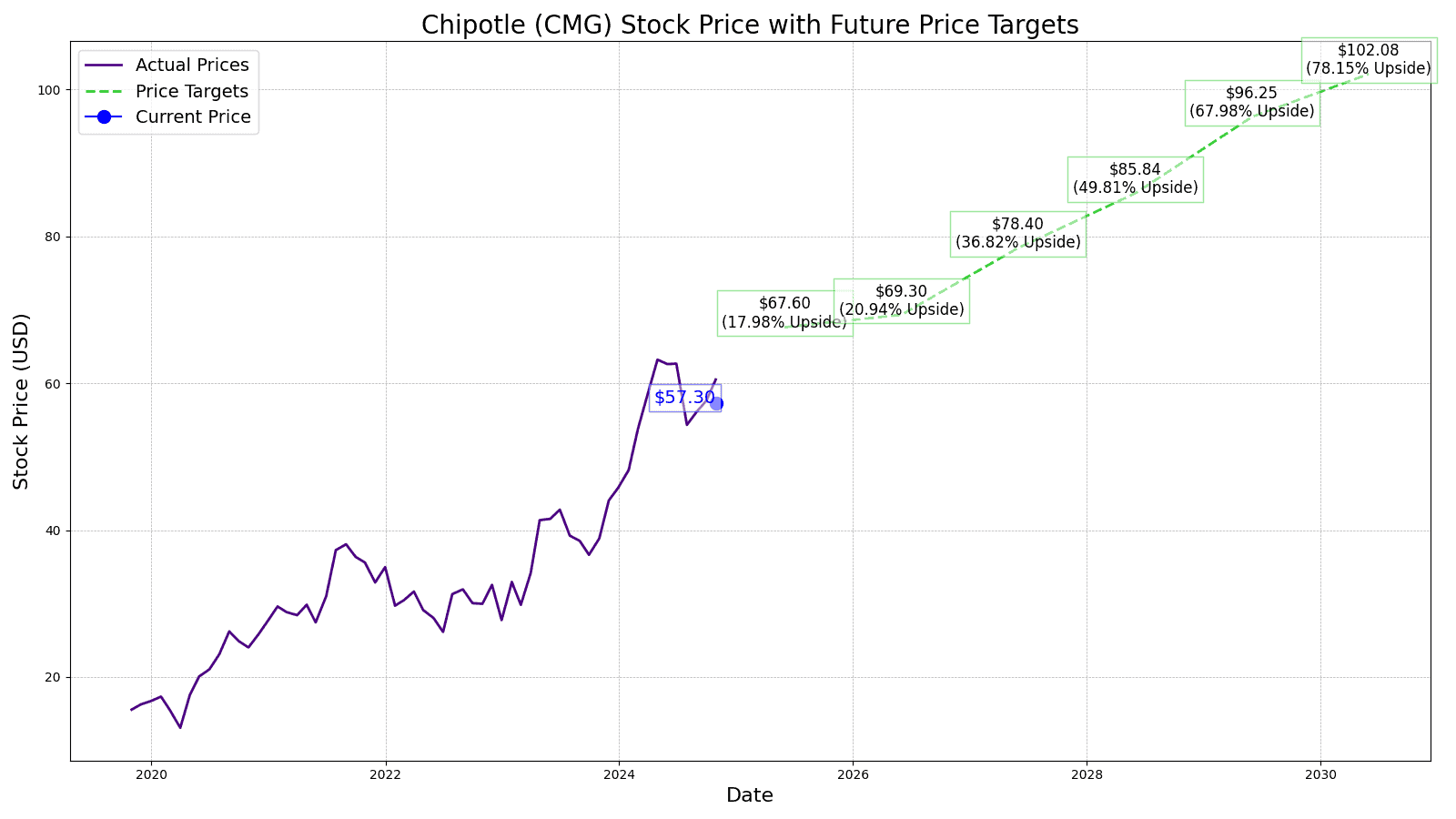

Chipotle (CMG) Price Prediction and Forecast 2025-2030 (March 2025)

Due to Chipotle Mexican Grill's focus on growth and innovation, 24/7 Wall St. projects huge upside on the stock through the end of the decade. The post Chipotle (CMG) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..

When Chipotle Mexican Grill Inc. (NYSE: CMG) released its most recent earnings report, the news seemed good. Revenue was strong, and the restaurant chain operator projected the addition of more than 315 new locations in 2025. Furthermore, the company has released new menu item Chipotle Honey Chicken and launched a new hiring campaign. Yet, the stock has continued a downward trend that began last December.

In the past month, the share price is down 12.3% and near a 52-week low. Year to date, the stock has retreated 20.7%, underperforming the S&P 500 in that time. Analysts remain optimistic, on average recommending buying shares and with a consensus price target that suggests 36.5% upside in the next year.

24/7 Wall St. Key Points:

-

Chipotle Mexican Grill Inc. (NYSE: CMG) has developed a big following with die-hard loyal diners for its health-conscious menus and fast-casual dining experience.

-

Due to its focus on growth and innovation, 24/7 Wall St. projects huge upside on the stock through the end of the decade.

-

Be sure to grab a complimentary copy of our “The Next NVIDIA” report, which includes a complete industry map of AI investments, including many small caps.

Chipotle Mexican Grill has developed a big Gen-Z following, in addition to its die-hard loyal diners, who appreciate health-conscious menus that deliver a dining experience that is somewhere in between a fast-food restaurant and fine dining. Chipotle offers burritos, tacos, and salads, among other items that keep varying throughout the year. The company offers these products by sourcing organic produce and responsible-ranched cows and chickens.

Nevertheless, investors are concerned with future stock performance over the next decade. Although most Wall Street analysts will calculate 12-month forward projections, it is clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term prognostications irrelevant. 24/7 Wall St. aims to present some farther-looking insights based on Chipotle’s own numbers, along with business and market development information that may be of help with your own research.

Challenges and Tailwinds

While Chipotle is experiencing strong growth, it still faces many challenges.

- It faces inflation and fluctuating food costs, especially dairy and avocados, which creates pressure on profit margins.

- Rising labor costs are having an impact on the restaurant industry.

- Inflation and economic uncertainty also weigh on consumer spending, affecting store traffic and sales.

- And the fast-casual restaurant sector remains highly competitive.

However, there is plenty for investors and fans to be positive about:

- Chipotle has made significant investment in digital innovation, including its mobile app, online platform, and “Chipotlanes” digital order pickup.

- It continues to focus aggressively on expansion and improving operational efficiency.

- It also continues to introduce new and appealing menu items to keep customers engaged.

- And its brand recognition and customer loyalty remain strong.

Chipotle Stock Performance

Here is a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2024.

| Fiscal Year (Dec) | Price | Total Revenues | Net Income |

| (Price reflects 6/2024 50:1 forward split) | |||

| 2014 | $13.69 | $4.108 B | $445.4 M |

| 2015 | $ 9.60 | $4.501 B | $475.6 M |

| 2016 | $7.55 | $3.904 B | $ 22.9 M |

| 2017 | $5.78 | $4.476 B | $176.3 M |

| 2018 | $8.64 | $4.865 B | $176.6 M |

| 2019 | $16.74 | $5.586 B | $350.2 M |

| 2020 | $27.73 | $5.984 B | $355.8 M |

| 2021 | $34.97 | $7.547 B | $653 M |

| 2022 | $27.75 | $8.634 B | $899.1 M |

| 2023 | $45.74 | $9.871 B | $1.228 B |

| 2024 | $60.30 | $11.310 B | $1.534 B |

Last year, Chipotle CEO Brian Niccol jumped ship to head up Starbucks Corp. (NASDAQ: SBUX). Chief Operating Officer Scott Boatwright replaced Niccol, but investors were understandably worried about what would happen to the company under new leadership. The stock initially pulled back but recovered and headed higher in the final months of the year.

Chipotle completed a 50-for-1 stock split on June 26, 2024, making it one of the largest in New York Stock Exchange history. The chief financial officer stated that the split would make the stock more accessible to employees and a broader range of investors.

Key Drivers for Chipotle’s Future

An ability to adapt to changing customer preferences.

- Enhancements in its digital platforms, including its mobile app and loyalty program, should drive customer engagement and repeat business.

- Ongoing personalized marketing and data-driven initiatives play a significant role in retaining customers and attracting new ones.

- Introducing new, appealing menu items and diversifying offerings beyond core products promotes growth.

Its ability to effectively manage costs.

- Such investments in technology and operational enhancements as new kitchen equipment and optimized restaurant layouts should improve efficiency and throughput.

- Effectively managing its supply chain is vital to mitigating the impact of inflation and ensuring consistent ingredient quality, while controlling costs is crucial for maintaining profitability.

And how well it maintains its brand reputation.

- Chipotle recognizes that consumers are increasingly conscious of environmental and social issues. The company’s commitment to sustainable sourcing and ethical practices will continue to enhance its brand reputation.

- Continued expansion into new geographic markets, both domestically and internationally, will be a significant driver of future growth and of customer engagement and ultimately repeat business.

Stock Price Prediction for 2025

The consensus recommendation of 35 Wall Street analysts is to buy Chipotle shares. Their average price target in 12 months is $64.91, which is roughly up 36.5% from today’s price.

24/7 Wall St.’s 12-month projection for Chipotle’s price is $67.60, which would be an 11.8% gain. We believe that Brian Niccol’s departure will not impact Chipotle’s revenues and earnings to a significant extent and that the strong corporate infrastructure that has maintained the growth pace for the past five years is resilient enough to continue.

Chipotle’s Outlook for the Next Five Years

Chipotle’s international expansion efforts in Europe and Canada are expected to gain traction in 2026. The company’s digital ordering platform should mature at this point where it can potentially account for over 50% of sales and drive higher margins. Our target price of $69.30 would be a small $1.70 gain, or 2.5%.

2027 could see Chipotle using data analytics and A.I. to personalize customer experiences and optimize marketing efforts. The company might also explore new store formats to penetrate urban markets more effectively, potentially boosting revenue and stock performance. The Middle East initiative with Alshaya in Kuwait should finally be able to kickstart, creating an entirely new customer demographic for all of Chipotle’s offerings, except for carnitas, which would be haram (prohibited under Sharia law) as it is pork. A $78.40 target price would represent a gain of 13.13%

Appealing to eco-conscious consumers and potentially reducing long-term costs through sustainable packaging and renewable energy could be another profit center by 2028. Chipotle might also introduce more plant-based protein options to cater to changing dietary preferences. A gain of 9.48% would be realized by Chipotle at a projected $85.84 price.

In 2029, Chipotle may focus on vertical integration, potentially acquiring some of its suppliers to ensure quality control and reduce costs. From a logistical perspective, owning crucial local supply chain components, especially for overseas clients, can be a risk mitigation tool. By eschewing long distance imports for its menu supplies and placing itself at the mercy of its suppliers. Taking the proactive course would make for a further strategy of better engagement to adapt to international outlets’ cultural differences, a highly important head of state, etc. Chipotle could also explore augmented reality for employee training and customer engagement, which would enhance operational efficiency. Our stock price target of $96.25.

Chipotle’s Stock in 2030

By 2030, Chipotle might introduce fully automated outlets in select locations, significantly reducing labor costs. Machines that work alongside human employees, automating tasks like avocado preparation and food assembly, would by this time have been successfully integrated, and fully automated 24/7 drive-throughs could still have a sufficient margin, thanks to reduced labor cost requirements.

The company could also expand its catering services, targeting corporate clients for B2B, and potentially opening up new revenue streams. Our price target is $102.08, which would be a 68.72% cumulative five-year gain.

| Year | P/E Ratio | EPS | Price |

| 2025 | 52 | $1.30 | $67.60 |

| 2026 | 45 | $1.54 | $69.30 |

| 2027 | 40 | 1.96 | $78.40 |

| 2028 | 37 | $2.32 | $85.84 |

| 2029 | 35 | $2.75 | $96.25 |

| 2030 | 32 | $3.19 | $102.08 |

The post Chipotle (CMG) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..