Japan prepared to use its role as America’s largest creditor as leverage in Trump trade talks

The White House confirmed a report in the Wall Street Journal that automakers won’t face additional tariffs for goods like steel and aluminum.

- No country holds more provable Treasury debt than Japan with roughly $1.1 trillion, equivalent to a quarter of its entire economy. Since dumping U.S. sovereign bonds would severely hurt both Japan and the United States, investors view the threat as a psychological tactic to exert pressure as the clock ticks down on Trump's 90-day tariff pause.

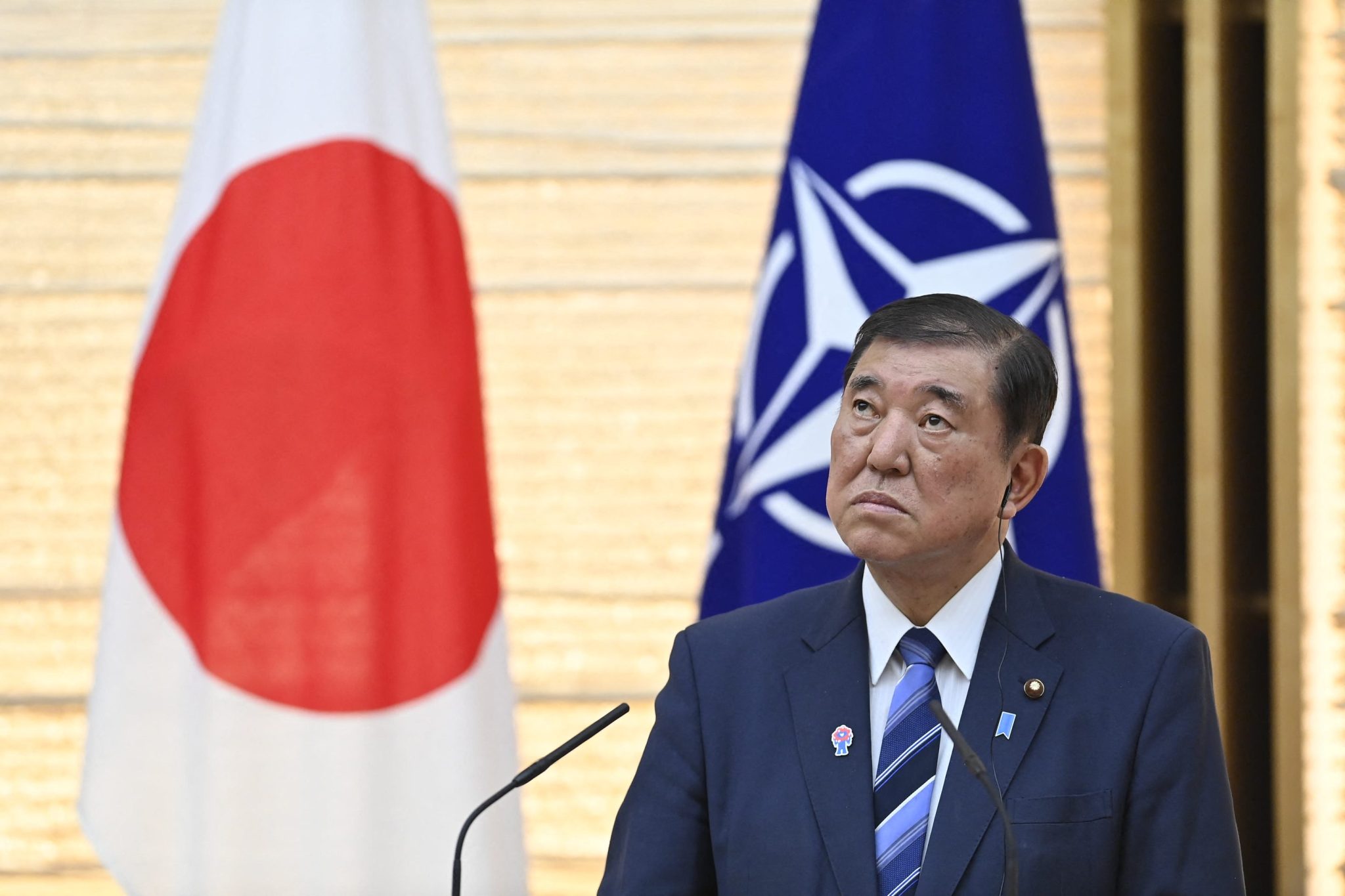

Call it the nuclear option—a last resort that could unleash mutually assured financial destruction for two allies joined at the hip. Japan is prepared to use its role as America’s single largest creditor as a bargaining chip in ongoing trade negotiations with the Trump administration.

On Friday, a senior member of the government said the stockpile, primarily maintained to periodically intervene in foreign exchange markets, would also serve as an emergency deterrent to protect against maximal demands from the White House.

“We obviously need to put all cards on the table in negotiations. It could be among such cards,” finance ministers Katsunobu Kato was quoted as saying. “Whether we actually use that card, however, is a different question.”

No other country is proven to currently own more U.S. sovereign debt. Japan's holdings of some $1.1 trillion in Treasury bond holdings represents a gargantuan sum, equivalent to roughly a quarter of its gross domestic product.

Treasury yields are the Achilles Heel of the U.S. economy. If a bondholder were to dump enough sovereign bonds it could tank their price, causing borrowing costs for a debtor nation like the U.S. to spiral out of control. Already servicing the U.S. national debt is more expensive than funding the military.

Ripple effects could radiate outward affecting maturities along the entire yield curve and raising the cost of home mortgages and car loans. All securities, equities included, are furthermore priced off Treasury bonds, since their interest rate guarantees the risk-free return every investor can expect.

Negotiating tactic to exert psychological pressure as trade talks stall

While the fallout from unloading bonds would undoubtedly be severe for Tokyo, with the yen soaring versus the dollar, the consequences for a U.S. economy dependent on foreign goodwill to underwrite its consumer-driven lifestyle could potentially be far more devastating.

