AGNC Investment Expects to Capitalize on Wide Spreads. But Is the High-Yield Dividend Stock a Buy?

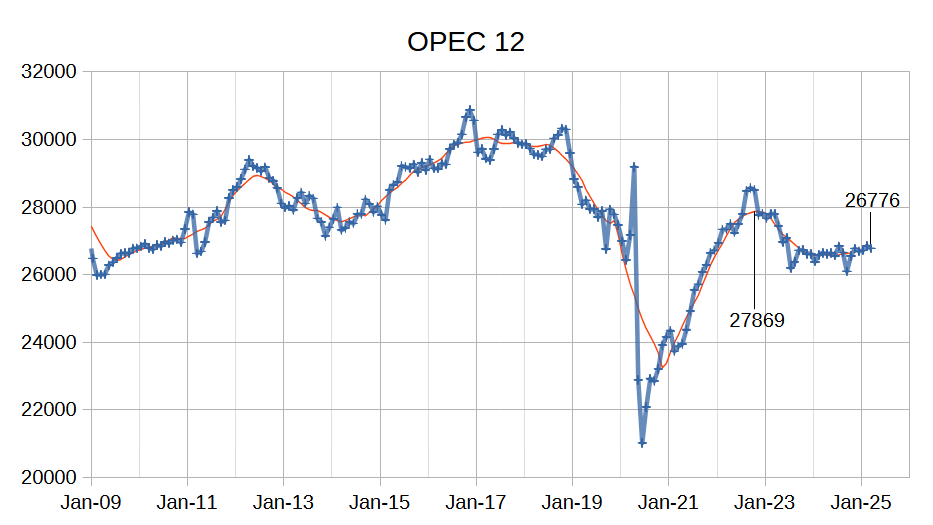

The escalating trade war and tariffs (actual and threatened) have disrupted several sectors of the economy, including the bond markets. This, in turn, has had an impact on mortgage real estate investment trusts (mREITs) like AGNC Investment (NASDAQ: AGNC). The stock looked like it was starting to turn the corner following a difficult operating environment the past few years, but then the sudden shock to the bond market once again left it reeling.However, AGNC management thinks the current market environment could set it up for strong future returns. Given the stock's 17% dividend yield, it's certainly worth investigating the mREIT's recent quarterly results and management's commentary.AGNC is a REIT that primarily holds a portfolio of mortgage-backed securities (MBSes) that are backed by government-sponsored agencies, such as Fannie Mae and Freddie Mac. MBSes are home mortgages that are bundled into bond-like securities. Because they are backed by government-sponsored agencies, they are generally regarded as virtually risk-free from default.Continue reading

The escalating trade war and tariffs (actual and threatened) have disrupted several sectors of the economy, including the bond markets. This, in turn, has had an impact on mortgage real estate investment trusts (mREITs) like AGNC Investment (NASDAQ: AGNC). The stock looked like it was starting to turn the corner following a difficult operating environment the past few years, but then the sudden shock to the bond market once again left it reeling.

However, AGNC management thinks the current market environment could set it up for strong future returns. Given the stock's 17% dividend yield, it's certainly worth investigating the mREIT's recent quarterly results and management's commentary.

AGNC is a REIT that primarily holds a portfolio of mortgage-backed securities (MBSes) that are backed by government-sponsored agencies, such as Fannie Mae and Freddie Mac. MBSes are home mortgages that are bundled into bond-like securities. Because they are backed by government-sponsored agencies, they are generally regarded as virtually risk-free from default.