Apple sees sharp narrative shift as tariffs dominate tech giant's outlook

Apple is moving quickly to address a growing investor concern.

Narratives can change pretty swiftly on Wall Street, dragging even the biggest companies into discussions that were largely ignored only a few months ago.

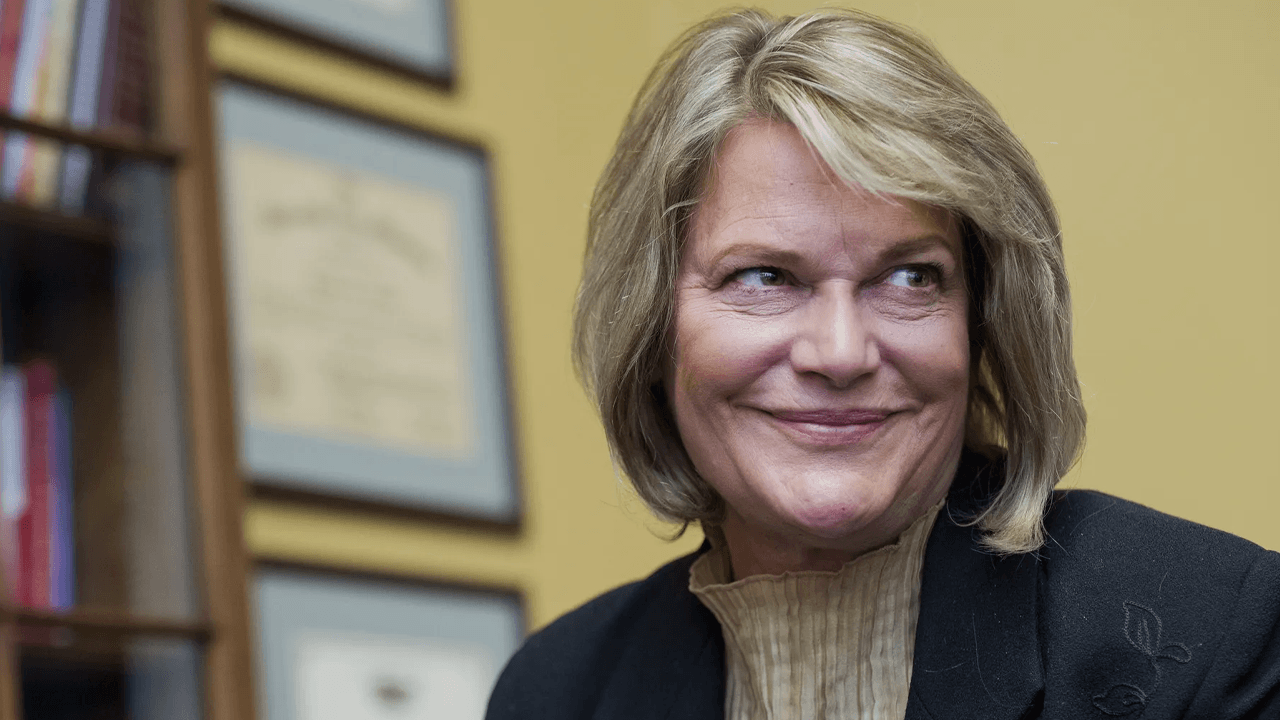

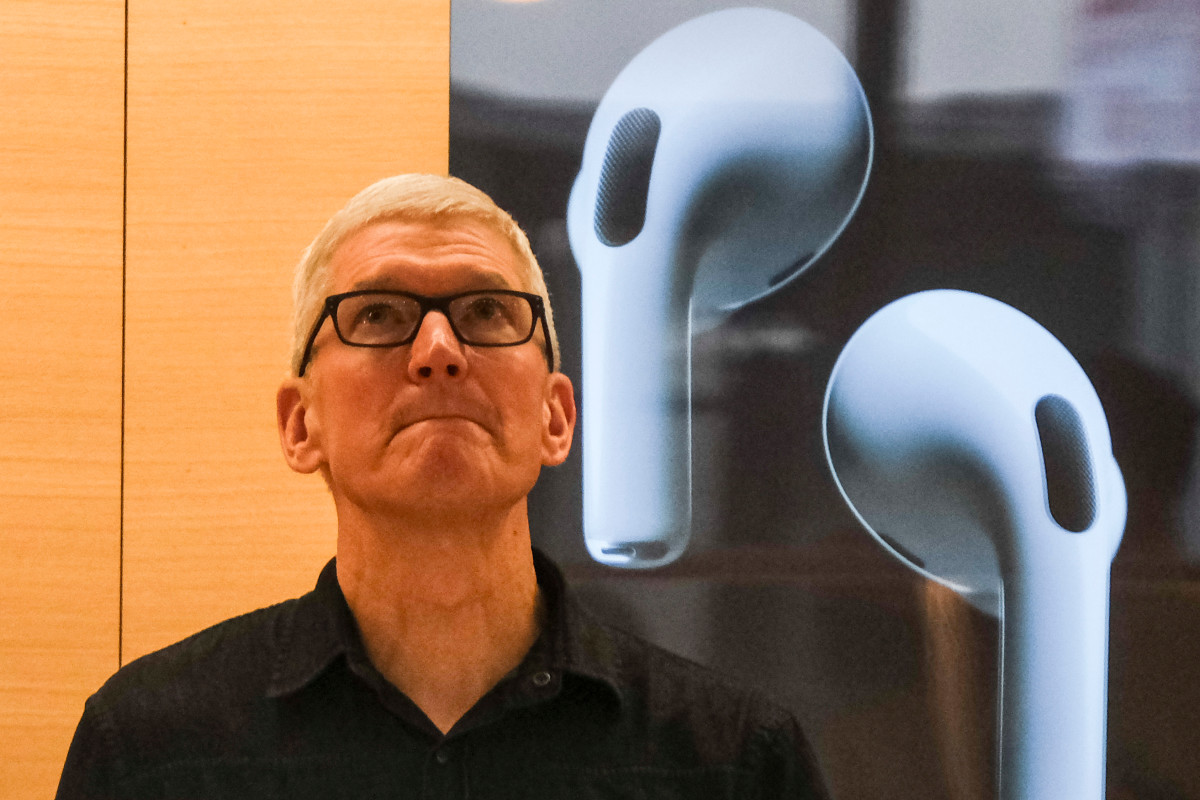

Apple (AAPL) , which earlier this year was under fire for failing to devote the proper resources to its AI investment thesis, made no mention of tariffs on its first quarter conference call in January. In fact, just ten days after President Trump's inauguration, CEO Tim Cook would only say that the world's biggest tech company was "monitoring the situation".

Last night, however, tariffs were mentioned 27 different times during Apple's March quarter earnings call as Cook conceded that the Trump administration's 145% levy on China-made goods, as well as baseline tariffs of 10% on virtually every other U.S. trading partner, would add a $900 billion cost headwind to the current quarter.

That's shifted investor concern from Apple's AI investments to the tech giant's supply chain, and the speed in which it can transition from an over-reliance on China-based production to avoid being caught in the crosshairs of the escalating trade war between Washington and Beijing.

Most U.S. iPhones this quarter will likely come from India, rather than China, Cook said, while other Apple hardware is expected to originate in Vietnam.

"What we learned some time ago was that having everything in one location had too much risk with it," Cook told investors late Thursday. "And so we have, over time, with certain parts of the supply chain, not the whole thing, but certain parts of it opened up new sources of supply. And you could see that kind of thing continuing in the future."

Apple still managed a solid March quarter, the second in its unique fiscal calendar, with overall revenues rising 5% from last year to $95.36 billion, topping Street forecasts, and iPhone sales rising 2% to $46.84 billion.

The group expects current quarter revenues to rise in the "low single digits" this quarter, suggesting an overall tally of between $86.6 billion and $90.1 billion, with profit margins narrowing to reflect the $900 billion in tariff costs.

Related: Analysts revisit Apple stock price targets as Cook courts Beijing

KeyBanc Capital Markets analyst Brandon Nispel, however, thinks the tariff overhang is likely to last week into the back half of the year and drag on Apple's share price performance at the same time.

"We think Apple's tariff mitigation efforts are likely better than most expect, but at the end of the day, we believe it's likely a little-to-no-growth business, where expectations continue to call for an acceleration in growth into 2026," he said in a note published Friday.

Wedbush analyst Dan Ives, however, thinks Apple was able to find some "breathing room" from the tariff uncertainty through its India supply chain shift, allowing it to introduce the new iPhone 17 later this autumn without a major disruption in its key U.S. market.

"The demand environment appears stable for Apple and the guidance for June was generally in-line with expectations and we were surprised the company actually gave an outlook at all given the tariff complexity," he said.

"It feels like Apple has a very good grip around this very complex tariff issue with Cook being 10% politician and 90% CEO," Ives added.

How that mix, which Ives suggests could be as high as 20%/80% in the current tariff climate, changes Apple's near-term performance is anyone's guess.

Shares in the group have fallen nearly 18% from their late-December peak, and were last marked 3.1% lower in premarket trading at $206.63 each.

China has suggested a potential thaw in U.S. trade relations, through a statement from its Finance Ministry that it's "evaluating" an overture from Washington, but also warned that "attempting to use talks as a pretext to engage in coercion and extortion would not work."

Related: Analysts revisit Apple stock price target as Trump offers tariff relief

Apple is also only getting a minimal tailwind from the infusion of Apple Intelligence into its new suite of iPhones, and a pullback in consumer spending over the coming months will cloud both its iPhone 17 launch and sales of its hardware and services.

That could be why Apple undershot expectations in its share buyback plans, which were pegged at $100 billion.

"We found this a bit of a head-scratcher, as Apple historically either holds its buyback or increases it authorization versus the prior year," said CFRA analyst Angelo Zino, who suggested the group is keeping some of its buyback powder dry amid tariff concerns.

Cook, however, struck and upbeat tone as he navigated investors into the murky uncertainty of a global trade war.

"For our part, we will manage the company the way we always have, with thoughtful and deliberate decisions, with a focus on investing for the long term, and with dedication to innovation and the possibilities it creates," he said.

"As we look ahead, we remain confident, confident that we will continue to build the world’s best products and services and confident that we can continue to run our business in a way that has always set Apple apart."

More Tech Stocks: