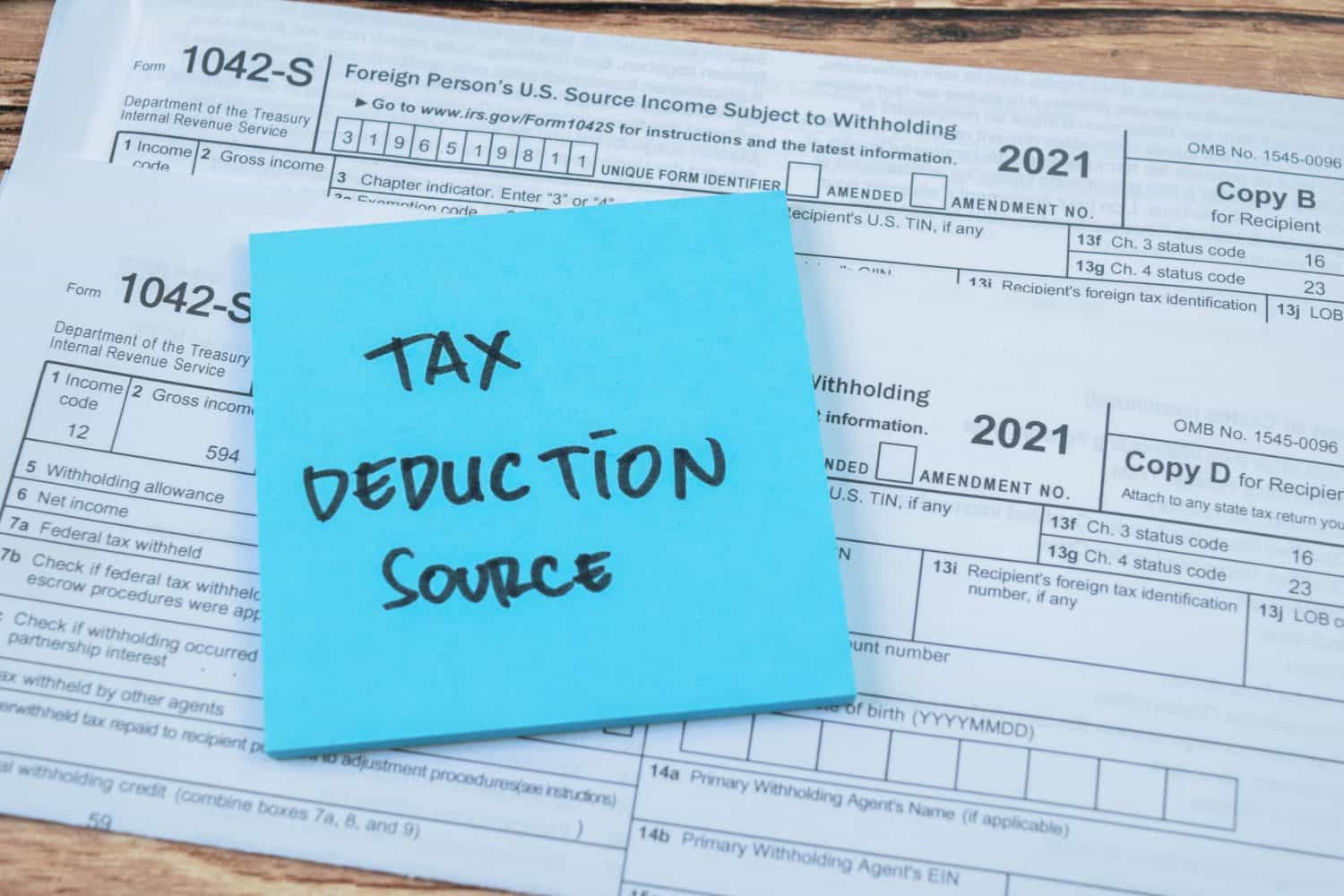

Donald Trump Pledged No Taxes on Overtime Pay – Where Does That Promise Stand Today?

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. President Trump is generating a lot of excitement over the possibility of making overtime pay, tax-free. In fact, he argues that by eliminating that tax, it would help incentivize work, benefit hardworking Americans, and […] The post Donald Trump Pledged No Taxes on Overtime Pay – Where Does That Promise Stand Today? appeared first on 24/7 Wall St..

President Trump is generating a lot of excitement over the possibility of making overtime pay, tax-free. In fact, he argues that by eliminating that tax, it would help incentivize work, benefit hardworking Americans, and make it easier for companies to attract new employees.

Unfortunately, he has to leap quite a few hurdles to make it a reality.

Key Points About This Article

- President Trump wants to cut taxes on overtime pay. All to put more money in the hands of Americans.

- However, for it to become a reality, Republicans need to find $2 trillion in spending reductions to offset the cost of potential cuts.

- The argument against cutting the overtime tax includes a potential drop in federal tax revenue and the idea that employers would rely more on overtime hours instead of hiring more employees.

- 4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

For one, Republicans need to find $2 trillion in spending reductions to offset the cost of potential tax cuts. If they can’t, tax cuts may need to be reduced. Two, even if the cuts are found, the cuts still need to make it through the Senate where Democrats and some Republicans may push back.

However, even with those challenges, Republicans have proposed a “current policy” baseline, according to Forbes.com. “Under this approach, the budget would assume that existing tax policies—including the 2017 Trump tax cuts—are permanent. Extending them wouldn’t count as new spending, effectively erasing their projected cost on paper,” they added.

Here’s How Taxes on Overtime Currently Works

At the moment, the Fair Labor Standards Act mandates that workers receive at least 1.5 times standard pay. That applies to hours worked beyond 40 hours.

As noted by the U.S. Department of Labor:

“The Act requires that employees must receive at least the minimum wage and may not be employed for more than 40 hours in a week without receiving at least one and one-half times their regular rates of pay for the overtime hours. The amount employees should receive cannot be determined without knowing the number of hours worked.”

That overtime pay is also subject to federal taxes, Social Security, and Medicare taxes.

The argument against cutting the overtime tax includes a potential drop in federal tax revenue (potentially $1.7 trillion) and the idea that employers would rely more on overtime hours instead of hiring more employees.

As noted by The Tax Foundation: “Employees would be encouraged to take more overtime work, and hourly or salaried non-exempt jobs may become more attractive if the benefit is not extended to salaried employees who are exempt from Fair Labor Standards Act (FLSA) overtime rules. Trump’s proposal would also affect employers as employees find ways to request more overtime work, raising employer labor costs.”

Right now, it’s all up in the air with solid arguments from both sides of the aisle.

We’d love to get your thoughts on the pros and cons of eliminating taxes on overtime pay.

The post Donald Trump Pledged No Taxes on Overtime Pay – Where Does That Promise Stand Today? appeared first on 24/7 Wall St..