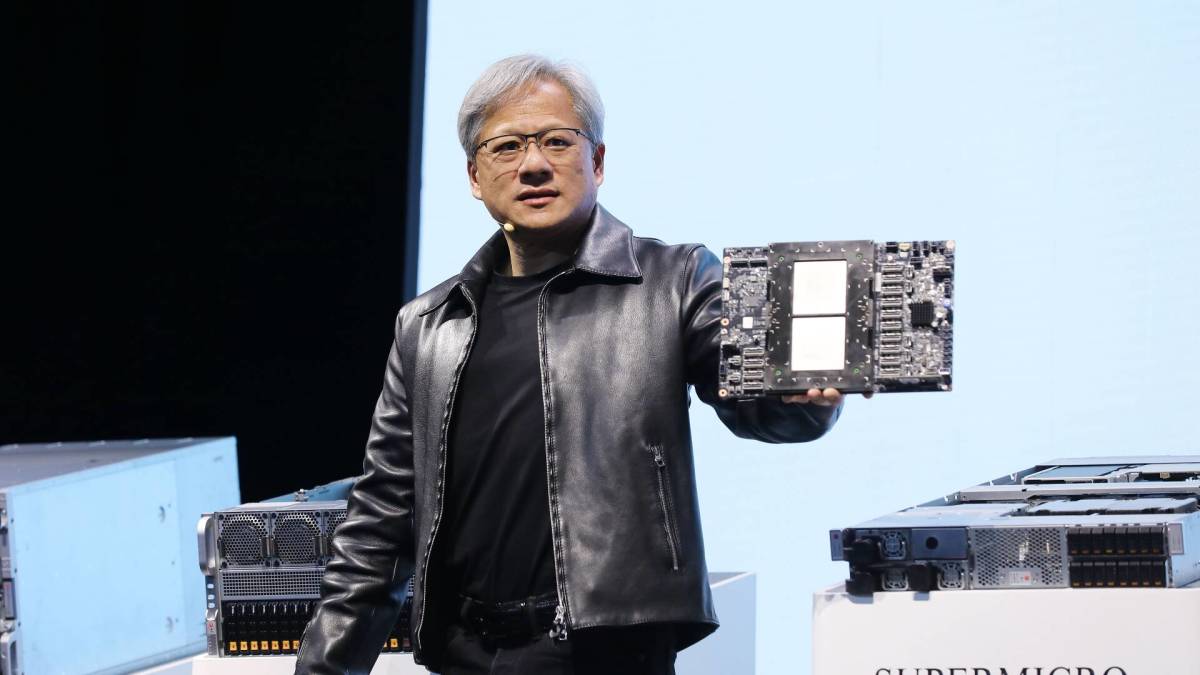

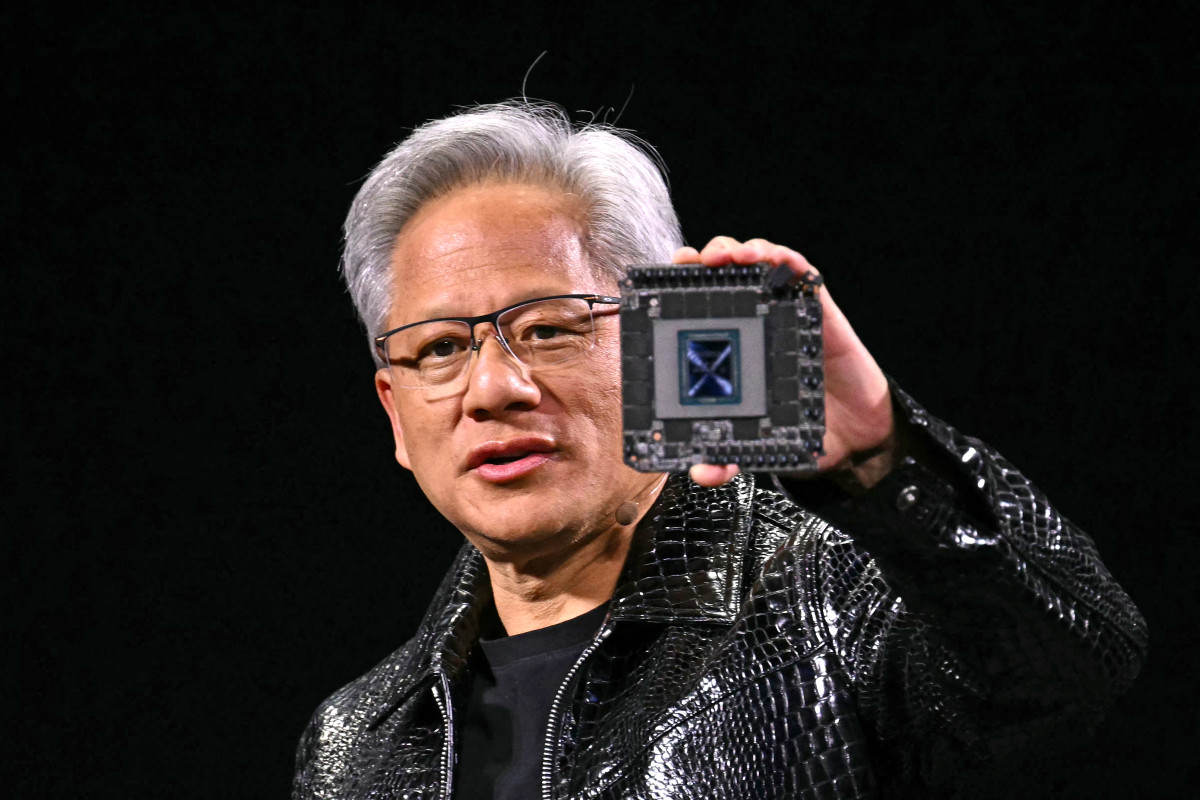

Nvidia CEO Jensen Huang could reboot AI trade with GTC address

The AI trade has stalled this year. Jensen Huang's speech today could change that.

Nvidia shares edged higher in early Tuesday trading as investors looked to the tech giant's highly-anticipated GTC event this week in San Jose to kick-start a rally for the world's leading AI chipmaker.

Nvidia (NVDA) shares touched a six-month low late last week, and remain deeply in the red since the start of the year, amid broader selloff in tech stocks and concerns that increasing competition and a pullback on AI investment spending will weigh on demand for its newly-released line of Blackwell processors.

Investors were also spooked by the emergence of China-based DeepSeek's AI chatbot earlier this year, which the startup claims was built, trained and launched at a fraction of the price of its US rivals using only lower-grade Nvidia 'hopper' line chips.

Nvidia CEO Jensen Huang will have a chance to speak to all of those concerns, while likely unveiling the newest iteration of the Blackwell lineup, Blackwell Ultra, during his keynote address to the GTC conference on Tuesday.

The company says he'll address on the future of agentic AI, robotics and accelerated demand, but investors are likely to focus on his remarks tied to Blackwell demand, AI investment spending from Nvidia's biggest clients and the timing of Rubin, its next-generation processor architecture.

Named after the American astronomer Vera Rubin, who is credited with discovering so-called dark matter, the new Rubin systems are expected to be rolled out in 2026.

“AI is pushing the limits of what’s possible — turning yesterday’s dreams into today’s reality,” Huang said in Nvidia release last week. “GTC brings together the brightest scientists, engineers, developers and creators to imagine and build a better future."

China, tariffs and Blackwell demand

He'll also likely have to weigh in on politics, given the impact that tariffs on Asia-made goods are likely to have on its business model, which relies on a manufacturing base in Taiwan, as well as the likelihood of stricter export rules on high-end technologies to customers in China.

