In Less Than 3 Years, The Bitcoin Price Will Change Forever?

Bitcoin Magazine In Less Than 3 Years, The Bitcoin Price Will Change Forever? Bitcoin’s price has long been driven by its 4-year halving cycle, but by 2028, this cycle may lose its influence. This post In Less Than 3 Years, The Bitcoin Price Will Change Forever? first appeared on Bitcoin Magazine and is written by Conor Mulcahy.

Bitcoin Magazine

In Less Than 3 Years, The Bitcoin Price Will Change Forever?

Bitcoin has long followed a predictable pattern driven by its halving events, which occur approximately every four years. These halving events, where the block reward for miners is halved, have historically been followed by significant Bitcoin price surges. However, as we move toward the next halving in 2028, many are questioning whether the old 4-year cycle will continue or if Bitcoin is on the cusp of a more fundamental change. In this article, we delve into the current state of Bitcoin’s market dynamics, how the 4-year cycle has shaped its history, and what the future holds for this revolutionary asset.

The 4-Year Cycle: The Historical Surge Pattern Of The Bitcoin Price

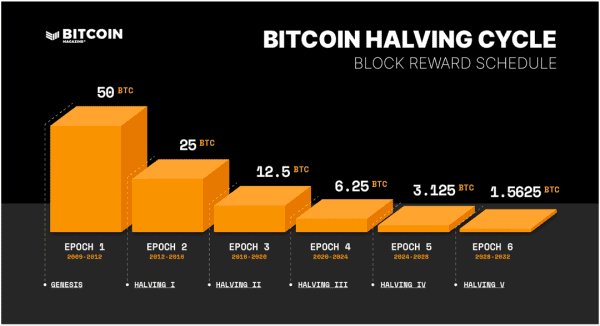

Halving events have been pivotal moments in its history, directly impacting the bitcoin price. Each halving reduces the block reward for miners by 50%, leading to a decrease in the issuance rate of bitcoin. The result is often a significant price increase as the reduced supply of new coins drives up demand. Historically, Bitcoin has experienced substantial price surges in the year following each halving event, albeit with some variation between cycles.

In the first halving event in 2012, the reward dropped from 50 BTC to 25 BTC per block, leading to a surge in bitcoin’s price that reached a peak in 2013. The second halving in 2016, which reduced the reward from 25 BTC to 12.5 BTC, was followed by a significant bull run, culminating in bitcoin’s meteoric rise to nearly $20,000 in December 2017. The third halving in 2020, reducing the reward to 6.25 BTC, preceded a rally that saw bitcoin’s price surpass $60,000 in 2021.

A Year After the 2024 Halving: A Softer Price Action Than Expected

However, the latest halving in April 2024 has seen a different kind of price action. While there was some positive appreciation in bitcoin’s price, the massive exponential growth that many expected has been notably absent. As of the one-year mark after the halving, bitcoin’s price has risen by about 40%, which, while positive, is far below the explosive returns seen in previous cycles, such as the 2020-2021 rally.

Historically, Bitcoin’s price has experienced a period of consolidation following each halving event, where the market adjusts to the new inflation rate. After this adjustment phase, a substantial rally usually ensues within the next 12 to 18 months. Given that bitcoin has shown some positive movement, many still anticipate the price to rise significantly in the second half of 2025, following the typical post-halving cycle.

