New rules could put ’buy now, pay later’ loans on life support

New FICO rules are going to change how a lot of people use BNPL loans.

The idea of buying now and paying later isn't necessarily new, but technology has made getting a short-term loan for a questionable purchase very attractive.

Unlike its retail forebearer layaway, buy now, pay later (BNPL) loans allow consumers to immediately take home their purchase, instead of only owning it after making the necessary payments.

BNPL companies like Affirm, Afterpay, Klarna, PayPal, Sezzle, and Zip offer customers no-interest, pay-in-four-installments loans.

Related: Klarna CEO sounds the alarm on a growing problem

To avoid charging interest, the companies charge the retailer a fee for financing the purchase. The retailer makes the sale (albeit at a slightly reduced proft margin), and the customer buys the item they would have otherwise been unable to afford.

It's easy to see why BNPL has become popular in recent years. One in five consumers with a credit history used the service.

Everyone wins, right?

Except recent data suggests that BNPL loans truly are too good to be true.

Earlier this month, the Consumer Financial Protection Bureau released a study of BNPL users from 2021 to 2023. It found that about 63% of borrowers utilized multiple loans at the same time during some time during the year, and 33% also took loans from multiple BNPL lenders.

Between 2021 and 2022, the average number of loans per borrower rose to 9.5 from 8.5.

The CFPB also found that BNPL lenders approved applicants wth subprime credit scores 78% of the time.

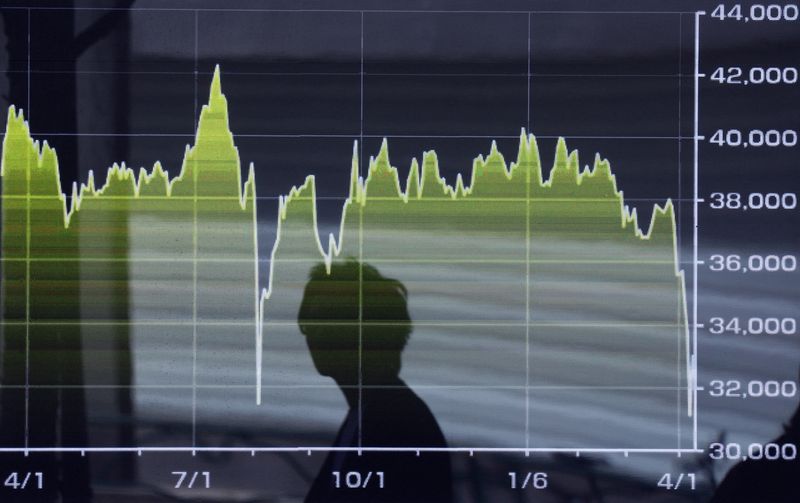

BNPL transactions are expected to reach $108 billion this year, up from $94 billion in 2024. Image source: B4LLS/Getty Images

New FICO rules will make BNPL loans more complicated to access

The growing number of BNPL users tend to be younger, as short-term loan purchases made up 28% of total unsecured consumer debt among borrowers ages 18-24, compared to an average of 17% among borrowers of all age groups.

Since users skew to the younger, less creditworthy end of the spectrum, Fair Isaac Corp., FICO, which dominates the credit reporting scene, said it will debut a new model that factors BNPL loans into users' official credit score.

Related: Huge housing brand franchisee was running a huge con

The Wall Street Journal reports that lenders have been blind to how much debt consumers have accumulated under the loans, since they weren't part of the record.

Affirm began reporting all new loans in April, and the other big players are expected to follow suit soon.

FICO will roll out its new credit scoring system later this year, making the information available to reporting agencies like Experian and Equifax. Those agencies have already made it available to consumers, but are waiting on more data before sharing it with lenders, the Journal reports.

Lending Tree released data in June showing that BNPL loans are becoming a financial burden for many users.

BNPL loans are increasingly underwater, new data shows

About 41% of BNPL loan users were late on at least one payment in the past year, a significant jump from the 34% who were late last year.

Nearly 25% of users say they have had three or more active loans at the same time (though Lending Tree does point out that those respondents tended to be high-income earners).

Perhaps most troubling, 25% of users say they use the loans to buy groceries, a more than 80% increase year over year.

More on personal finance:

- Major housing expert predicts huge change to mortgage rates in 2026

- Social Security faces huge threat sooner than you think

- Fed official makes surprising interest rate cut prediction

Equally concerning is that 33% of users say they use the loans as a bridge to their next paycheck, a 10% increase year over year. This is especially true among high earners, men and younger Americans.

While groceries are a reasonable expense to prompt taking out a short-term loan, BNPL users also spend on frivolous things.

Two-thirds said they considered using the loans for food delivery, and in response, DoorDash and Klarna announced that they would offer that option.

However, users' ignorance about the loans may be the most frightening insight to emerge from the data.

More than six in 10 BNPL users (62%) wrongly believe that making on-time BNPL payments helps their credit score. Only 13% knew that this practice did not affect credit positively.

With these new rule changes, even taking the loan out in the first place will actually ding your score.

Related: Klarna backpedals after making a devastating mistake