Nvidia remains fundamentally sound heading into the event, even if the stock's momentum has stalled noticeably over the past six months.

The group's fourth quarter earnings, published in late February, included a 78% year-on-year surge in overall revenues, which topped $39 billion, as well a a stronger-than-expected $11 billion contribution from the recently-launched Blackwell line.

Related: Fund manager sends blunt message on Nvidia stock before conference

Nvidia also said it sees current-quarter revenues rising another 10% sequentially, to around $43 billion, amid what the company described as "rapidly rising demand for AI reasoning models and agents."

That said, evidence is starting to mount that some of Nvidia's biggest customers, including Microsoft (MSFT) and Amazon (AMZN) , are slowing AI spending plans amid a longer-than-expected gap between building their new infrastructure and generating bottom-line profits.

AI spending pullback?

Microsoft is reportedly canceling some leases with private data center operators, and slowing the pace of converting other agreements, while Amazon's near-term spending plans suggest an annual pace that's largely in line with the $26.3 billion it spent over the three months ended in December.

The sector-focused VanEck Semiconductor ETF, meanwhile, is down more than 6.5% so far this year, around twice that of the S&P 500, with Meta Platforms (META) the only Magnificent 7 stock in positive territory.

More AI Stocks:

- Nvidia-backed startup could be hottest tech IPO of the year

- Apple blames name-calling glitch on its new AI feature

- Several AI leaders are considering a deal that could save Intel

"We're at the beginning of reasoning AI and inference time scaling," Huang told investors in February. But we're just at the start of the age of AI, multimodal AIs, enterprise AI sovereign AI and physical AI are right around the corner."

"We will grow strongly in 2025," he added. "Going forward, data centers will dedicate most of capex to accelerated computing and AI."

Nvidia shares were marked 0.14% higher in premarket trading to indicate an opening bell price of $119.70 each.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast