Is Tesla Stock the Smartest Investment You Can Make Today?

Tesla's (NASDAQ: TSLA) stock is undoubtedly risky, but then again, so are many other stocks on the market, and there's no such thing as a reward without risk. The question is whether the risk/reward calculation makes sense for Tesla stock. Here's one view on matters.It's easy to point at the stock's current valuation based on earnings, cash flow, and sales and quickly conclude that the stock is ridiculously overvalued. For example, here's a look at Tesla's enterprise value (market cap plus net debt) to earnings before interest, taxation, depreciation, and amortization (EBITDA) compared to other companies and another one of the so-called "Magnificent Seven" stocks, Google owner Alphabet (NASDAQ: GOOG)There is no way around it -- Tesla's valuation as a car company alone doesn't add up.Continue reading

Tesla's (NASDAQ: TSLA) stock is undoubtedly risky, but then again, so are many other stocks on the market, and there's no such thing as a reward without risk. The question is whether the risk/reward calculation makes sense for Tesla stock. Here's one view on matters.

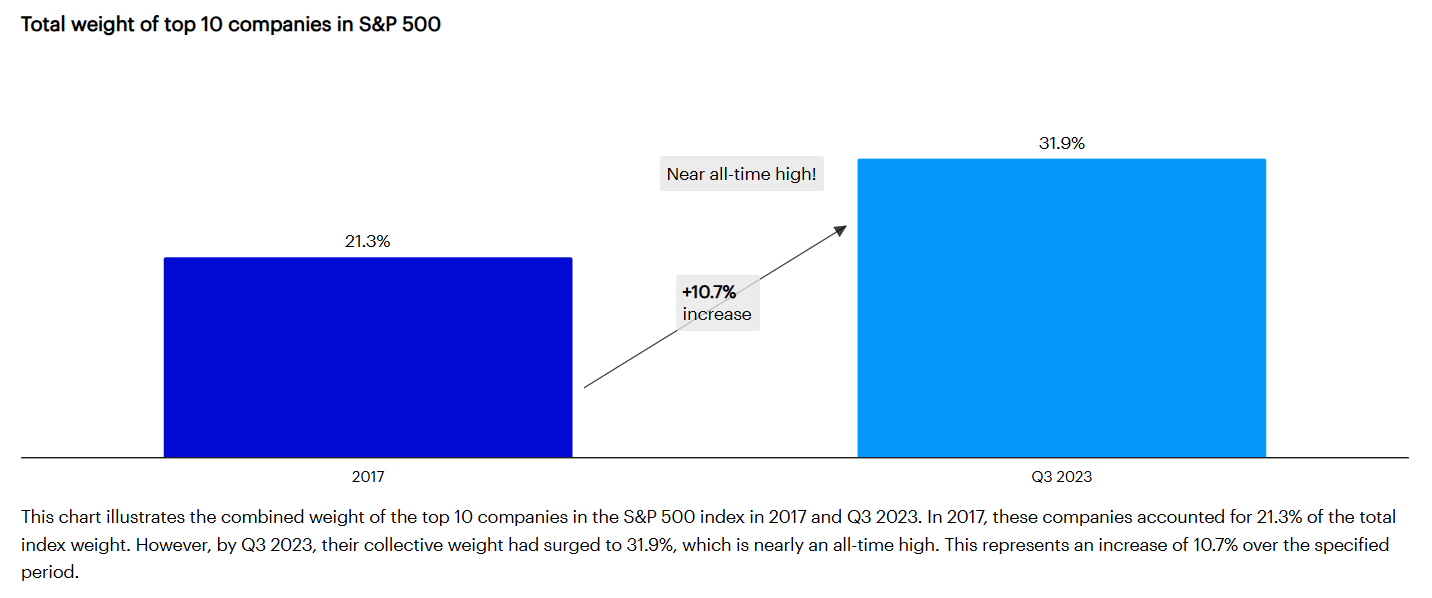

It's easy to point at the stock's current valuation based on earnings, cash flow, and sales and quickly conclude that the stock is ridiculously overvalued. For example, here's a look at Tesla's enterprise value (market cap plus net debt) to earnings before interest, taxation, depreciation, and amortization (EBITDA) compared to other companies and another one of the so-called "Magnificent Seven" stocks, Google owner Alphabet (NASDAQ: GOOG)

There is no way around it -- Tesla's valuation as a car company alone doesn't add up.