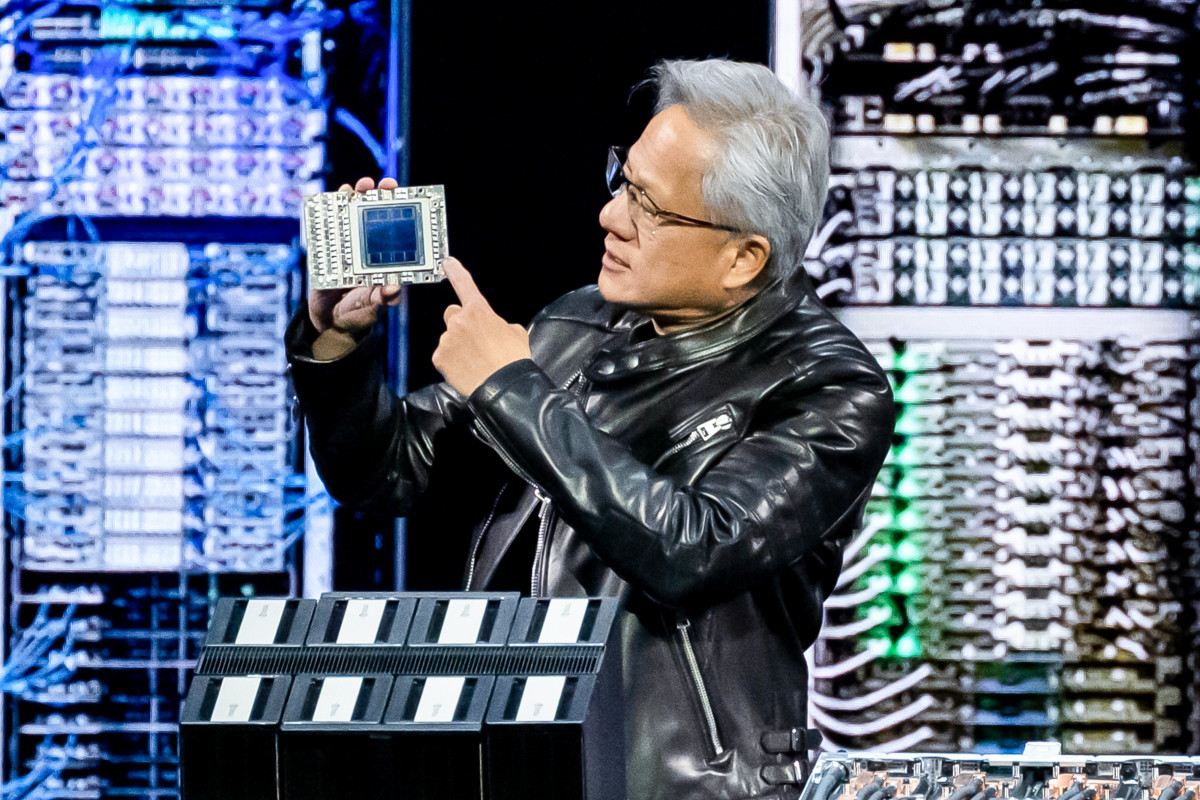

NVIDIA Stock Back In Free Fall

Nvidia (NASDAQ:NVDA) is the biggest beneficiary of the AI rally, but as analysts get more cautious about the AI narrative, those gains are starting to dissipate. NVDA stock has fallen sharply and plunged 12.5% in just the past five days. Many believe the stock could fall even further as fears deepen. Let’s take a look […] The post NVIDIA Stock Back In Free Fall appeared first on 24/7 Wall St..

Nvidia (NASDAQ:NVDA) is the biggest beneficiary of the AI rally, but as analysts get more cautious about the AI narrative, those gains are starting to dissipate. NVDA stock has fallen sharply and plunged 12.5% in just the past five days. Many believe the stock could fall even further as fears deepen. Let’s take a look at what has been happening.

24/7 Wall St. Key Points:

- NVDA stock has been plunging over the past week.

- The company beat earnings estimates but investors remain cautious.

- On top of that, the broader semiconductor market has been gripped by fears. Speaking of Nvidia, grab our free “The Next NVIDIA” report. It includes a software stock with 10X potential.

What’s Happening With Nvidia?

The semiconductor giant is facing a perfect storm of challenges as Trump’s 25% tariff plan is now back in the spotlight. He slapped another 10% on China (on top of the previous 10%). It is now directly impacting systems using Nvidia chips assembled in those regions. Since 56% of Nvidia’s revenue is linked to overseas sales, analysts are fearful of the U.S. climbing up the trade war escalation ladder.

New reports suggest potential expansion of U.S. chip export bans to Singapore and Vietnam as Chinese firms allegedly “launder” advanced chips from those countries.

Moreover, there’s an earnings paradox at play here. Nvidia momentarily satisfied investors by beating earnings estimates in Q4 FY2025. However, that was expected, and Wall Street is second-guessing how much they are paying for Nvidia as time passes since Nvidia’s beat wasn’t big enough to overshadow macro and trade war shocks.

What This Means for NVDA Stock

The reversal in Nvidia’s long-term uptrend could turn into a cyclical downturn for not just Nvidia but the entire chip industry. In the worst-case scenario, a 2022-esque decline may happen. Tariffs could slice off a significant portion of sales. If you add chip bans to both Singapore and Vietnam on top of more restrictions for China, that could possibly even cause a revenue decline.

Analyst Vijay Rakesh from Mizuho thinks this could strip $4 billion to $6 billion from H2 2025 revenue.

In addition, there are fears that the demand for semiconductors will slow down regardless. The DeepSeek spook could rear its head again if an R2 model is introduced earlier than expected.

However, even then, the bearish argument remains speculative. Nvidia has beaten earnings estimates, and the outlook remains pretty solid if you follow the guidance.

It could be worth buying if you think that Trump’s tariffs will end up being a nothingburger again and that chip bans will not end up materializing.

The consensus price target of $169.62 implies 48.62% upside from here.

The post NVIDIA Stock Back In Free Fall appeared first on 24/7 Wall St..