World’s Third-Largest Pension Fund Pours Half a Billion Into These 2 Stocks

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. South Korea’s National Pension Fund (NPF) is the world’s third-largest pension fund by total assets. It manages 1,185.2 trillion South Korean won ($817 billion). NPF was created by the National Pension Service in 1999 […] The post World’s Third-Largest Pension Fund Pours Half a Billion Into These 2 Stocks appeared first on 24/7 Wall St..

compensation for actions taken through them.

South Korea’s National Pension Fund (NPF) is the world’s third-largest pension fund by total assets. It manages 1,185.2 trillion South Korean won ($817 billion).

NPF was created by the National Pension Service in 1999 to create a professional investment management organization to grow the pension’s assets. In 2003, NPF had just 100 trillion South Korean won ($69 billion) in assets. It’s come a long way since.

A fund this large is going to have billions invested in every nook and cranny around the globe. In the U.S., it recently filed its 13F holdings report for Q4 2024. As of Dec. 31, 2024, it had $105.67 billion invested in 550 stocks. Its top 10 holdings accounted for 35.5% of its assets.

The big news in the fourth quarter was the fund’s sale of 45% of its position in Edwards Lifesciences (NYSE:EW). Even bigger news, however, was that it poured approximately $500 million into BlackRock (NYSE:BLK) and Lam Research (NASDAQ:LRCX).

Here’s why.

Key Points About This Article:

- The world’s third-largest pension shed a big chunk of Edward Lifesciences.

- The pension fund spent over $300 million in the fourth quarter on a new stake in BlackRock.

- If you follow the 13F reports, you’ll see that it added to its position in semiconductor equipment maker Lam Research.

- 4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

Why Did NPF Cut EW Stock?

As mentioned in the introduction, NPF cut its Edwards Lifesciences position by 45% in the fourth quarter. That works out to 715,605 shares sold. Based on the average of its high ($75.95) and low ($64.01) share prices during the final quarter of 2024, it likely generated $50.1 million in proceeds from the sale.

That’s not a huge chunk of change for a pension fund of its size. However, of the 330 stocks trimmed during the quarter, it was the 206th-largest at the end of September. And even after cutting its holdings in EW nearly in half, it remained the 236th-largest, accounting for 0.10% of NPF’s assets.

The pension fund first owned EW in Q4 2014, so there’s a chance it trades in and out of this healthcare stock. However, according to its Q4 2014 13F, it owned 37,194 shares, so unless it started this high-turnover strategy recently, EW was a long-time hold that it has chosen to reduce in influence on the fund.

There is one of two reasons for this.

Either NPF’s investment managers believe EW has hit or is near its intrinsic value–it’s down nearly 8% over the past five years–or it believes the healthcare sector may be in for a rough ride over the next four years of the Trump administration. There are better opportunities to produce now.

BlackRock Is the Largest New Buy

In the fourth quarter, NPF acquired 314,207 shares of the world’s largest asset manager. Its BLK holdings finished 2024 with a value of $322.1 billion, making it the pension fund’s 60th-largest holding, accounting for 0.30% of its assets.

That might not seem like a lot, but it’s six times larger than Flutter Entertainment (NYSE:FLUT), the third-largest new stock purchase in the quarter.

Based on the average of its high ($1,082.45) and low ($918.96) share prices during the final quarter of 2024, it likely paid approximately $314.4 million for its BLK stock. It’s down nearly 4% year-to-date.

Why did it buy BlackRock stock? Analysts certainly like it.

According to MarketWatch, of the 19 analysts covering its stock, 15 rated it a Buy (79%) with a target price of $1,175, above where it’s currently trading.

Another big reason for the interest from NPF could be the fact its $12 billion acquisition of HPS Investment Partners announced in December–a leading private credit investor–could be the first move in its transition to alternative asset management.

Over the past five years, Blackstone’s (NYSE:BX), the world’s leading alternative asset managers, saw its stock appreciate by 168%, more than double BLK. It pays to be in alternatives.

What’s Up With Lam Research?

