4 of Our Favorite Dividend Aristocrats Offer a Lifetime of Secure Passive Income

These four Dividend Aristocrat stocks look like outstanding ideas now for investors looking for dependable passive income streams. The post 4 of Our Favorite Dividend Aristocrats Offer a Lifetime of Secure Passive Income appeared first on 24/7 Wall St..

Dividend stocks are a favorite among investors for good reason. They provide a steady income stream and offer a promising avenue for total return. Total return, a comprehensive measure of investment performance, encompasses interest, capital gains, dividends, and distributions realized over time. For example, if you buy a stock at $20 that pays a 3% dividend and rises to $22 in a year, your total return is 13%. That is, 10% for the increase in stock price and 3% for the dividends paid.

24/7 Wall St. Key Points:

-

The Dividend Aristocrats are among the safest passive income stocks to buy.

-

During a recession or downturn, the Dividend Aristocrats have held up better.

-

In the 2008 sell-off, the S&P 500 dropped 38%, while the Dividend Aristocrats dropped just 22%.

-

Is investing in the Dividend Aristocrats a good idea for your portfolio? Why not set up a meeting with a financial advisor near you to find out more? Click here today to get started. (Sponsored)

Investors looking for defensive companies paying big dividends are drawn to the Dividend Aristocrats, and with good reason. The 66 companies that made the cut for the 2025 S&P 500 Dividend Aristocrats list have increased dividends (not just remained the same) for 25 years straight. But the requirements go even further, with the following attributes also mandatory for membership on the aristocrats list:

- Companies must be worth at least a minimum of $3 billion for each quarterly rebalancing.

- Average daily volume must be of at least $5 million in transactions for every trailing three-month period at every quarterly rebalancing date.

- They must be a member of the S&P 500.

We screened the 2025 Dividend Aristocrats looking for the companies Wall Street endorses for passive income investors. Passive income is a steady stream of unearned income that doesn’t require active traditional work. Ideas for earning passive income include investments, real estate, and side hustles. Four stocks look like outstanding ideas for investors looking for dependable passive income streams.

Why do we cover the Dividend Aristocrats?

S&P 500 companies that have paid and raised their dividends for 25 years or longer are the kind that growth and income investors want to buy and hold in stock portfolios forever. These stocks are mostly conservative, and should we see a dramatic market correction, they will likely keep their ground much better than volatile technology names.

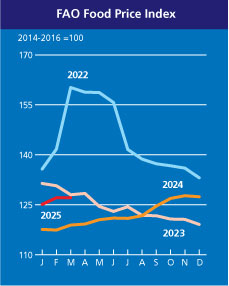

ADM

This solid play for volatile markets offers a very reasonable entry point and a solid 3.80% dividend. Archer Daniels Midland Co. (NYSE: ADM) processes oilseeds, corn, wheat, cocoa, and other agricultural commodities.

The company operates through the following segments:

- Ag Services and Oilseeds

- Carbohydrate Solutions

- Nutrition

The Ag Services and Oilseeds segment includes activities related to the origination, merchandising, crushing, and further processing of oilseeds such as soybeans and soft seeds, such as cottonseed, sunflower seed, canola, rapeseed, and flaxseed into vegetable oils and protein meals.

The Carbohydrate Solutions segment engages in corn wet milling and dry milling activities and converts corn into sweeteners, starches, and bioproducts.

Lastly, the Nutrition segment provides customer needs for food, beverages, health and wellness, and more.

Consolidated Edison

This old-school utility stock offers income investors the stability and track record many seek now and a 3.65% dividend. Consolidated Edison Inc. (NYSE: ED) engages in the regulated electric, gas, and steam delivery businesses in the United States.

It offers electric services to approximately:

- 3.6 million customers in New York City and Westchester County

- Gas to about 1.1 million customers in Manhattan, the Bronx, parts of Queens, and Westchester County

- Steam to approximately 1,530 customers in parts of Manhattan

The company also supplies electricity to approximately 0.3 million customers in southeastern New York and northern New Jersey and gas to about 0.1 million customers in southeastern New York.

In addition, it operates:

- 543 circuit miles of transmission lines

- 15 transmission substations3 distribution substations

- 87,951 in-service line transformers

- 3,869 pole miles of overhead distribution lines

- 2,320 miles of underground distribution lines

- 4,359 miles of mains

- 377,741 service lines for natural gas distribution

Consolidated Edison owns, develops, and operates renewable and energy infrastructure projects, provides energy-related products and services to wholesale and retail customers, and invests in electric and gas transmission projects.

Medtronic

This medical technology giant is a solid pick for investors looking for a safe position in the healthcare devices sector and pays a 3.20% dividend. Medtronic PLC (NYSE: MDT) develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide.

The Cardiovascular Portfolio segment offers:

- Implantable cardiac pacemakers

- Cardioverter defibrillators

- Cardiac resynchronization therapy devices

- Cardiac ablation products

- Insertable cardiac monitor systems

- TYRX products; and remote monitoring and patient-centered software

It also provides aortic valves, surgical valve replacement and repair products, endovascular stent grafts and accessories, transcatheter pulmonary valves and percutaneous coronary intervention products, percutaneous angioplasty balloons, and other products.

The Neuroscience Portfolio segment offers:

- Medical devices and implants

- Biologic solutions

- Spinal cord stimulation and brain modulation systems

- Implantable drug infusion systems

- Interventional products

- Nerve ablation systems under the Accurian name

The segment offers products for spinal surgeons, neurosurgeons, neurologists, pain management specialists, anesthesiologists, orthopedic surgeons, urologists, urogynecologists, interventional radiologists, ear, nose, and throat specialists, and energy surgical instruments.

The Medical Surgical Portfolio segment offers:

- Surgical stapling devices

- Vessel sealing instruments

- Wound closure and electrosurgery products

- AI-powered surgical video and analytics platform

- Robotic-assisted surgery products

- Hernia mechanical devices

- Mesh implants

- Gynecology products

- Gastrointestinal and hepatologic diagnostics and therapies

- Therapies to treat other non-exclusive diseases and conditions; and patient monitoring and airway management products.

The Diabetes Operating Unit segment provides insulin pumps and consumables, continuous glucose monitoring systems, and InPen, a smart insulin pen system.

Realty Income

This is an ideal stock for growth and income investors looking for a safer contrarian idea for the rest of 2025 that pays a whopping 5.80% dividend. Realty Income Corp. (NYSE: O) is an S&P 500 company that provides stockholders with dependable monthly income.

The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 15,540 real estate properties (including properties acquired in the Spirit merger in January 2024) owned under long-term lease agreements with commercial tenants.

The company has declared 649 consecutive common stock monthly dividends throughout its 55-year operating history and increased the dividend for the last 29 consecutive years. It is a top real estate member of the S&P 500 Dividend Aristocrats index.

J.P. Morgan’s Best 2025 Stock Ideas Include 5 Blue-Chip Dividend Giants

The post 4 of Our Favorite Dividend Aristocrats Offer a Lifetime of Secure Passive Income appeared first on 24/7 Wall St..