I’m in my 40s with millions in the bank – can we handle $220k a year in spending if I quit my $1 million tech job now?

Saving a lot of money gives you more options, and it can help you retire sooner. One Redditor finds himself in that situation and is wondering if he can step away from a $1 million tech job. He and his wife are both 46 years old, and they are raising two children in a VHCOL […] The post I’m in my 40s with millions in the bank – can we handle $220k a year in spending if I quit my $1 million tech job now? appeared first on 24/7 Wall St..

Saving a lot of money gives you more options, and it can help you retire sooner. One Redditor finds himself in that situation and is wondering if he can step away from a $1 million tech job. He and his wife are both 46 years old, and they are raising two children in a VHCOL area.

They have a $12 million net worth which makes the husband believe he can retire early. They are projected to spend $220,000 per year after considering that they will have to pay for healthcare. Is it too early for the husband to retire, or can he walk away from the tech job at an early age? Commenters share their thoughts in the Chubby FIRE Reddit community.

Key Points

-

A Redditor with a $12 million net worth wonders if it makes sense to walk away from a $1 million tech job.

-

Most commenters agree that the original poster has put himself in a good enough position to retire early.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

The Brokerage Account Has Enough Money For The Redditor To Retire

The commenters almost universally agreed that the Redditor is able to retire. He husband did a breakdown of his wealth and explained that $6.9 million is in a brokerage account. Following the 4% withdrawal rule, the husband can tap into $276,000 per year. That’s above the family’s annual expenses, so he can get closer to a 3% annual withdrawal rate.

Using the brokerage account shields his other wealth-producing assets. For instance, he has $1.2 million in a 401(k) and has even allocated $600,000 into his children’s 529 savings plans. He doesn’t have to worry about college expenses. The kids are 15 and 13 years old, respectively, so college tuition can’t inflate by too much by the time they attend.

Use Cash Flow From The Rental Property

The Redditor doesn’t only have stocks. He also has investment properties that generate $42,000 in annual income. This income source means he only has to withdraw $178,000 per year to keep up with $220,000 in annual expenses. Now, the annual withdrawal rate is just above 2.5%, making it even easier to retire.

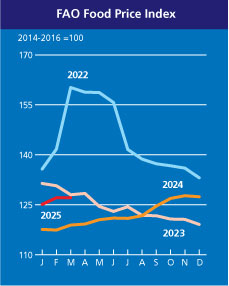

Rental cash flow can gradually go up over time if the Redditor raises rent prices as inflation goes up. However, real estate can also reduce his income taxes due to depreciation. He also has a $1.8 million home that is fully paid off.

The Redditor Hates His Job

The husband also mentioned in his post that he hates his job. Meanwhile, his wife works part-time as a hospital admin because she enjoys the work. She technically doesn’t have to work, but people tend to stick with jobs that they enjoy.

The husband also said that if he sticks it out for a few more years, his income will go up to $1.8 million. That’s obviously a lot of money, but what will the husband do with it? By that point, his children may be deep into their college education or already graduated, and they have 529 savings plans ready to go.

The husband may benefit greatly from leaving the tech job and looking for work that is more enjoyable. The only reason to continue working now is to give your children a large inheritance. However, a $12 million net worth is massive already, and the Redditor will have more time to serve as a career mentor for his children if he leaves the tech job. He has put himself in a good position at a job he doesn’t like, and he is ready to leave whenever he desires.

The post I’m in my 40s with millions in the bank – can we handle $220k a year in spending if I quit my $1 million tech job now? appeared first on 24/7 Wall St..