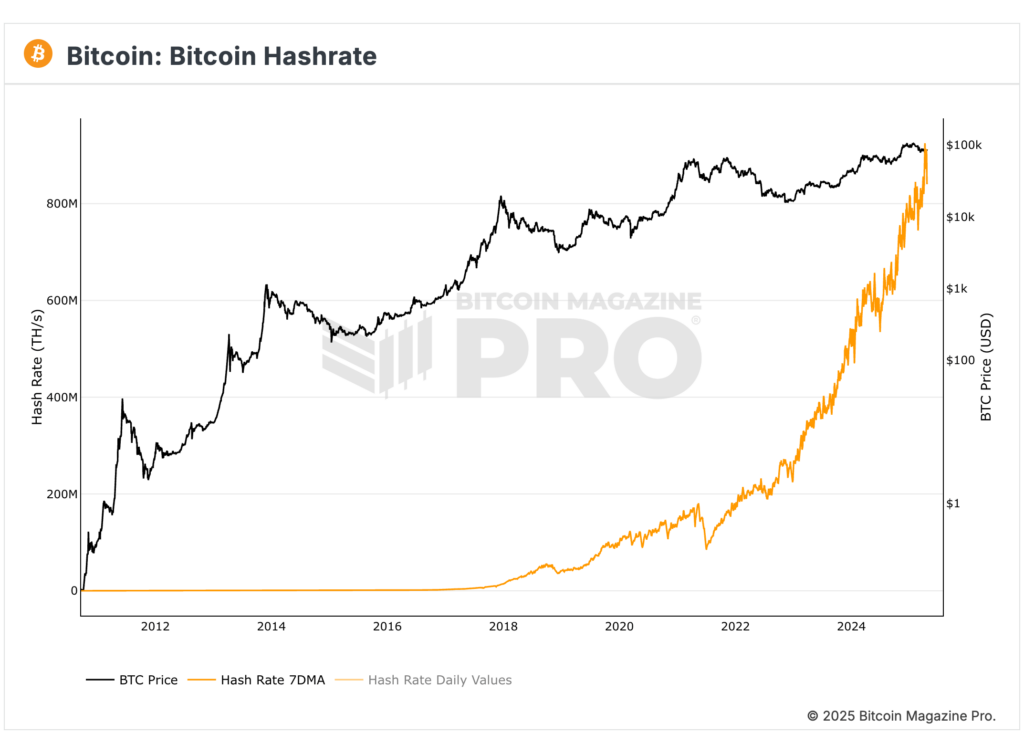

Bitcoin’s Hashrate and Miner Revenue: An Important Signal

One of the more important indicators of Bitcoin’s health post-halving is its hashrate, which refers to the total computational power of the network. Since the halving event in 2024, Bitcoin’s hashrate has continued to climb. In fact, the hashrate has surged by almost 50%, despite the reduction in miner rewards. This is a testament to the growing strength of Bitcoin’s network and the increasing competition among miners to secure the block rewards.

