3 ETFs to Load Up On Before June for Explosive Growth

Rallies, then sharp pullbacks seem to be the norm for the stock market these days. One step forward, two steps back. For volatile markets, characterized by economic uncertainty, geopolitical tensions, and fluctuating interest rates, exchange-traded funds (ETFs) offer investors a compelling option to steer through the storm. ETFs provide diversification by tracking broad indices, sectors, […] The post 3 ETFs to Load Up On Before June for Explosive Growth appeared first on 24/7 Wall St..

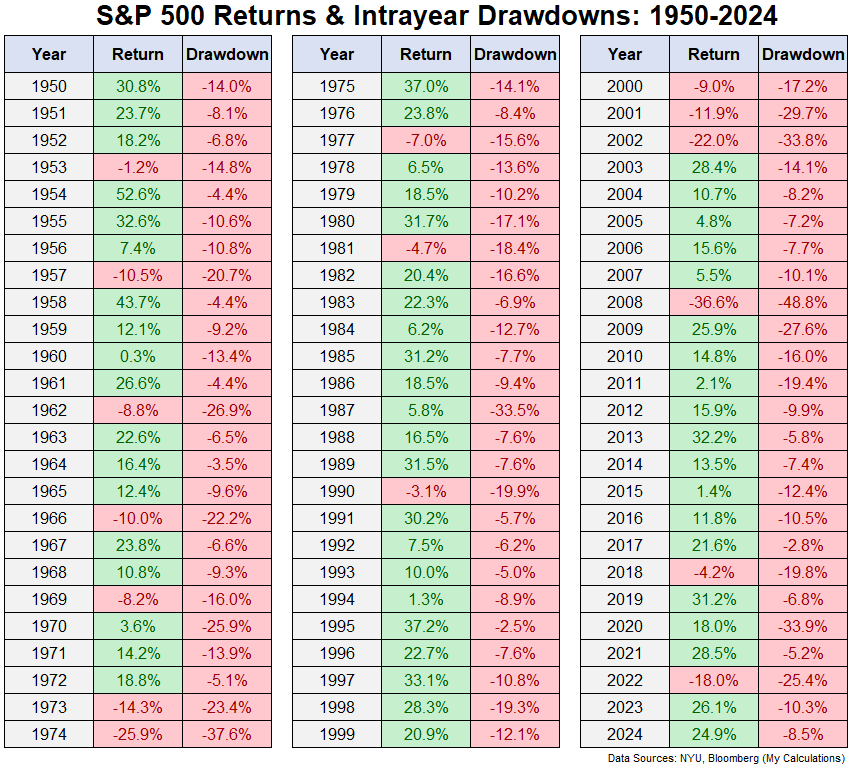

Rallies, then sharp pullbacks seem to be the norm for the stock market these days. One step forward, two steps back.

24/7 Wall St. Insights:

-

ETFs mitigate the risks associated with investing in individual securities because they diversify risk.

-

In volatile markets like those we’re currently experiencing, some ETFs are better positioned to capitalize on opportunities amid tariffs and macroeconomic turmoil.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

For volatile markets, characterized by economic uncertainty, geopolitical tensions, and fluctuating interest rates, exchange-traded funds (ETFs) offer investors a compelling option to steer through the storm.

ETFs provide diversification by tracking broad indices, sectors, or asset classes, reducing the risk associated with individual stocks. With low expense ratios, often below 0.5%, and high liquidity, ETFs enable cost-effective, flexible portfolio management for investors. They also allow exposure to stable assets like bonds or defensive sectors, cushioning against market swings.

For investors seeking resilience without sacrificing growth potential, ETFs are a strategic tool. However, selecting ETFs aligned with risk tolerance and market conditions is crucial.

VanEck Semiconductor ETF (SMH)

The VanEck Semiconductor ETF (NYSEARCA:SMH) is poised for explosive growth in 2025, despite tariff-related challenges, due to its alignment with powerful industry trends and robust fundamentals. SMH tracks the MVIS US Listed Semiconductor 25 Index, holding leading firms like Nvidia (NASDAQ:NVDA), Taiwan Semiconductor Manufacturing (NYSE:TSM), and Broadcom (NASDAQ:AVGO), which are central to the AI, cloud computing, and 5G revolutions.

The global semiconductor market is projected to grow 13% annually, driven by insatiable demand for advanced chips in artificial intelligence data centers and autonomous vehicles. SMH’s compound annual growth rate (CAGR) return for the past decade of 23.9% underscores its long-term strength.

New U.S. tariffs, particularly on Chinese imports, pose challenges by increasing costs for some chipmakers reliant on Asian supply chains. However, SMH’s diversified portfolio mitigates this risk, as many holdings, like Taiwan Semiconductor, are expanding U.S.-based manufacturing to counter tariff impacts. Additionally, government incentives, such as the CHIPS Act, are fueling domestic semiconductor production, benefiting SMH’s U.S.-centric holdings. The ETF’s low 0.35% expense ratio enhances its appeal for cost-conscious investors.

As enterprises prioritize AI and digital transformation, SMH’s exposure to cutting-edge chipmakers positions it to outperform. Despite tariff headwinds, its resilience and growth potential make it a standout investment for 2025.

Global X U.S. Infrastructure Development ETF (PAVE)

The Global X U.S. Infrastructure Development ETF (NYSEAMEX:PAVE) is the second ETF to buy in May that is primed for tremendous growth this year. Driven by its focus on domestic infrastructure and favorable economic policies, PAVE tracks the Indxx U.S. Infrastructure Development Index, investing in companies like Caterpillar (NYSE:CAT), Deere (NYSE:DE), and Vulcan Materials (NYSE:VMC), which benefit from U.S. construction, engineering, and materials sectors. With a 13.4% CAGR since its inception in 2017 and a low 0.47% expense ratio, PAVE offers strong performance and affordability.

PAVE’s domestic focus shields it from tariff-related disruptions that impact international projects. New U.S. tariffs, particularly on Chinese goods, are encouraging reshoring and domestic manufacturing, boosting demand for infrastructure like roads, bridges, and factories. Unlike globally exposed ETFs, PAVE’s portfolio is insulated from foreign supply chain risks, making it a beneficiary of protectionist policies.

The anticipated infrastructure spending boom, fueled by deregulation and potential federal investments under the current administration, further amplifies PAVE’s growth potential. Additionally, rising urbanization and the need for modernized infrastructure drive demand for PAVE’s holdings.

As companies prioritize domestic expansion, PAVE’s alignment with these trends positions it for outsized gains. Its resilience to tariffs and exposure to a revitalized U.S. economy make it a compelling investment for 2025.

VanEck Junior Gold Miners ETF (GDXJ)

The VanEck Junior Gold Miners ETF (NYSEARCA:GDXJ) is the third ETF poised for explosive growth in 2025. Soaring gold prices and the high-upside potential of small-cap gold and silver miners, are driving GDXJ higher.

GDXJ tracks the MVIS Global Junior Gold Miners Index, focusing on junior mining companies with agile operations and significant exploration potential. With a year-to-date return of 47% and a 0.51% expense ratio, GDXJ offers compelling value for investors seeking exposure to precious metals.

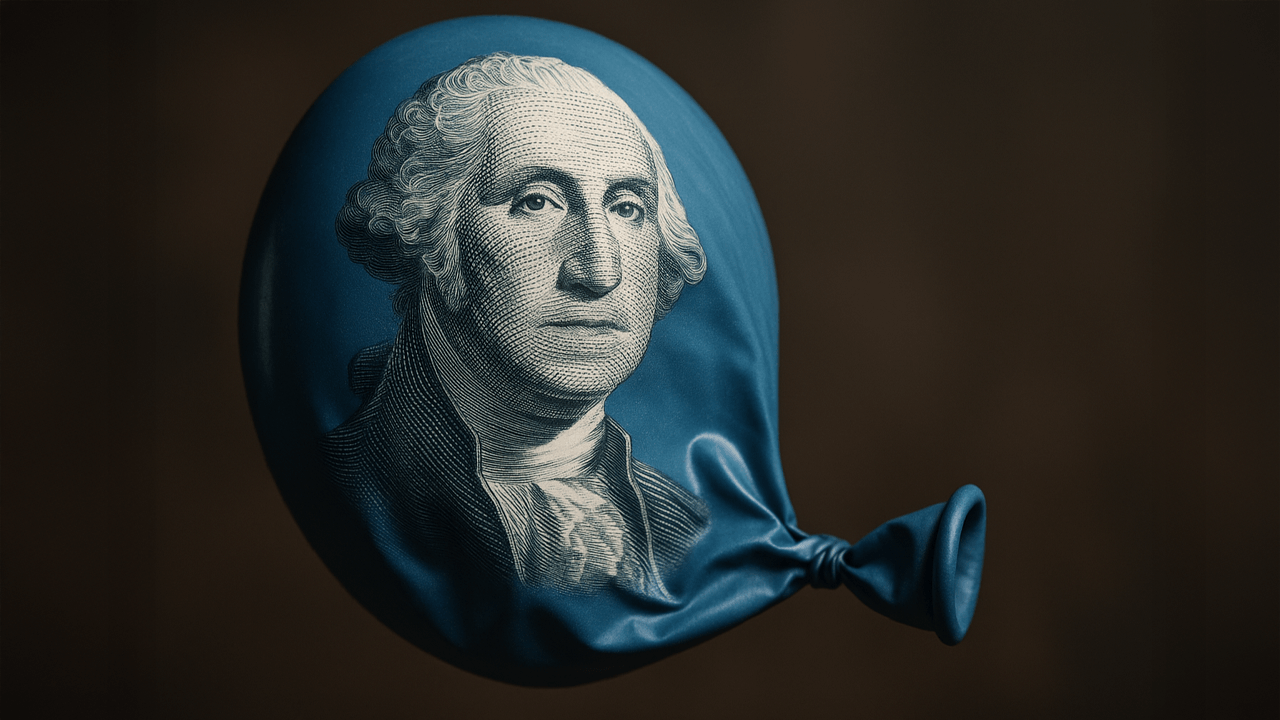

Gold prices just hit an all-time high north of $3,400, fueled by geopolitical instability, persistent inflation, and central bank buying. It is creating a bullish environment for miners. Junior miners, like those in GDXJ’s portfolio, amplify gold price gains due to their leveraged exposure and growth-oriented projects. Unlike senior miners, these smaller firms offer higher risk-reward profiles, making GDXJ a standout for aggressive investors. The ETF’s diversified holdings, including companies like Kinross Gold (NYSE:KGC) and Pan American Silver (NASDAQ:PAAS), mitigate individual stock risk while capturing sector upside.

Macroeconomic uncertainties, including tariff-driven trade tensions and potential currency devaluation, further enhance gold’s safe-haven appeal, boosting GDXJ’s prospects. As investor demand for inflation hedges grows, GDXJ’s focus on nimble, high-growth miners positions it to capitalize on the gold rally, driving potentially explosive returns in 2025.

The post 3 ETFs to Load Up On Before June for Explosive Growth appeared first on 24/7 Wall St..