That’s why investors believe it is little more than a negotiating tactic to exert psychological pressure. “Playing the card early while the U.S. bond market is in the minds of the administration after recent weeks is a smart move,” said Martin Whetton, head of financial markets strategy at Westpac in Sydney, in comments reported by Reuters.

Yields on 10-year Treasuries would seem to agree, remaining roughly stable at 4.22% on Friday.

Trump has tried to convince voters that key U.S. allies including Japan have gotten a free ride for decades, ripping off the American people.

Last month his administration pulled the trigger on a 90-day period to negotiate more favorable deals and the clock is now ticking for the White House to deliver on its promises just as the U.S. economy is shrinking. This may explain why foreign governments have thrown cold water on optimistic Trump officials talking up the potential for swift deals.

“We have not yet reached a point where common ground has been found,” Japanese prime minister Shigeru Ishiba told reporters on Friday after the second round of negotiations ended without a breakthrough. (This week Japan has been slightly more optimistic, with its lead negotiator admitting "concrete negotiations" had taken place and could continue in May.)

Japan's geostrategic alliance with the United States tested

Tokyo does maintain a considerable trade surplus. Including services, Japan exported $64.3 billion more than it imported with the United States last year, according to the official government statistics. Some $149 billion worth of goods brought into the U.S. were shipped from the country.

But Japan isn’t just another large market like Germany with which America trades — it’s a key strategic partner on the doorstep to Indo-Pacific rival China. Underpinning the U.S. economic ties with Japan is a symbiotic security relationship exemplified by the large American military presence on Okinawa that gives the Pentagon a beachhead in the region.

That’s why its so rare for Japan to use its role as America’s number one creditor to level veiled threats. The only comparable instance came in 1997 when the-then prime minister, Ryutaro Hashimoto, briefly sparked a market panic by before it was dismissed as empty saber rattling.

At the time, investment bank Merrill Lynch argued Hashimoto’s suggestion Japan could sell Treasuries “may be a threat, but it’s a very empty one,” since it would “throw global financial markets into turmoil” and damage Japan in the process.

This story was originally featured on Fortune.com