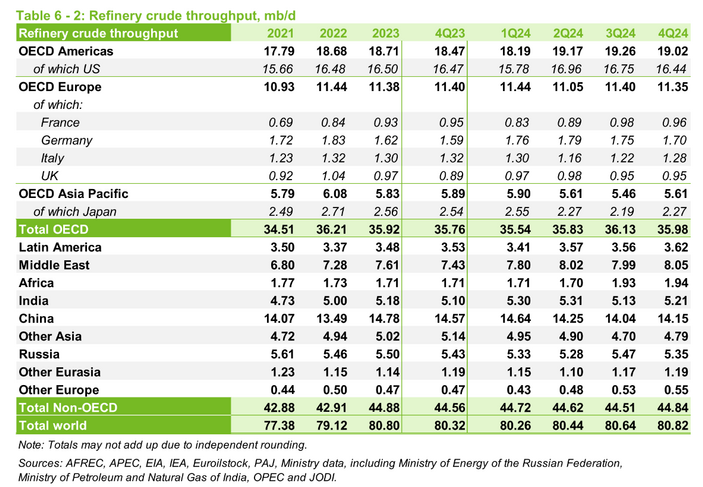

The chart above is included to show that demand for crude oil (input of crude to refineries constitutes most of crude oil demand) has actually decreased from 80.8 Mb/d in 2023 to 80.54 Mb/d in 2024, a decrease of 260 kb/d. So the petroleum liquids demand increase of 1600 kb/d in 2024, plus the 260 kb/d crude demand decrease would suggest NGL and other liquids demand increased by 1860 kb/d in 2024. Recent levels of output for non-crude liquids is around 25 Mb/d, so this would be a 7.4% increase in non-crude liquids demand, if both World liquids demand estimate and the refinery throughput estimates by OPEC are correct. I expect OPEC will eventually revise its demand estimate lower to match reality.

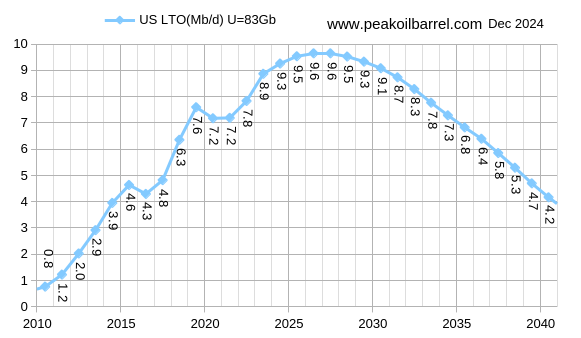

The tight oil estimate for 2023 was revised higher by 30 kb/d compared to last month’s report, the 2024 tight oil output estimate is unchanged so that growth is 30 kb/d lower than last month, tight oil growth in 2025 was also revised lower by 20 kb/d compared to last month.

My best guess tight oil estimate for the US has been revised from what I reported last month, primarily due to new estimates for the Permian basin based on regional output data for the Permian based on Texas RRC data, New Mexico OCD data and EIA estimates for Texas and New Mexico, along with rig counts from Baker Hughes. The peak is 9644 kb/d in 2026 for this scenario compared to a 2024 peak at 8810 kb/d in the scenario presented last month.

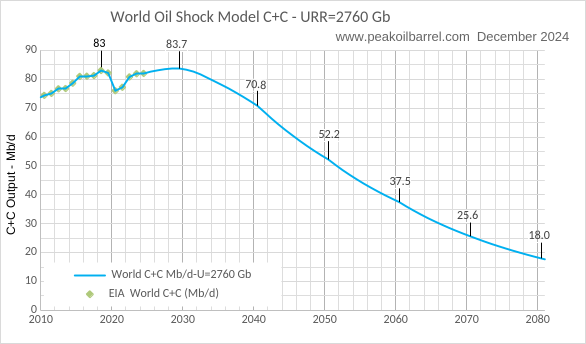

The World C+C estimate gets revised when using this updated tight oil scenario as in the chart above with a peak at 83.7 Mb/d in 2028 and a URR of 2760 Gb (2658 Gb produced by 2100). For those who understand that climate change may be an existential environmental crisis, the scenario above would be considered pessimistic. An optimist might believe there is less crude oil that will be extracted, but I believe that is wishful thinking. I hope I am wrong, but think I am not.