Mondelez vs. General Mills: Better Defensive Dividend Stock to Buy for Passive Income?

Many investors discovered the value of playing it defensively the hard way earlier this year following some brutal Liberation Day tariffs that sent shivers down the spine of Wall Street. Indeed, risk exists, even amid one of the biggest technological booms (the AI tailwind is still strong) in recent memory. Of course, defensive dividend stocks […] The post Mondelez vs. General Mills: Better Defensive Dividend Stock to Buy for Passive Income? appeared first on 24/7 Wall St..

Key Points

-

Mondelez and General Mills are fantastic high-yield consumer staple stocks to shelter from tariffs. But which is the better pick to play defense this summer?

-

Mondelez is a fairly-valued growth staple while General Mills is a better pick for value-conscious yield seekers.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

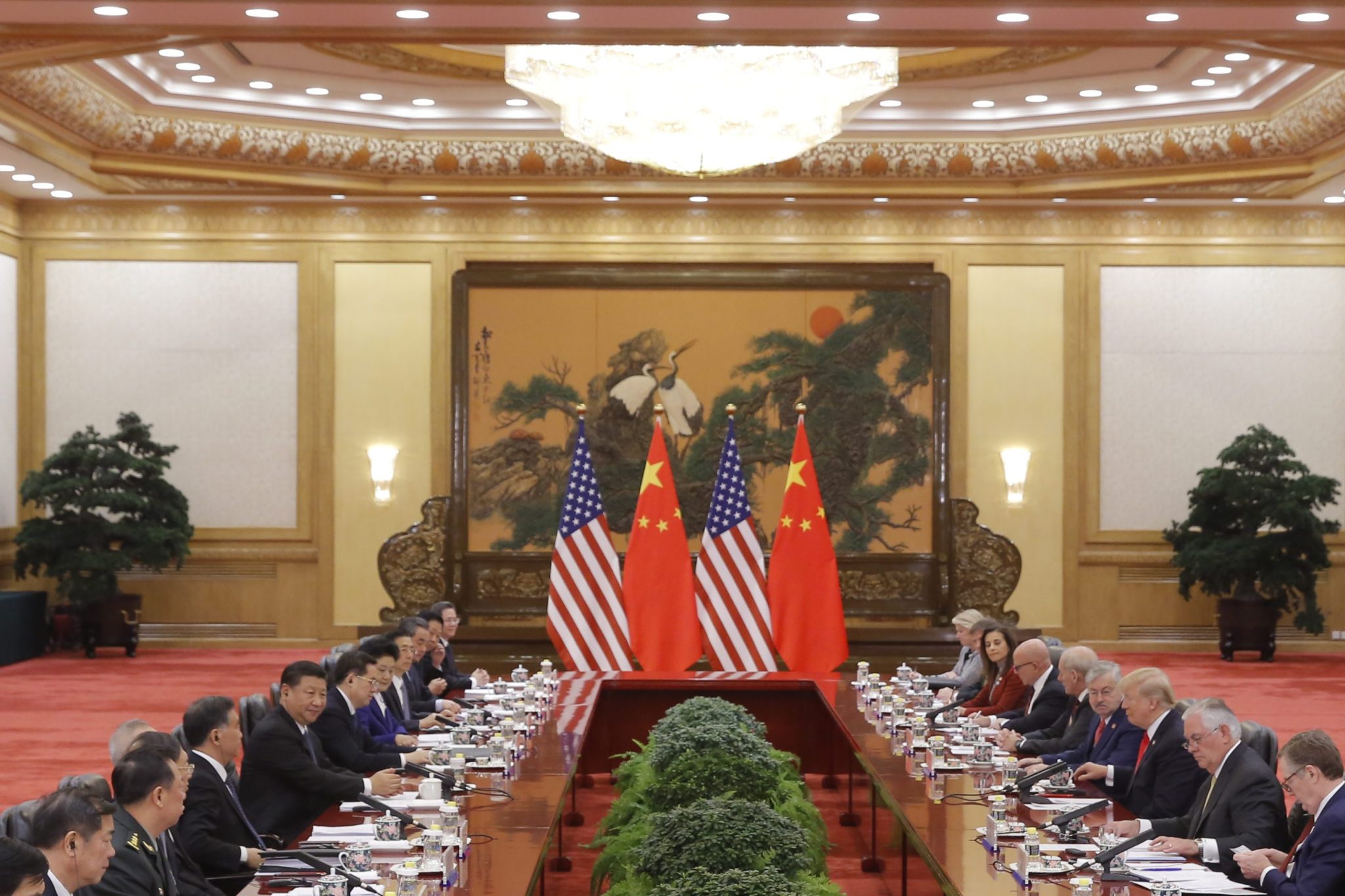

Many investors discovered the value of playing it defensively the hard way earlier this year following some brutal Liberation Day tariffs that sent shivers down the spine of Wall Street. Indeed, risk exists, even amid one of the biggest technological booms (the AI tailwind is still strong) in recent memory.

Of course, defensive dividend stocks may stand to gain less at the hands of a technological revolution as prominent as the AI boom. But, at the very least, many of them can stay upright when the market is walloped with a once-in-a-decade sort of sell-off. As the great Warren Buffett once put it, “Only when the tide goes out do you discover who’s been swimming naked.”

When the bear market ravages global financial markets on any given day, we all saw that boring, old-fashioned stability stocks and defensive dividend payers like Mondelez (NASDAQ:MDLZ) and General Mills (NYSE:GIS) were more than able to keep their cool, at least better than the market. Today, shares of both consumer packaged goods (CPG) companies are in very different spots. Mondelez, the legendary confectionery firm behind Oreo, has seen its shares on the mend of late, gaining close to 13% year to date, recovering much of the ground it and many other CPG plays lost during the Ozempic craze.

In any case, let’s look at both of the consumer staple dividend plays to see which is the better way to play defense in the face of a recession.

Mondelez

Despite the tariff shock, things have been looking up for Mondelez. And the second half of 2025 could stay bright as more investors rotate back into the tried and proven defensives. Of course, cocoa prices have been a bit of a worry for Mondelez, and the full extent of the GLP-1 headwind remains unclear over the long run. Either way, until consumers reach for generics over the Oreos, I’d continue to treat Mondelez as one of the highest quality consumer staple stocks out there.

