Ethereum's new staking limit is not a risk to decentralization, says Consensys researcher

Ethereum’s Pectra upgrade doesn’t pose a threat to decentralization, according to Mallesh Pai, senior research director at blockchain software firm Consensys, describing the update as a cleanup of the behind-the-scenes “busy work” currently handled by validators. During a May 9 Cointelegraph X Space, Pai said a validator’s chances of proposing a block or earning rewards remain tied to how much ETH they hold, adding that larger validators don’t gain any new advantages under the upgrade: “Rewards continue to be proportional to the amount of ETH you have. […] it's not the case that if you're a big validator, you somehow have any more advantages than you did before.”Pectra is Ethereum’s most extensive network upgrade since the Merge took place in September 2022. Pectra allows validators to stake as much as 2,048 ETH, up from the previous limit of 32 ETH. The new standard has raised community concerns about the risks of centralization on the network.According to Pai, the Pectra upgrade has taken “a bunch of busy work that the network was doing behind the scenes and removed it.”Pai noted that while there are about a million technical validators on Ethereum, many aren’t truly distinct — large validators often operate numerous virtual keys from a single physical machine. With the Pectra upgrade, those keys can now be consolidated — something he says they are already seeing.“In the best case, we’ll get to about 30,000 validators,” he said, adding that this consolidation reduces auxiliary work and enables network stakeholders to focus on what matters, such as lowering gas limits.Related: Ethereum Pectra upgrade adds new features — How long before ETH price reacts?New Pectra staking limit paves the way for institutionsThe new limit could pave the way for institutions to stake ETH, according to Artemiy Parshakov, vice president of institutions at Ethereum staking service P2P.org. “EIP-7002 makes institutional staking much easier to integrate without taking too much risk.”Ether staking within exchange-traded funds has been a hot topic in 2025. BlackRock has said that the successful Ether ETFs are less perfect without staking, and multiple financial institutions have filed for amendments to their Ether ETFs to allow for staking.If approved, investors might be more inclined to buy into the ETFs, as they could receive yield. The SEC has yet to rule on staking amendments. Bloomberg ETF analyst Eric Balchunas recently forecast in a podcast interview that if staking were to be approved for Ether ETFs, it would have “a little impact” on inflows. “The bigger problem with Ethereum is performance; it just doesn’t ever go on a nice long rally.”Magazine: Pectra hard fork explained — Will it get Ethereum back on track?

Ethereum’s Pectra upgrade doesn’t pose a threat to decentralization, according to Mallesh Pai, senior research director at blockchain software firm Consensys, describing the update as a cleanup of the behind-the-scenes “busy work” currently handled by validators.

During a May 9 Cointelegraph X Space, Pai said a validator’s chances of proposing a block or earning rewards remain tied to how much ETH they hold, adding that larger validators don’t gain any new advantages under the upgrade:

“Rewards continue to be proportional to the amount of ETH you have. […] it's not the case that if you're a big validator, you somehow have any more advantages than you did before.”

Pectra is Ethereum’s most extensive network upgrade since the Merge took place in September 2022. Pectra allows validators to stake as much as 2,048 ETH, up from the previous limit of 32 ETH. The new standard has raised community concerns about the risks of centralization on the network.

According to Pai, the Pectra upgrade has taken “a bunch of busy work that the network was doing behind the scenes and removed it.”

Pai noted that while there are about a million technical validators on Ethereum, many aren’t truly distinct — large validators often operate numerous virtual keys from a single physical machine. With the Pectra upgrade, those keys can now be consolidated — something he says they are already seeing.

“In the best case, we’ll get to about 30,000 validators,” he said, adding that this consolidation reduces auxiliary work and enables network stakeholders to focus on what matters, such as lowering gas limits.

Related: Ethereum Pectra upgrade adds new features — How long before ETH price reacts?

New Pectra staking limit paves the way for institutions

The new limit could pave the way for institutions to stake ETH, according to Artemiy Parshakov, vice president of institutions at Ethereum staking service P2P.org. “EIP-7002 makes institutional staking much easier to integrate without taking too much risk.”

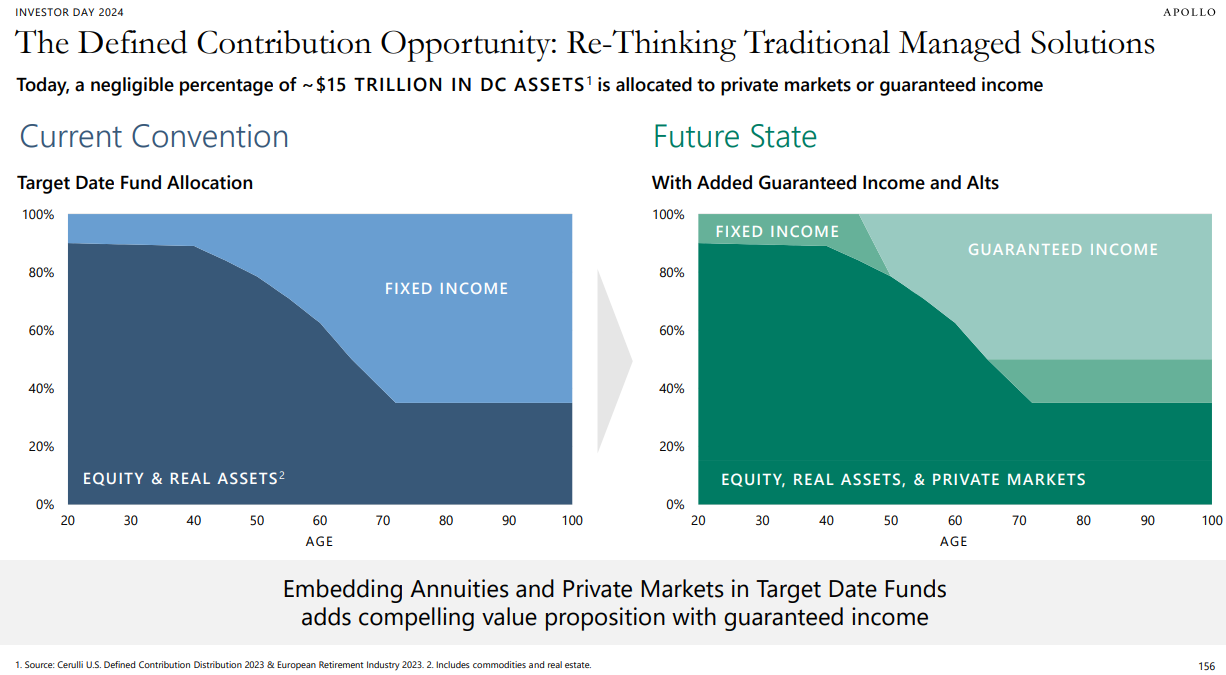

Ether staking within exchange-traded funds has been a hot topic in 2025. BlackRock has said that the successful Ether ETFs are less perfect without staking, and multiple financial institutions have filed for amendments to their Ether ETFs to allow for staking.

If approved, investors might be more inclined to buy into the ETFs, as they could receive yield. The SEC has yet to rule on staking amendments.

Bloomberg ETF analyst Eric Balchunas recently forecast in a podcast interview that if staking were to be approved for Ether ETFs, it would have “a little impact” on inflows. “The bigger problem with Ethereum is performance; it just doesn’t ever go on a nice long rally.”

Magazine: Pectra hard fork explained — Will it get Ethereum back on track?