Polymarket faces scrutiny over $7M Ukraine mineral deal bet

Polymarket, the world’s largest decentralized prediction market, is under fire after a controversial outcome raised concerns over potential governance manipulation in a high-stakes political bet.A betting market on the platform asked whether US President Donald Trump would accept a rare earth mineral deal with Ukraine before April. Despite no such event occurring, the market was settled as “Yes,” triggering a backlash from users and industry observers.This may point to a “governance attack” in which a whale from the UMA Protocol “used his voting power to manipulate the oracle, allowing the market to settle false results and successfully profit,” according to crypto threat researcher Vladimir S.“The tycoon cast 5 million tokens through three accounts, accounting for 25% of the total votes. Polymarket is committed to preventing this from happening again,” he wrote in a March 26 X post.Source: Vladimir S.Polymarket employs UMA Protocol’s blockchain oracles for external data to settle market outcomes and verify real-world events.Polymarket data shows the market amassed more than $7 million in trading volume before settling on March 25.Source: PolymarketStill, not everyone agrees that it was a coordinated attack. A pseudonymous Polymarket user, Tenadome, argued that the outcome was the result of negligence.“There is no ‘tycoon’ who ‘manipulated the oracle,’ Tenadome wrote in a March 26 X post, adding:“The voters that decided this outcome are the same UMA whales who vote in every dispute, who (1) are largely affiliated with/on the UMA team and (2) do not trade on Polymarket, and they just chose to ignore the clarification to get their rewards and avoid being slashed.”Related: Polymarket whale raises Trump odds, sparking manipulation concernsPolymarket won’t issue a refundDespite user frustration, Polymarket moderators said no refunds would be issued.“We are aware of the situation regarding the Ukraine Rare Earth Market. This market resolved against the expectations of our users and our clarification,” Polymarket moderator Tanner said, adding:“Unfortunately, because this wasn’t a market failure, we are not able to issue refunds.”Source: Vladimir S.Polymarket said it will build new monitoring systems to ensure this “unprecedented situation” does not occur again.Related: eToro trading platform publicly files for US IPOUS elections fuel 565% prediction markets risePrediction markets saw significant growth in the third quarter of 2024, driven by bets on the United States presidential election.Top three crypto prediction markets. Source: CoinGeckoThe betting volume on prediction markets rose over 565% in Q3 to reach $3.1 billion across the three largest markets, up from just $463.3 million in the second quarter.Polymarket, the most prominent such decentralized platform, dominated the market with over a 99% share as of September.Magazine: Memecoins are ded — But Solana ‘100x better’ despite revenue plunge

Polymarket, the world’s largest decentralized prediction market, is under fire after a controversial outcome raised concerns over potential governance manipulation in a high-stakes political bet.

A betting market on the platform asked whether US President Donald Trump would accept a rare earth mineral deal with Ukraine before April. Despite no such event occurring, the market was settled as “Yes,” triggering a backlash from users and industry observers.

This may point to a “governance attack” in which a whale from the UMA Protocol “used his voting power to manipulate the oracle, allowing the market to settle false results and successfully profit,” according to crypto threat researcher Vladimir S.

“The tycoon cast 5 million tokens through three accounts, accounting for 25% of the total votes. Polymarket is committed to preventing this from happening again,” he wrote in a March 26 X post. Source: Vladimir S.

Polymarket employs UMA Protocol’s blockchain oracles for external data to settle market outcomes and verify real-world events.

Polymarket data shows the market amassed more than $7 million in trading volume before settling on March 25. Source: Polymarket

Still, not everyone agrees that it was a coordinated attack. A pseudonymous Polymarket user, Tenadome, argued that the outcome was the result of negligence.

“There is no ‘tycoon’ who ‘manipulated the oracle,’ Tenadome wrote in a March 26 X post, adding:

“The voters that decided this outcome are the same UMA whales who vote in every dispute, who (1) are largely affiliated with/on the UMA team and (2) do not trade on Polymarket, and they just chose to ignore the clarification to get their rewards and avoid being slashed.”

Related: Polymarket whale raises Trump odds, sparking manipulation concerns

Polymarket won’t issue a refund

Despite user frustration, Polymarket moderators said no refunds would be issued.

“We are aware of the situation regarding the Ukraine Rare Earth Market. This market resolved against the expectations of our users and our clarification,” Polymarket moderator Tanner said, adding:

“Unfortunately, because this wasn’t a market failure, we are not able to issue refunds.”

Source: Vladimir S.

Polymarket said it will build new monitoring systems to ensure this “unprecedented situation” does not occur again.

Related: eToro trading platform publicly files for US IPO

US elections fuel 565% prediction markets rise

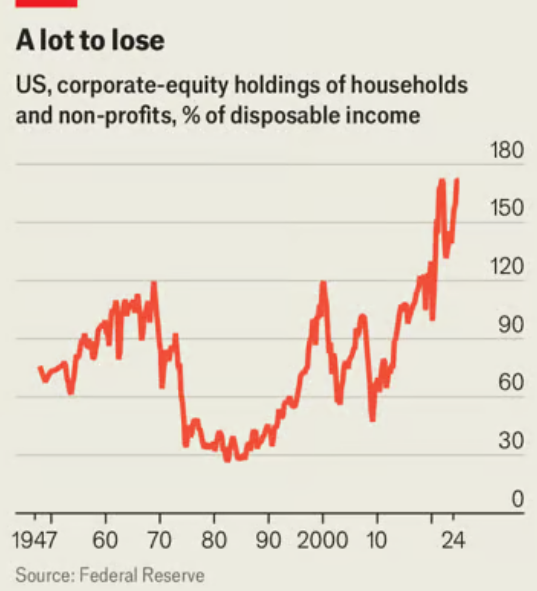

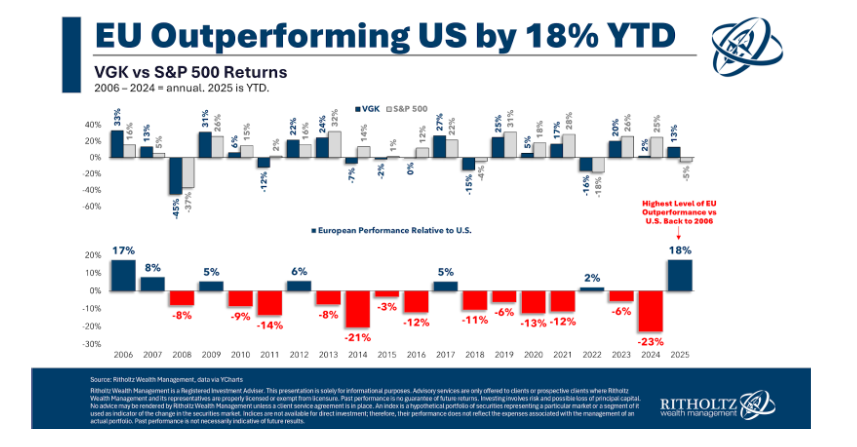

Prediction markets saw significant growth in the third quarter of 2024, driven by bets on the United States presidential election. Top three crypto prediction markets. Source: CoinGecko

The betting volume on prediction markets rose over 565% in Q3 to reach $3.1 billion across the three largest markets, up from just $463.3 million in the second quarter.

Polymarket, the most prominent such decentralized platform, dominated the market with over a 99% share as of September.

Magazine: Memecoins are ded — But Solana ‘100x better’ despite revenue plunge