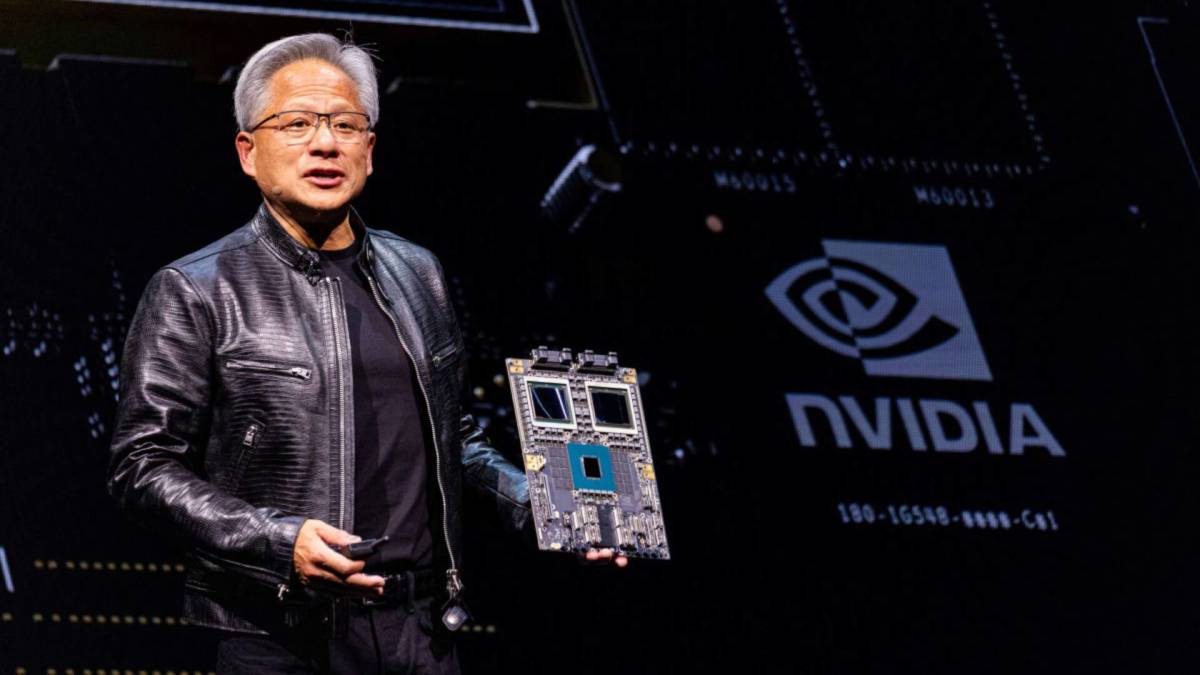

Lam Research provides semiconductor companies with the equipment and solutions to help them improve their chipmaking and the quality of chips.

The company’s next growth phase could come from makers of NAND memory chips. Lam believes that there will be an upgrade cycle to these chips. The company’s equipment, which it sells to semiconductor firms for the deposition and etch phases of chipmaking, would need what they’re selling in the event of this.

Currently, NAND spending is not significant but is likely to increase. It’s one possible reason NPF acquired 3.03 million LRCX shares in the fourth quarter, making it the pension fund’s 95th-largest position, accounting for 0.21% of its assets.

Interestingly, however, in Q3 2024, NPF sold out of its position in LRCX, selling 100% of its 2.62 million shares. The pension fund first owned Lam shares in Q4 2014, buying 58,431 shares.

However, it turns out that it likely didn’t sell out of its Lam position in the third quarter. Rather, Lam did a 10-for-1 stock split on Oct. 2.

So, it had 262,306 shares as of June 30, which means NPF acquired 411,688 additional LRCX shares in the fourth quarter, a 16% increase over its previous holdings, not 3.03 million.

It helps to pay closer attention to 13F reports.

The post World’s Third-Largest Pension Fund Pours Half a Billion Into These 2 Stocks appeared first on 24/7 Wall St..