Insider Buying Surges in May. Especially These 5 Stocks

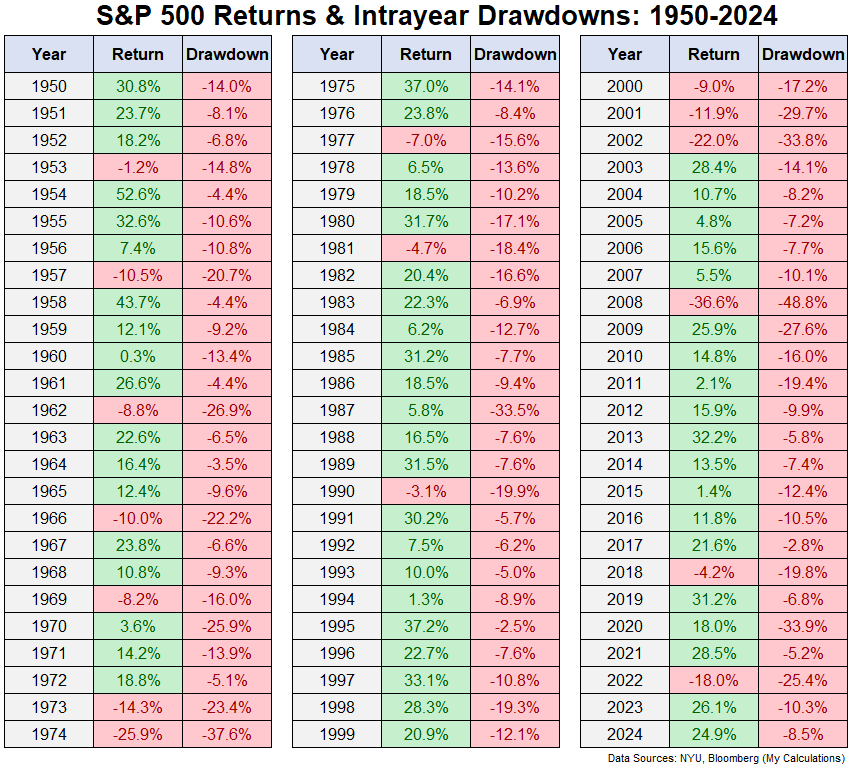

The Securities Act of 1934 established many of the US rules for the securities market in the aftermath of the 1929 Stock Market Crash that ushered in The Great Depression. In particular, anyone who has attained a 5% stake or greater in a particular security was required to file Form 13D for official public disclosure. […] The post Insider Buying Surges in May. Especially These 5 Stocks appeared first on 24/7 Wall St..

The Securities Act of 1934 established many of the US rules for the securities market in the aftermath of the 1929 Stock Market Crash that ushered in The Great Depression. In particular, anyone who has attained a 5% stake or greater in a particular security was required to file Form 13D for official public disclosure. Material ownership of any significant size is important information for the investing public, since any changes of ownership to that degree could have a positive or negative effect on the market price, and thus give an unfair advantage to larger stockholders.

Insider buying or selling from management, board members or famous investors like Warren Buffett can indicate upcoming news events that would tangibly escalate or scuttle a stock’s market price. For those who already have an inside track on a company due to their currently large or accumulating holdings, adding to those positions are a bullish sign.

Key Points

-

Insider buying from board members, management executives, and large position shareholders is often a hint of upcoming positive news that will boost a stock’s price.

-

13D filings with the SEC are one of the primary official means by which public disclosure of insider buying occurs, albeit for 5% or more shares. Failure to file 13D forms promptly can trigger civil and criminal penalties.

-

It is helpful to distinguish actual stock purchases of new stock as opposed to stock that may be part of compensation or transferred from other accounts, which may register as insider buying but are actually stock already in an insider’s possession.