Today, the sweets stock is down around 14% from its all-time high to go with a 2.8% dividend yield. The yield isn’t all too sweet compared to other yield-heavy consumer staple stocks. However, Mondelez is a very well-managed firm with a wide moat and more growth than most other CPG stalwarts as it expands its offering internationally.

Mizuho analyst John Baumgartner is a fan of Mondelez’s brand portfolio and its geographic diversification. Though he recently lowered his price target modestly, he thinks the firm is relatively well-insulated from the same cocoa shocks that have weighed down the CPG stocks more heavily invested in chocolate. As cocoa prices cool off while more people look for a cheap treat at the grocery store, I’d not bet against Mondelez as the economy is tested with a tariff downturn. The stock trades at 24.9 times trailing price-to-earnings (P/E). Not cheap, but if you want a premier, higher-growth defensive dividend stock amid rising recession risks, that’s the price of admission.

General Mills

General Mills is a staple around the breakfast table, but amid secular weakness in cereals, GIS stock has been a real laggard. The stock peaked back in early 2023, and it’s been painful ever since. With the stock touching a new six-year low of $54 and change, I think there’s real value to be had by investors seeking more insulation from broader market volatility. Sure, the stock is in an accelerating bear market, now off 14% year to date and 40% from all-time highs. A lower full-year guide and a Q3 sales miss aren’t all too encouraging, either.

That said, the stock looks dirt-cheap at 11.9 times trailing P/E. And the dividend looks even sweeter at 4.4%. Combined with a 0.05 beta (one of the lowest you’ll come by), buying the dip could make sense for those looking for less correlation to the S&P 500. Though General Mills has its unique slate of issues, I think they’re more than manageable for those seeking deep value in a rocky market.

Between Mondelez (the growth play) and General Mills (the value and yield play), I’d have to go with the latter. The stock is way too cheap to ignore, especially given management’s willingness to innovate and cater to consumers who are increasingly gravitating towards health-conscious products. General Mills is all aboard the health and wellness trend. And that should work out for them as they attempt to stage a comeback after some brutal headwinds, which may be mostly baked into the stock at today’s depressed multiples.

The post Mondelez vs. General Mills: Better Defensive Dividend Stock to Buy for Passive Income? appeared first on 24/7 Wall St..