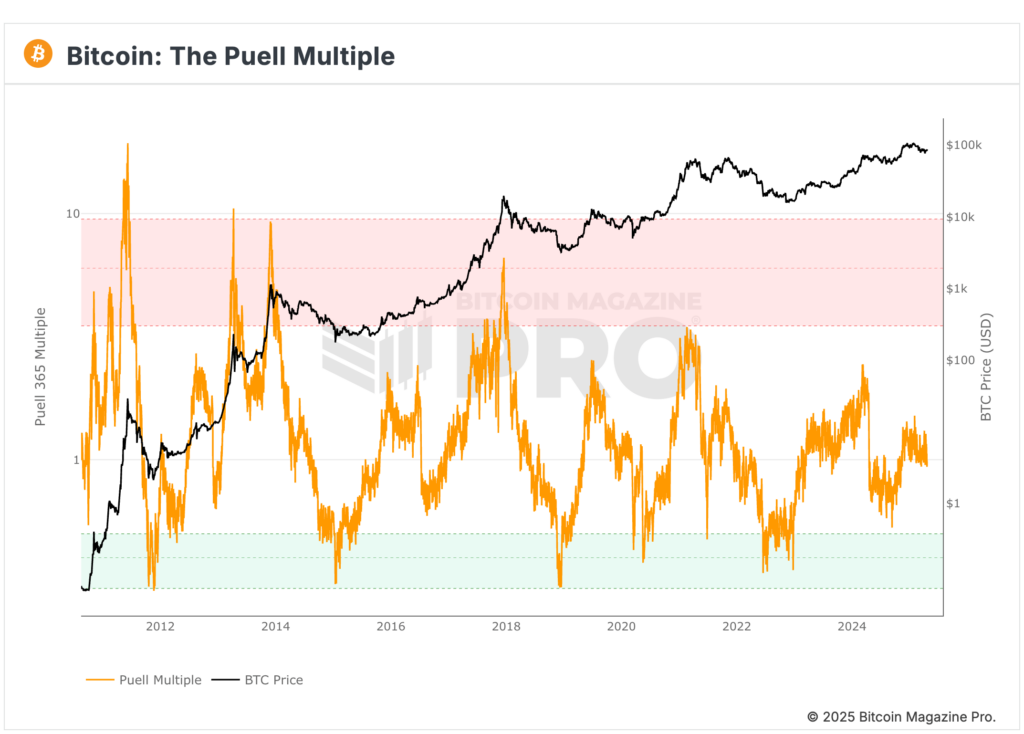

Additionally, Bitcoin’s Puell multiple, which measures miner revenue relative to the network’s price, also dropped significantly after the halving. However, it has since rebounded, signaling that the market is stabilizing and preparing for the next phase of the cycle. These indicators suggest that Bitcoin’s fundamental network strength is intact, even as the market adjusts to a lower block reward.

The End of the 4-Year Cycle: What’s Changing?

Despite the strength of Bitcoin’s network and the continued institutional interest, there are signs that the traditional 4-year halving cycle may no longer be as relevant in the future. As of now, 94.5% of Bitcoin’s total supply has already been mined, and by the time of the next halving in 2028, nearly 97% of all Bitcoin will be in circulation.

The reduced flow of new BTC into the market means that the price may no longer be as influenced by the halving events. The amount of new BTC being mined daily after the 2028 halving will be minimal—only around 225 BTC per day, a number that will barely register on daily inflows compared to current levels of tens of thousands of BTC.

As the inflation rate of Bitcoin continues to decrease, it is likely that Bitcoin’s price action will increasingly be driven by macroeconomic factors rather than the halving cycle. Institutional interest in Bitcoin has grown significantly in recent years, and this will likely continue to influence the price. Furthermore, Bitcoin’s correlation with traditional assets like the S&P 500 has strengthened, suggesting that Bitcoin’s price could begin to follow more conventional liquidity and business cycles.

The Influence of Macroeconomics: Bitcoin’s Shift Toward Traditional Business Cycles

Bitcoin’s relationship with traditional financial markets, particularly the S&P 500, has become somewhat aligned in recent years. This correlation grew significantly after the 2020 COVID-induced market downturn, as massive liquidity injections from central banks led to a sharp rise in asset prices, including bitcoin.

Looking forward, it’s likely that Bitcoin will become more aligned with global liquidity cycles and business cycles. Rather than being solely driven by the halving events, Bitcoin’s price may start to mirror broader economic trends, particularly as institutional investors become an even more dominant force in the market.

If Bitcoin follows these traditional business cycles, the role of halvings in driving price action may diminish. Instead, Bitcoin could experience more gradual price movements, influenced by factors such as the expansion and contraction of global liquidity, investor sentiment, and market cycles that are familiar to traditional assets.

The 2028 Halving and Beyond: A New Era for Bitcoin

The upcoming 2028 halving event is expected to be a crucial turning point for Bitcoin. By this point, the network will have reached nearly its maximum supply, and the block reward will be reduced to just 1.5625 BTC per block. This will mark a significant shift in Bitcoin’s inflation rate, as the amount of new bitcoin entering circulation will be minimal.

It’s likely that the 2028 halving will be the last to have a profound impact on Bitcoin’s price. After this, Bitcoin may no longer experience the traditional post-halving price surges that have characterized its history. Instead, Bitcoin’s price action will likely be driven by a combination of institutional interest, global liquidity cycles, and traditional market forces.

In Conclusion: A Changing Landscape for Bitcoin

Bitcoin’s traditional 4-year halving cycle has been a fundamental driver of its price history, but the market is evolving. As the block reward decreases and Bitcoin’s circulating supply nears its maximum, the influence of halving’s on price action will likely diminish. Instead, Bitcoin will probably follow more conventional business and liquidity cycles, similar to other major assets. This shift will be driven by the growing institutional interest in Bitcoin, its increasing correlation with traditional markets, and the evolving role of Bitcoin in the broader economic landscape.

As we look ahead to the 2028 halving and beyond, it’s clear that Bitcoin’s future should be shaped by macroeconomic trends rather than the old cycle-driven model. While this may change the way we approach Bitcoin investment and analysis, it also opens up exciting possibilities for Bitcoin’s role in the global economy.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post In Less Than 3 Years, The Bitcoin Price Will Change Forever? first appeared on Bitcoin Magazine and is written by Conor Mulcahy.