-

Are you ahead or behind on retirement goals? SmartAsset’s free tool can match you with a financial advisor in minutes to help you find out. Each advisor has been carefully vetted and must act in your best interests. Don’t waste another minute – get started by clicking here.(Sponsor)

Sonoco Products Company

- Coker R. Howard, CEO: bought 20,000 shares on 5-1-2025. Cost: $823,472

- Robert R. Hill, Jr., Director: bought 5,475 shares on 4-30-2025. Cost: $220,859.60

- John R. Haley, Director: bought 2,246 shares on 5-2-2025. Cost: $100,100.18

As April drew to a close and progressed to May, Sonoco (NYSE: SON) reported some sizable insider buying activity from CEO Coker Howard and Directors Robert Hill and John Haley. The three insiders bought over $1.15 million worth of Sonoco stock on the open market after the company released positive Q1 earnings. However, despite record net sales of $1.7 billion (up 31%) and a 23% gain in EPS, the stock sold off over 11%. Messrs. Howard, Hill and Haley must have thought this was a buying opportunity, as they promptly scooped up over 27,000 shares within the next 72 hours.

What hints might be gleaned from this move? In a more careful look at the earnings report and investor call transcript, the selloff seemed to be preoccupied with a decrease in industrial packaging business, higher tax rate, and the prospect of European market softness in the wake of tariffs.

On the other hand, Sonoco also saw a 127% EBITDA growth in its consumer packaging sector, $1.56 billion in after-tax proceeds for debt reduction, and a 24-month target savings of $100 million from metal packaging due to its acquisition of Eviosys.

In the investor call, Coker alluded to 66% of sales being related to food packaging, and that its local market focused network significantly “reduced the company’s cross-border and tariff disruption risk”. The lack of detail on this strategy might well be the card of Sonoco’s sleeve as to why its insiders jumped to buy when the occasion arose.

Walgreens Boots Alliance Inc.

- Pessina Stefano, Exec. Chairman: Bought 832,258 shares on 4-27-2025. Cost: $145.26 million

When marquee public companies become ensconced in the Mergers & Acquisitions game, it can foster speculation, but when the major players make a move – they usually do so because they have a profit in mind.

Walgreens in the US and Boots in the UK are two of the most ubiquitous drugstore, cosmetic, and personal care products retail chains operating today. With 8,000 outlets, and 9 million daily customers, Walgreens Boots Alliance is a huge international enterprise, as it also has retail outlets or subsidiaries in Ireland, Germany, Thailand, Mexico, and Chile. Walgreens Boots Alliance Inc. (NASDAQ: WBA) is the present public entity holding both companies.

It has become no secret that WBA is involved in a deal to be taken private by private equity group Sycamore for a projected $23.7 billion. WBA’s Executive Chairman and largest shareholder is Stefano Pessina, who was instrumental in the 2014 merger of Walgreens and Boots. His 17% WBA stake is expected to be increased to roughly 30% as a result of his $145 million purchase of 832,258 additional shares, officially filed in a 13D at the end of April. .

Pessina’s aggressive bullishness would seem to indicate that he believes the Sycamore deal will go through, and at a higher price than its $11 per share range. The Sycamore deal is estimated to be for $11.45 per share, but WBA’s latest Q2 $38.6 billion revenues beat estimates, so it begs the question if a higher price is in the works behind the scenes.

TriMas Corp.

- Shawn Sedaghat, Director: Bought 123,388 shares. Cost: $2.94 million

- Shawn Sedaghat, Director: Bought 16,930 shares. Cost: $406,100

- Herbert K. Parker, Director: Bought 14,612 shares. Cost: $304,128

- Teresa Finley, CFO: Bought 14,388 shares. Cost: $303,865

Based out of Bloomfield Hills, MI, TriMas Corp. (NASDAQ TRS) manufactures a variety of utility products for other industries in 4 divisions:

TriMas reported Q4 2024 earnings in February. It reported $241.67 million in sales, up 6.4% year over year. Adjusted EBITDA increased 13.5%, and EPS rose 24.3%. Interestingly, April saw significant insider buying in April by Directors Shawn Sedaghat and Herbert Parker, as well as from CFO Teresa Finley. The total 169,318 shares cost $3.95 million. Earlier in February and March, Finley and other insiders apparently bought $22.27 million worth of TRS.

With Q1 2025 earnings reports coming up later on in May, this level of bullish sentiment would hint that there is positive news in the works. While the company announced the debut of new beauty industry dispensers and pumps to be unveiled at the Luxe Pack NY and China Beauty Expo trade shows, a new aerospace development related to TriMas’ acquisition of GMT Aerospace would be a best guess, based on manufacturing issues faced by its rivals in supplying parts for Airbus that were alluded to by CEO Thomas Amato.

MicroStrategy Inc.

- Executive Chairman Michael Saylor and 3 unnamed insiders: Cumulative purchase of MSTR preferred shares: $680,000.

MicroStrategy Inc. (NASDAQ: MSTR) was founded in 1989 by Michael Saylor and two other partners. As the burgeoning use of computers began to pervade ubiquitously to all businesses large and small, Saylor found a niche need. The data from all of the increased volume of transactions and other computer uses for internal operations held value if it could be compiled and analyzed for trends, deficiencies, and other business aspects. The data mining and business intelligence analytical software became the core of MicroStrategy.

Due to Michael Saylor’s obsession with cryptocurrency Bitcoin (BTC), MicroStrategy’s emphasis, by virtue of its large Bitcoin holdings, has become, in the eyes of investors and analysts alike, a BTC proxy investment. The stock’s +175% 12-month gains are mostly attributed to its commensurate BTC appreciation.

MicroStrategy’s recent preferred stock offering to further expand its BTC acquisition binge has met with enthusiasm on the street. Saylor reportedly purchased 6,000 shares for himself, and 3 other insiders followed, amounting to $680,000. Saylor’s overall game plan is to raise a total of $84 billion. He anticipates a 25% BTC yield and $15 billion in BTC gains by the end of 2025. As of May 2, MicroStrategy had reportedly raised $28.3 billion with $56.7 billion targeted over the next 32 months.

TD Cowen analyst Lance Vitanza was quoted as calling Saylor’s strategy “aggressive perhaps, but by no means out of the question.” Given that MSTR has gained nearly 150 points between April 8th and May 2nd, watching for dips may be opportunities, as there are apparently enough market bulls that share Saylor’s vision.

BioCardia, Inc.

- Andrew Scott Blank, Chairman: Bought 131,233 shares on 4-23-2025. Cost: $249,999

- Simon Stertzer, Director: Bought 104,986 shares on 4-23-2025. Cost: $199,998

Sunnyvale, CA headquartered BioCardia, Inc. (NASDAQ: BCDA) is a biotech company with a commercial device to aid insertion of catheters, guidewires and other devices, with a high profile cardio treatment currently in FDA Phase 3 trials. Chairman Andrew Scott Blank and Director Simon Stertzer, MD, bought a combined 236,219 shares on the open market for roughly $450,000 towards the end of April.

Phase 3 FDA trial results for BioCardia’s CardiAMP HF treatment had been announced at the beginning of April, highlighting the following:

- CardiAMP HF demonstrated a 47% risk reduction in heart death equivalents and a 16% risk reduction in cardiac events.

- BioCardia observed a clinically meaningful 10.5% quality of life improvement scores and a 13.9 meter six minute walk distance improvement.

Given that there is presently no currently existing therapy that can reduce mortality, BioCardia believes that CardiAMP HF can be instrumental in not only reducing mortality, but in helping to lower the costs of cardiac failure patient care.

Given that Dr. Stertzer previously founded Arterial Vascular Engineering, a public angioplasty company that was later sold to Medtronic, BioCardia likely has a strong likelihood of being able to commercialize CardiAMP HF in the not too distant future, if the insider buying is any indication.

The post Insider Buying Surges in May. Especially These 5 Stocks appeared first on 24/7 Wall St..